The CFO role has evolved more apparently during dramatic changes brought by the pandemic, increased attention to social and environmental issues, and the accelerated adoption of technology to address myriad business and social problems, said McKinsey & Company recently when releasing results of a survey.

CFOs are deeply involved in determining how businesses adapt to these trends — particularly in those places where digital and finance intersect, the firm pointed out.

“The latest survey results show that in the throes of the pandemic, the CFO’s focus has shifted toward crisis management and away from longer-term responsibilities such as strategic leadership, organisational change, and finance capabilities,” McKinsey said.

But the results also point to a way forward for CFOs and their companies, as more industries and economies move toward recovery — suggesting the degree to which finance leaders can have more impact in key areas of the business, and how companies can take advantage of missed opportunities to leverage the CFO’s insights and leadership.

Digital responsibilities

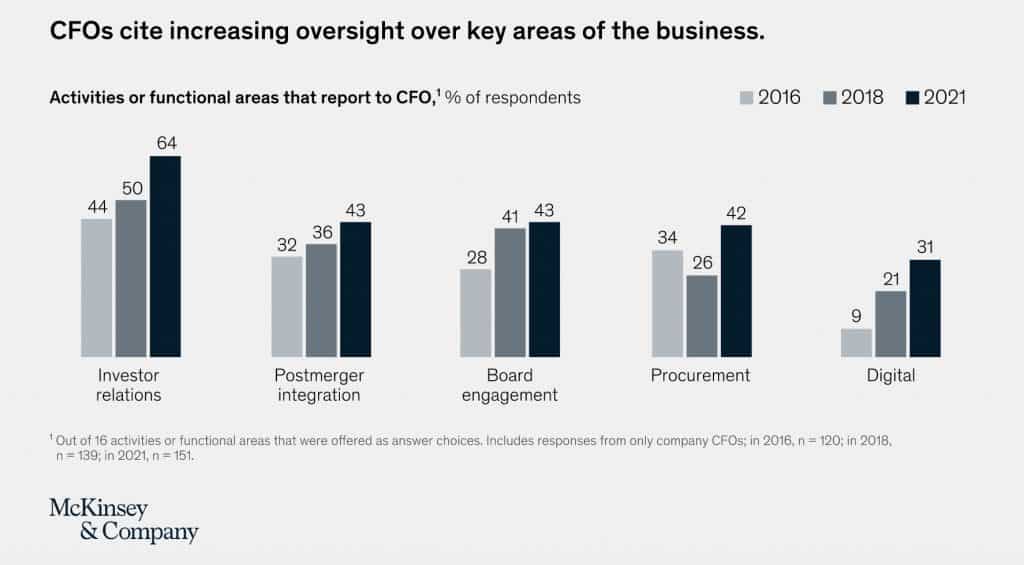

The CFO’s responsibilities have grown in several key areas — particularly in digital — in recent years, McKinsey pointed out.

- Between 2016 and 2021, the share of finance leaders who say that they are responsible for their companies’ digital activities has more than tripled.

- Investor relations has also grown dramatically as an area of focus for CFOs.

- Nearly two-thirds of finance leaders say that they are responsible for these activities, up from 44% in 2016.

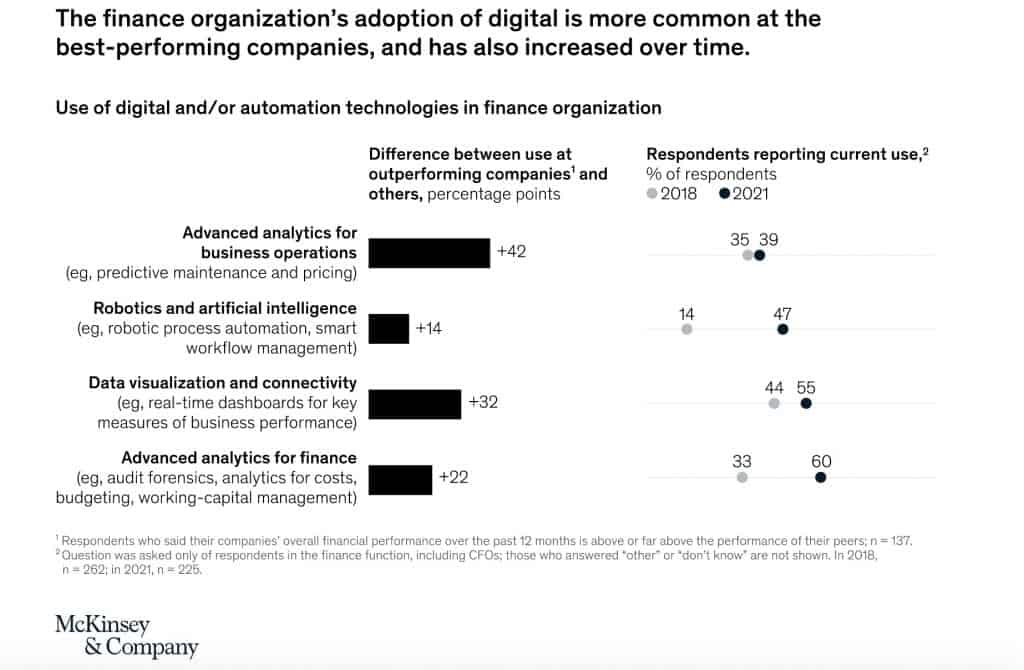

Across the entire finance function, the survey results suggest that digital adoption is on the rise.

