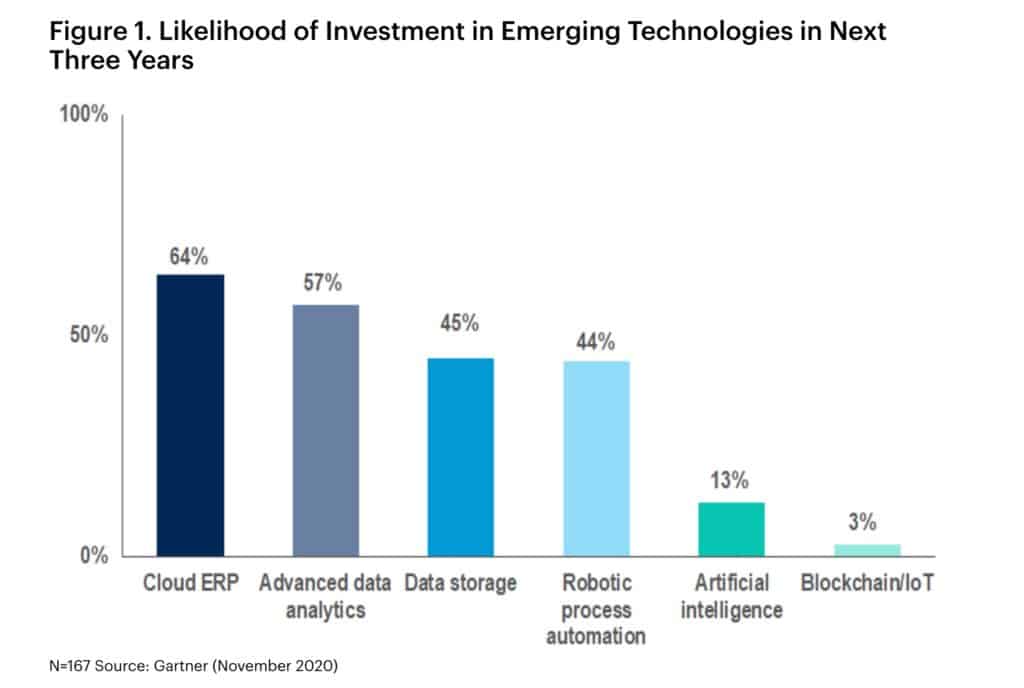

Finance functions are likely to invest in four emerging technologies, according to a Gartner survey of 167 finance organisations conducted last November.

While cloud enterprise resource planning (ERP) is the most favoured choice, other likely areas for investment include advanced data analytics, data storage, and robotic process automation (RPA), according to the advisory firm.

As with many business functions, COVID-19 has accelerated the pace of finance investment in digital transformation, Dan Garvey, vice president in the Gartner Finance practice pointed out.

While digital transformation has been a major priority for finance functions in the past, the pace of transformation has materially changed, he said.

“Digital investment and transformation are no longer things that CFOs can take a ‘wait and see’ approach on or throw small investments at,” Garvey noted. “The time is now, and CFOs need to act swiftly.”

“It’s not surprising to see cloud ERP as the top choice for finance organisations because it’s a maturing technology with clearly established benefits that offer an escape from the bloated ‘monolithic’ ERP systems of yesteryear,” said Garvey.

In addition, advanced analytics, data storage and RPA are also all established technologies with well-proven use cases in finance, he observed.

AI and blockchain are not so well-established for finance

AI and blockchain, however, are not so well-established and for many finance organisations would pose bigger implementation problems and a less certain return on investment, Garvey said.

It’s also possible to get some exposure to the potential benefits of AI without investing directly, he added.

Embedded AI in cloud ERP and advanced analytics

Many cloud ERP and advanced analytics offerings are increasingly offering embedded AI capabilities, and that neatly solves many challenges around integration and in-house expertise, Garvey pointed out.

There’s no doubting the potential of building your own AI, but the questions is whether the finance function is capable of realising that potential,” He said.

“Blockchain also has great transformative potential, but right now out-of-the-box use cases are also limited and not applicable to most of the work that the finance organization conducts,” Garvey observed.

While the size of the business in revenue correlates closely with its propensity to invest in AI, Blockchain or the Internet of Things (IoT), this is likely in part because of the sophistication of an organisation’s IT infrastructure, according to him.

“Implementing AI, blockchain or IoT is unlikely to be simple, and there are lower hanging fruit for most finance functions that want to drive meaningful gains with emerging technologies,” he said.