* Editor's note: This article is co-produced by Sukhpreet Kaur

Philanthropist Andrew Carnegie may have challenged the wealthy to support social causes, but it was economist Howard Bowen, in his publication Social Responsibilities of the Businessman, who called businesses out by coining corporate social responsibility (CSR) as “the obligation of businessmen to pursue those policies, to make those decisions, or to follow those lines of action which are desirable in terms of objectives and values of our society.”

CSR activities continue to thrive today through efforts to improve labour practices, charitable global giving, providing opportunities for workplace volunteering, as well as committing to diversity, equity, and inclusion.

More recently, with global temperatures rising resulting in devastating effects on the environment, organisations are being asked to do more. Without dropping the ball on their CSR commitments, companies are being asked to look at their overall sustainability performance.

With global warming on the rise, organisations are being asked to consider the impact of their efforts on the environment and the long-term survivability of humanity and the planet.

Activist Jane Fonda is famously quoted as saying: “There’s no more important fight than climate change.

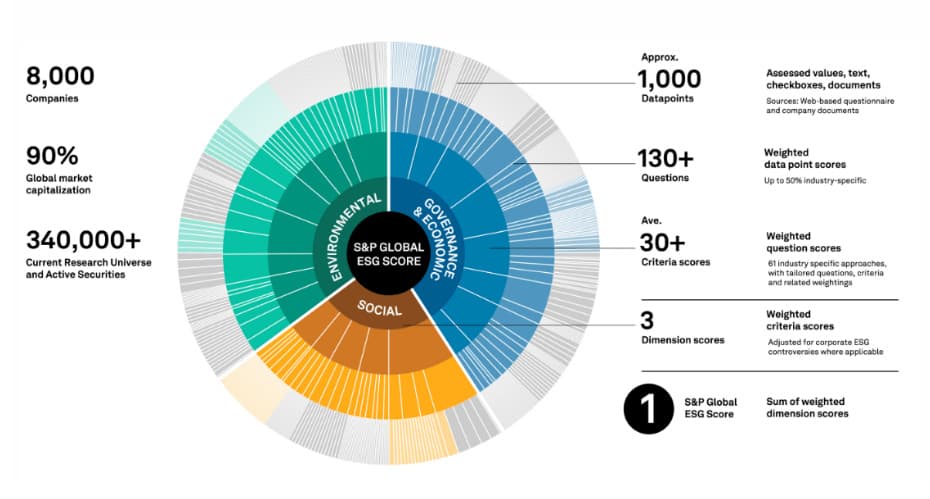

ESG or environmental, social and governance embodies efforts to force governments and enterprises to work towards reversing the effects of climate change through sustainable practices.

ESG performance has become a sustainability credit rating for companies and their investors.

Why ESG is important to CFOs

For CFOs, applying ESG initiatives cuts two ways: what the company invests in, and who are those investing in the company.

Investors are looking for opportunities that go beyond the financial return on investment. They want to know that what they are investing in will have consequential benefits to the environment.

Jef Lacson, regional deputy CFO for Asia for Pacific Cross International, says the role of CFOs is very crucial for the success of ESG initiatives.

“Our expertise in measurements, reporting and promoting transparency within the organisation puts us in a perfect position to take the lead in creating ESG strategies and practices for the company. The social impact of business is one of the core priorities of the CFOs,” he called out.

How should CFOs prepare for this? Where should they start and what do they need to know?

Jeff Lacson: It is easier if the companies already have a mature corporate social responsibility (CSR) program, they can just evolve that to ESG. Companies without a CSR program will need to start from scratch.

"CFOs must be involved and intentional in their engagement. They need to focus on the four areas of their organisation - environment, operations, products and services, and people. Define priorities and decide how ESG efforts will be measured."

Jef Lacson

Then, find ways to implement strategies and be innovative.

How can CFOs who set their sights on ROI translate non-financial metrics as a source of value for the company?

Jeff Lacson: The change in mindset is very critical. It is not a difficult transition if you believe in profit for a purpose. ESG, in my view, should not be regarded simply as an obligation or a non-financial initiative.

It can lead to new business opportunities, new investments, and more significant profit margins in the future as long as you implement it correctly. Even the younger generation has a preference to work for companies with a net positive impact on the world.

Should companies integrate their ESG reporting with their financial reporting and why?

Jeff Lacson: I believe the most logical approach is that when businesses engage in ESG initiatives, they must keep records to showcase their results and to share as part of their storytelling because we can prove ESG efforts via documents. It ensures that all events and transactions are recorded and adequately supported so they are all auditable.

Based on your observation, how are companies in Asia doing in moving forward with their ESG initiatives or strategies, and how engaged are the CFOs and finance departments in these initiatives?

Jeff Lacson: Personally, I think the Asia Pacific market is getting there. The pandemic has emphasised the hybrid-connected nature of our world today.

Mature markets such as Singapore, Hong Kong, and Australia, have increased focus or prioritisation in terms of ESG whereas emerging markets like the Philippines, Indonesia, Vietnam, and probably Thailand, are more focused on fighting the disruption.

But overall, ESG is recognised by Asian leaders as a rising issue within their organisations.

In terms of challenges, what do you see are the challenges that CFOs will face in helping drive their company's commitments and how can they resolve them?

Jeff Lacson: With the pandemic, pushing for ESG funding in an emerging market or company is a big challenge but the economy is starting to recover. Always look at the organisation from various horizons and perspectives.

ESG is a long-term strategic initiative. As CFOs, we should not allow our organisations to be short-sighted. We do not need to start ESG with a big initiative or big donation or big change. We can start slowly. Have a framework, determine your purpose, and try to make an impact on your community.

Jef Lacson

Click on the PodChat player and listen to Lacon’s views on how the CFO can lead the organisation in the fulfilment of its ESG commitments.

- How do you see the role of CFOs in driving the success of their company’s ESG initiatives?

- As CFOs address the issues around ESG, how should they prepare for this? Where should they start? What do they need to know?

- Investors, stakeholders and management are increasingly asking companies to give quantifiable metrics for their ESG initiatives. Many analysts say that the finance department with its experience in compiling and reporting is a natural fit for this task. However, many CFOs still see non-financial metrics around ESG as costs. How can CFOs, who set their sights on ROIs, translate these non-financial metrics as a source of value?

- Should companies integrate their ESG reporting with their financial reporting? Why?

- Based on your observation, how are companies in the Asia Pacific doing in moving forward their ESG strategies and initiatives – and how engaged are the CFOs and the finance department in these initiatives?

- What are the challenges CFOs face in helping drive their company’s ESG commitments and how can they resolve them?