Digital transformation emerges as the top priority for finance professionals, focusing on enhancing financial planning and budgeting, optimising ERP systems, and improving data integration.

This is the findings of a study by non-profit research organisation APQC, polling more than 300 professionals to learn about the focus areas, initiatives, and challenges that will shape finance functions in 2025.

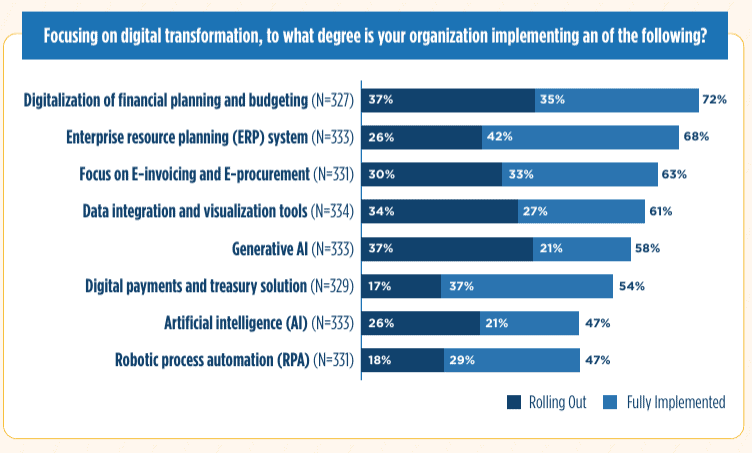

In the study, 72% of respondents say their organisation is prioritising the digitalisation of their financial planning and budgeting. Among which, 37% are already rolling out initiatives, while 35% say strategies are already fully implemented.

Data analytics follow digital transformation in the list of finance professionals' priorities, primarily leveraging it to gain accurate insights into key performance indicators and generate precise, timely financial forecasts.

Eighty percent of those polled says they turn to data analytics in providing them an accurate view of key performance indicators (KPIs), such as net income, revenue, and expenses, while 69% says they use it to create accurate and timely financial forecasts. Thirty-three percent notes they use data analytics to detect fraud.

Additionally, 43% of the respondents view cash flow management as a priority, focusing on timely accounts receivable collections and maintaining financial institution relationships for credit access, marking a shift from last year's emphasis on cost-cutting and labour reductions.

The study found that 62% analyse accounts receivable to ensure timely collections and minimise delays, while 41% manage relationships with financial institutions allowing access to lines of credit.