Wolters Kluwer Tax & Accounting (TAA) Asia Pacific (APAC) reported a significant uptake in the adoption of BEPS Pillar Two Initiative, according to a press release.

New insights from the latest Wolters Kluwer BEPS Pillar Two Readiness Index show an accelerated global adoption of the BEPS Pillar Two initiative, despite some continued challenges.

The BEPS Pillar Two Readiness Index, which serves as a barometer to assess readiness among global tax jurisdictions subject to BEPS Pillar Two measures, reveals that over 70% of organisations indicated that they have begun preparations to comply while 58% are transitioning into the middle-to-late stages of preparedness.

Confidence in international collaboration has also improved substantially, with 60% now saying it is achievable.

"There is a critical need for multinational companies to meet and manage the complex global requirements related to BEPS Pillar Two, and we are encouraged by the progress that organisations are continuing to make in their compliance efforts," says Andy Hung, Director of Product Management at Wolters Kluwer TAA APAC.

Other key insights from the latest BEPS Pillar Two Readiness Index Report include:

- Recognised Benefits: A strong 74% of organisations are already recognising the positive effects of the initiative, including streamlined processes and increased standardisation across varying jurisdictions.

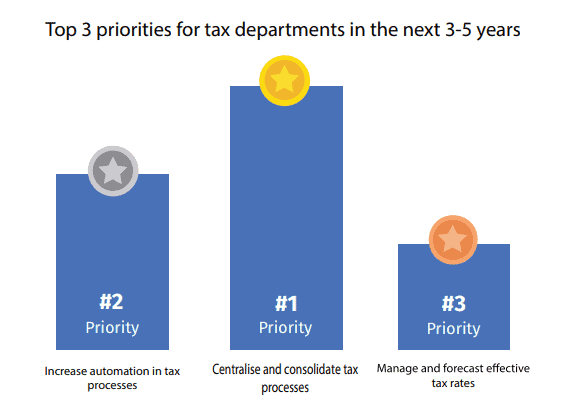

- Adoption of Tax Technology: Technology appears to be a core facet of how manyentities will look to address those obstacles, with a majority of respondents (61%) prioritising the centralisation and consolidation of various tax processes via a single platform. Meanwhile, 58% are focused on increasing automation processes. 34% of organisations overall are actively considering the implementation of tax technology solutions to streamline their tax obligations.

- Anticipated Challenges: Despite the positive reception, 70% of respondents foresee potential concerns or challenges related to international collaboration.

- Hurdles to Implementation: Key challenges also include legislative uncertainty, understanding data requirements, and access to limited resources.

Wolters Kluwer CCH Integrator BEPS Pillar Two solution was designed specifically to assist multinational corporate tax departments as they seek to simplify and streamline reporting obligations. The solution provides users with a complete corporate tax performance

management platform that will guide them through the entire data capture, calculation, and reporting requirements of Pillar Two.