Have you ever wondered if your finance function is over-investing in new analytics tools? Gartner confirms your thought if you do.

Many finance leaders have transformation plans that seek to expand the role of their analytics portfolios, without recognising the improvement in enterprise-wide access to analytics capabilities that were previously the sole domain of finance, the advisory firm pointed out.

This means many finance organizations risk investing in analytics that is already being utilised within the business, Gartner noted.

Planned new investments featured in many forward-looking finance transformation plans intend to have finance functions expand their analytic portfolios, often planning to offer new, more commercially focused, forms of analytics such as pricing strategy and capacity planning, the firm observed.

However, in parallel, the business has increasingly gained access to more data, as well as access to more sophisticated tools to analyse that data, the firm added.

This presents a risk that finance will over-invest in analytics capabilities at a time when business partners are increasingly less dependent on the financial planning and analysis (FP&A) team for support, said Alexander Bant, chief of research in the Gartner Finance practice.

“This is a situation that will lead to duplication and less confidence in which set of analytics results are ‘correct,” Bant noted.

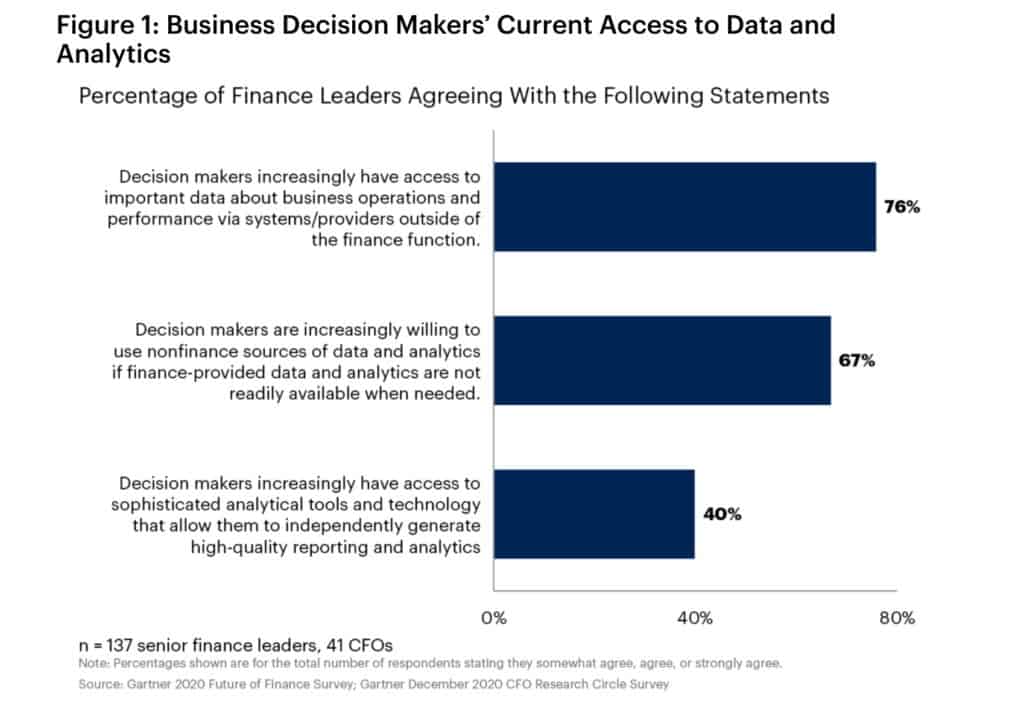

A Gartner survey of 127 finance leaders in December showed that a clear majority felt both that decision makers in the business were already getting increasing amounts of important data on performance and business operations from outside the finance function, and that business decision makers were increasingly willing to use non-finance sources of data and analytics in cases where finance data is not ready as needed

“Finance transformation plans should incorporate a heavier emphasis on enterprise-wide data governance and quality, and a willingness to cut analytics capabilities that are under-utilised or already operational in other functions,” Bant advised.

“We think about it in terms of the menu that finance offers. You don’t want competing menu items being put in front of the same customer twice,” he added.

How to right-size analytics role for finance

Finance leaders, according to Gartner, should pursue the following two primary actions to right size finance’s analytics portfolio and finance’s role in providing financial and performance data.

Audit the form of analytics. This should include analytics the business receives both from other functions and that it independently prepares. Identify which current forms of finance analytics have a questionable ROI in the eyes of FP&A staff.

Finance leaders can ask FP&A staff to identify the forms of analytics that experience low demand, or are highly time or resource-intensive to generate.

Double down on performance data governance, not performance data synthesis. Finance leaders should promote a “sufficient versions of the truth” strategy rather than a “single source of the truth” approach, which is more effective for today’s highly distributed, complex data sources.

“Finance leaders who fail to right-size their analytics portfolios risk growing duplication and adding to confusion around the correct interpretation of analytics, ultimately risking finance’s reputation as a trusted advisor on financial data,” said Bant.