The current pandemic will trigger a major acceleration in business insolvencies due to both the suddenness and historic size of the economic shock and its expected lasting effects, said Euler Hermes recently.

The lasting effects are critical for companies that were already the most fragile before the crisis and are now among the sectors —transportation, automotive, non-essential retail, as well as hotels and restaurants — hit the hardest by measures to contain the pandemic, the trade credit insurer noted.

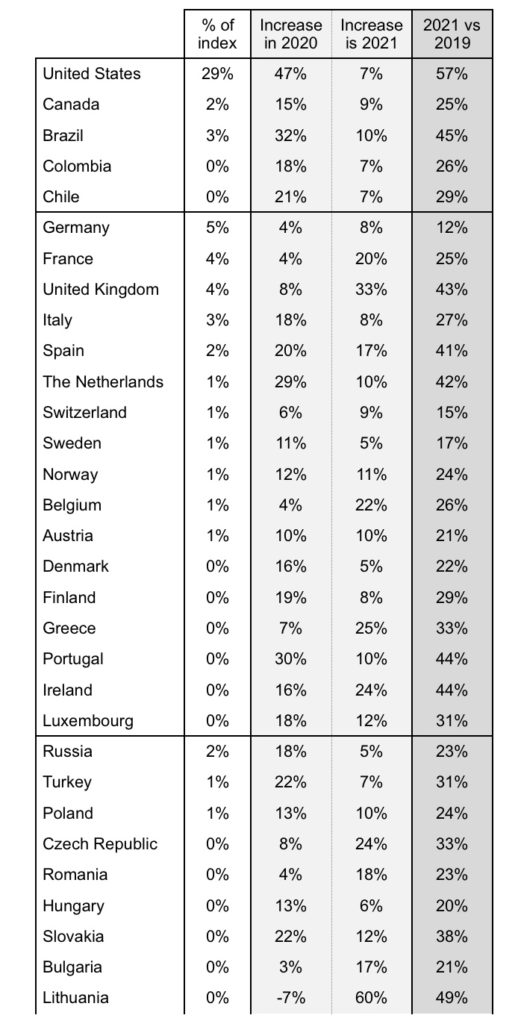

At a global level, Euler Hermes’ insolvency index is expected to surge to a record high of +35% cumulated over a two-year period (after +17% in 2020 and +16% in 2021) as the global economy faces a U-shaped recovery from the pandemic.

This would represent a +16% y/y CAGR of insolvencies over the two-year period, similar to the intensity level of the 2008 financial crisis, said Maxime Lemerle, Head of Sector and Insolvency Research at Euler Hermes.

Bulk of insolvencies between H2 2020 and H1 2021

Unlike in 2007-09, all regions and countries are expected to post double-digit increases in insolvencies, with the biggest surges seen in North America (+56% by the end of 2021), followed by Central and Eastern Europe (+34%), Latin America (+33%) and Western Europe (+32%), Euler Hermes pointed out.

So far, government interventions to prevent a liquidity crunch for corporates, including tax deferrals, state loans and guarantees, wage subsidies and debt moratoriums, have helped limit the immediate translation of the pandemic shock into official insolvencies in many countries. Lemerle said.

“However, if this policy relief is withdrawn too fast, we expect the increase in insolvencies to be +5 to +10pp higher,” he noted. “At the same time, prolonging support for too long could prop up ‘zombie’ companies, increasing insolvency risk in the medium to long term.”

China tops the insolvency list in APAC

Euler Hermes also identified two clusters of countries — those that will see a stronger rise in insolvencies in 2020 and those that will see a delayed surge in 2021.

Most Asia Pacific economies are in the first group (China, Japan, South Korea, Taiwan, Hong Kong and New Zealand, with India as key exception) mainly because they were the first to be impacted by the coronavirus outbreak, the firm said.

China tops the list with an expected +40% more insolvencies by the end of 2021, followed by Singapore (+39%), Hong Kong (+23%), Japan (+13%) and Australia (+11%), the firm added.

In Asia Pacific, not only have we estimated insolvencies to increase by +31% by the end of 2021, we also marked down the region’s 2020 GDP contraction to -1.3% from our estimation of -0.6% made in April, said Françoise Huang, Senior Economist for Asia Pacific at Euler Hermes.

The company considers transportation, automotive, retail and textile are the most vulnerable sectors under the latest lockdown measures and environments.

“On the positive side, economies such as Australia, New Zealand, South Korea and Taiwan are seen benefiting from the comparatively earlier recovery of the Chinese economy, as trade data shows that exports to China have outperformed those to the US and the Eurozone,” Huang noted.