In its Top 5 Finance Trends and Priorities for CFOs in 2024, Gartner says economic headwinds have forced CFOs to look beyond temporary measures and find new ways to lead finance through digital transformation. The analyst forecasts that through 2025, more than 40% of finance roles will be either new or significantly reshaped due to finance technology.

Keeping the organisation agile, resilient, and competitive is no simple task, but with the right partner and program, processes can be a lot easier and better.

This is among the aims of software company Esker, which seeks to unlock strategic value for finance, procurement, and customer service professionals.

For Esker, while their solutions are utilised to drive added value creation within the finance function, the benefits expand beyond the doors of the company itself. This, in turn, gives new meaning to jobs and boosts strategic relationships.

This year, Esker bagged the FutureCFO Reader's Choice Awards for Finance Automation partner, serving as a testament to the company’s commitment to technological excellence driving results for success.

Charlie Cheah, managing director for Asia at Esker, discusses the importance and relevance of positive-sum growth for the organisation, calling it a ‘game-changer’.

Everybody wins

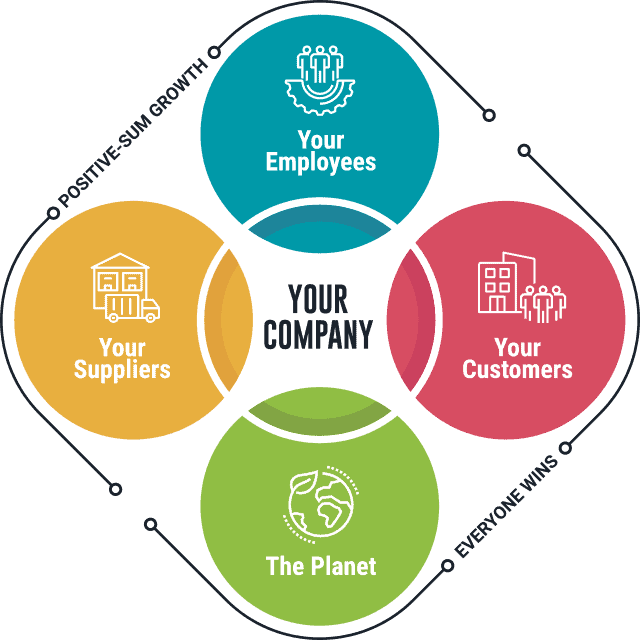

Esker believes there is more to business than the bottom line, that is why they strive to equip their clients with technology that creates positive-sum growth.

Positive-sum growth, in their definition, is a fancy way of saying that when the company succeeds, it never happens at the expense of any team, individual or enterprise in the business ecosystem.

Through this, they pave the way to staff empowerment while ensuring that customers have an easy and reliable experience.

Cheah observes that a lot of companies take positive-sum growth for granted and tend to overlook it. “A lot of cases we see in the past is always winning, but [a] win for the company, not [a] win for the rest.”

He points out that Esker is promoting holistic change, one that will impact not only the organisation but also the stakeholders such as the suppliers and employees. He explains that Esker not only seeks to bring transformation and victory for the company.

He also notes that they have seen companies agreeing to this initiative.

Esker believes that the old ‘when I win, you lose’ approach will not work in the current business environment. This is why automating finance and customer service processes sets the foundation for future growth while ensuring that the workforce is fulfilled and motivated.

Moreover, Esker seeks to increase value across the business while equipping organisations with tools to help them be resilient in times of crisis.

Adoption

As for the adoption of positive-sum growth within various organisations, Cheah thinks this has been around, but companies have not been doing it holistically.

He explains that in Asia, for example, some sectors such as service and manufacturing have not been holistically adopting positive-sum growth. “That’s why supply chain is important,” he says.

“In any organisation, finance is always one of the backbones of the companies,” Cheah adds, saying supply chains must be done more cost-effectively and efficiently.

How to start

Admittedly, the first step is always the most difficult one.

This is why in starting an organisation’s journey toward positive-sum growth, Cheah explains that the management must be driving the transformation first to bring forth the ideals within the company.

“The management needs to believe in it, [positive-sum growth] needs to be part of the organisation’s vision.”

Charlie Cheah

He points out that it is not enough to just talk about positive-sum growth, saying the management must commit to it to make it work, otherwise, it will just look good on paper.

“Doing the same thing is going to give you the same result,” the Esker managing director says.

Cheah also highlights the importance of achieving efficiency and the need to streamline the workflow. In this regard, leaders and organisations must be committed to delivering results for success as this will filter down to the employees within the company.

Communicating change

Change is constant, but it does not mean that people are always welcoming about it. Cheah believes that for transformation to be effective, change—no matter how small—must be communicated first.

He notes that communication is important, and the benefits expected from a proposed shift within the organisation must be discussed and shared with stakeholders.

“What’s in it for them?” Cheah probes.

Automation and data

Finance automation is proven to increase efficiency, save time and remove bottlenecks and pressure points within workflows where human error or fatigue can cause issues. With the market and the business world of today becoming more and more interested in automation, Cheah points out that data is important, saying it is the key as it brings in real-time accessibility to needed information.

As a company recognised by FutureCFO readers for its dedication to automation, Esker highlights the importance of driving stronger growth with smarter data using information accumulated from millions of documents processed on its digital platform.

This helps customers and suppliers to predict trends and behaviours to allow for better prioritisation of collections according to levels of risks and reduction of write-offs.

Cheah says they have seen how humans have evolved, which made way for transformation even in the business setting, highlighting that automation has brought this acceleration.

He also takes note of how artificial intelligence, particularly generative AI, has assisted people today in their work. Esker uses intelligent recommendations to help speed up business processes to save time in daily activities such as fraud and detecting unusual quantities in orders and deliverables. With Technology, employees can Make smarter and more predictive decisions.

Gartner concurs noting that automation is already widely used for transactional tasks, but machines will become more capable of judgement-based decisions and provide more prescriptive advice to humans.