Boosting working capital efficiency remains as a key priority for chief financial officers in the Asia-Pacific region, according to a recent survey by FTI Consulting.

According to the business consulting firm's Global CFO Survey 2025, 82% of respondents view improving their working capital efficiency as an area for enhancement.

This will be through leveraging digital tools for real-time monitoring of accounts receivable and payable, which can optimise cash cycles and boost liquidity management.

Meanwhile, talent retention is also a pressing concern, as 71% of APAC CFOs face challenges in retaining skilled finance professionals.

FTI Consulting suggests on focusing on employee engagement initiatives, competitive compensation packages and flexible work arrangements to help maintain a strong finance talent pool and reduce turnover, ensuring continuity in finance operations.

Additionally, FTI Consulting recommends accelerating digital transformation, seeing it as vital, with 69% of CFOs in the region looking to modernise finance processes.

Investing in automation and data analytics can streamline workflows and improve data-driven decision-making, allowing finance teams to shift their focus from manual tasks to strategic growth initiatives, thus driving overall business performance.

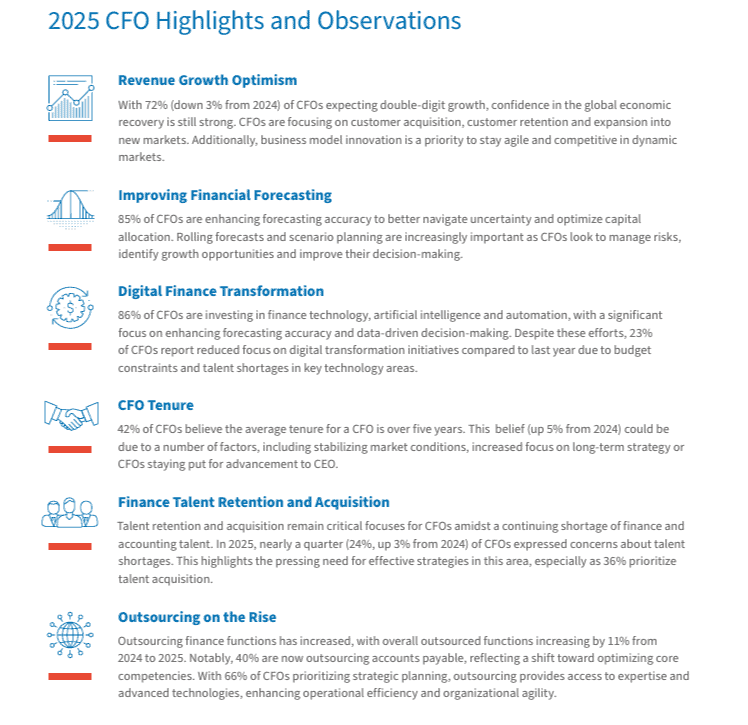

Overall, the report highlighted the following for CFOs in 2025:

As enterprise transformation initiatives continue to accelerate, FTI Consulting says CFOs are often leading the charge. This involves driving operational improvements, adopting technology, and upskilling talent to seize opportunities and manage risks in 2025 and beyond.