- The share of finance-function respondents reporting the use of robotics and AI tools has more than tripled since our 2018 survey, while the share saying that they use advanced analytics for finance tasks has almost doubled.

- What’s more, respondents say that their companies’ IT and digital investments have paid off. Nearly six in ten report either a positive or very positive ROI from investments made in the past year.

Re-engaging with the CEO

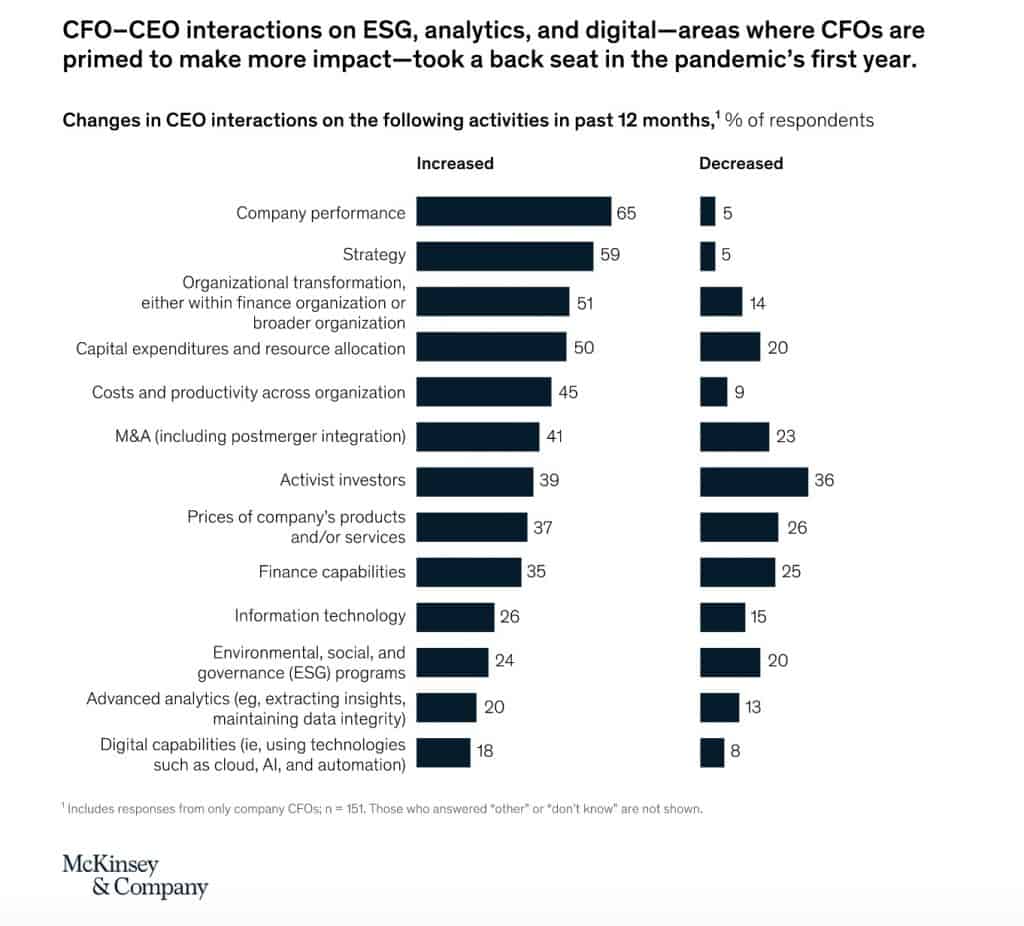

There are also clear opportunities for the CFO to reengage with the CEO, according to survey results.

When asked about the interactions CFOs have had with their CEOs on critical activities during the pandemic, both digital and environmental, social, and governance (ESG) topics took a back seat to the 11 other topics we asked about.

However, that could change with the increasing prevalence of digital technologies in finance’s day-to-day work and an increasing CFO focus on relations with investors —whose interest in ESG has only grown over time, the CFO and CEO will likely need to communicate more directly on these issues, McKinsey said.

CFOs have a meaningful role to play in their companies’ ESG programmes—especially now, as finance leaders and CEOs report that investor interest in these issues has increased dramatically during the pandemic, the firm noted.

For all three areas related to ESG programmes, the CFO role and involvement also seem to support greater alignment between these programmes and the company’s strategic and financial objectives, the firm added.

What has increased significantly in CFO-CEO interaction during the pandemic is organisational transformation and survey data show that CFOs’ leadership in this area adds significant value, McKinsey observed.

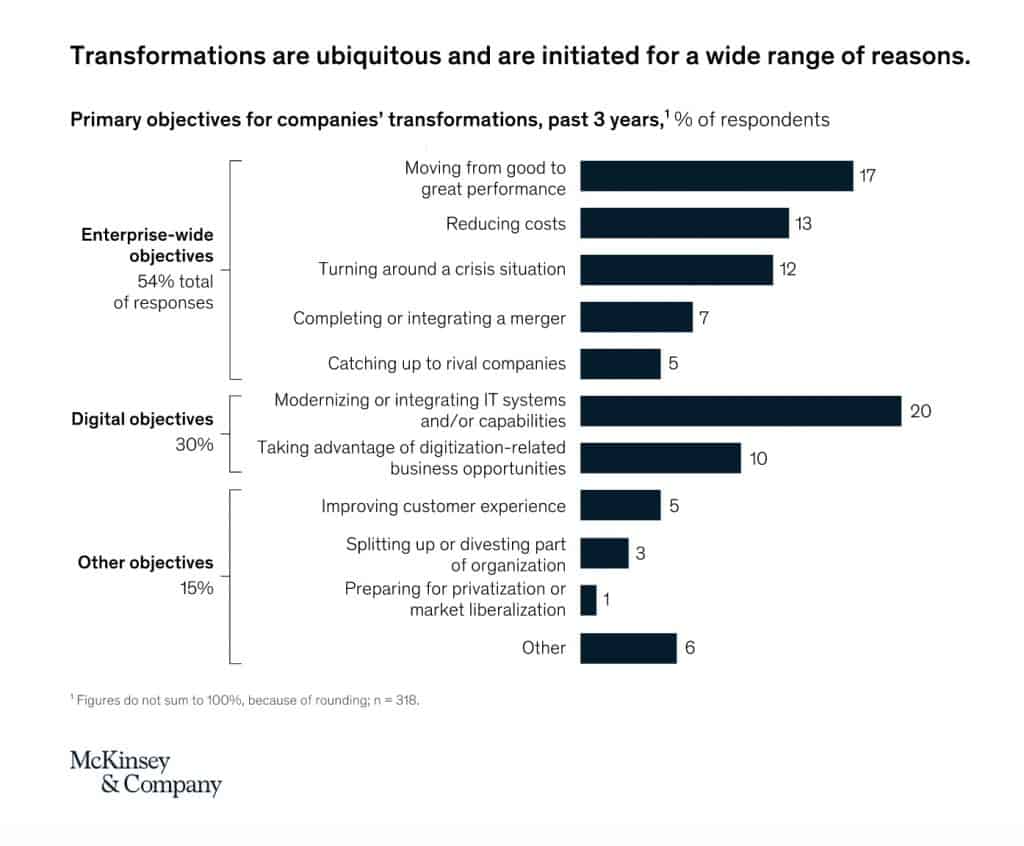

Respondents say that they are pursuing transformations for a range of reasons, particularly in support of performance improvement and digital initiatives, the firm said.

A transformation initiated by the CFO is just as likely to succeed as one started by the CEO, even though it is much more common for the CEO to initiate such an effort, McKinsey observed.

What’s more, finance leaders view their own role and contribution in a transformation more expansively than do their fellow executives, the firm said.

CFOs say that their time on transformations would be best spent on role-modelling new mindsets and behaviours, setting high-level goals, and communicating the transformation’s results—when, in practice, they are most often charged with traditional finance-oriented responsibilities, McKinsey added.

The next step

While many CFOs have to focus on their business’s shorter-term needs and have closely monitored performance, costs, and productivity, the longer-term implications of many critical business trends such as those related to digital, transformation, and ESG are now apparent and require the CFO’s leadership as well, McKinsey advised.

CFOs are also best qualified to drive changes, given the CFO’s focus on the kind of value creation that relies on their deep understanding of the economics of the company’s business model, their strategic perspective on sector-shaping trends, and their role as thought partner with the CEO and the board, the firm added.

In particular, CFOs can continue to experiment with new tools and technologies, digitise their own functions, and, with that experience, help spread digitisation throughout the organisation, McKinsey noted.

For instance, CFOs can lead the way in evaluating ESG risks and opportunities by factoring ESG-related criteria into their firms’ investment objectives and decision making, the consulting firm pointed out.

There is also a bigger CFO role in executing transformations, beyond traditional financial tasks, since finance leaders control most of the key business levers that determine a transformation’s success, McKinsey added.