In the US, the US Federal Reserve is set to introduce to the local market FedNow – an instant payment solution that will enable customers of participating banks and credit unions to instantly send and receive money transfers outside of traditional banking hours.

In Asia, instant payment has been around for some time and has been instrumental in consumers, and some industry sectors, to return to a post-pandemic normal faster than may have been possible.

The transformation all industry sectors underwent during and after the COVID-19 pandemic is without a doubt a testament to how well industries can rebound from losses and challenges brought about by the change. The payment landscape is no exception.

Why real-time payment matters to the CFO

The 2023 U.S. Bank CFO Insights Report revealed that among 1,400 senior finance professionals in the US, cost control within the finance function and across the entire business ranked as the top priorities in 2023. Faced with the rising cost of capital alongside rising inflation, finance leaders are taking a defensive mode focusing on efficiency. With growth also high on the agenda of Boards and CEOs, finance leaders must balance cost-control efforts against investments.

Real-time payment offers several benefits that CFOs and finance leaders may find valuable to optimising capital allocation. In terms of intracompany transfers, real-time payment will enable companies to deploy working capital more efficiently across subsidiaries.

Suppliers can embed real-time payment instructions in customer communications to simplify invoice processing. This can be used to launch programs to encourage early payments or accelerate late payments. Real-time payments can facilitate emergency payroll, fund disaster relief and AP exception payments.

Beyond improving supplier relationships, and better control over working capital, other benefits include better security given the increased visibility of payment details, and improved ROI with the anticipated lowering of bank wire fees. Real-time payments also mean account balances stay up-to-date.

In Asia, real-time payments are now available in Australia, Hong Kong, Japan, Singapore and Thailand. Efforts are underway in other markets to facilitate cross-border e-payments.

Real-time payments in the Philippines

In the Philippines, like every country affected by the pandemic, banks were forced to keep up with the rapid changes to keep the business afloat—juggling between the needs of the employees, the customers, and the organisation itself.

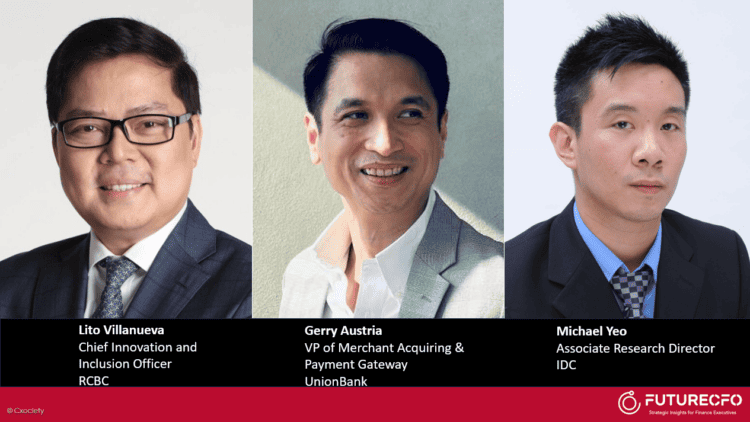

Michael Yeo, associate research director at IDC Financial Insights and Retail Insights, observed that there has been a huge acceleration in the uptake of digital payments in the Southeast Asian nation during the pandemic, with the effects of such continuing post-COVID period. “Digital payment methods such as InstaPay and mobile wallets such as GCash have seen massive surges in usage.”

Lenders were put in a position to find ways to accommodate the increased number of digital transactions and ensure resiliency and uptime rise accordingly, said Yeo. They also had to learn how to leverage the new opportunities from payments to go beyond just the handling of transactions, and how to derive new revenue streams and build new products and services around payments.

The digital payments propulsion in the Philippines

Gerry Austria, vice president for merchant acquiring and payment gateway at Union Bank of the Philippines (UnionBank), said the pandemic propelled the digital payments scene in the country, as the adoption of contactless payments was accelerated by consumers, merchants, and the banking sector.

Moreover, it was also during the pandemic period when the Philippines saw the establishment of a national QR code, the QR Ph, which was initially intended for person-to-person transfers before evolving to person-to-merchant transactions.

For Austria, these accelerated the growth of the Philippine payments landscape as establishments embraced QR Ph as a mode of payment from their consumers.

The popularity of P2P (person-to-person) and P2M (person-to-merchant) also reached greater heights during the pandemic, said Austria, attributing this to the ability to transfer funds in real-time which attracted consumers and merchants to adapt.

“Banks are now into the development of mobile platforms,” Austria added.

Regulation

Among the changes brought about by COVID-19 is the Digital Payments Transformation Roadmap launched by the Banko Sentral ng Pilipinas (BSP) to foster the growth and development of the sector’s innovations, to convert at least 50% of all retail payment transactions into digital form by 2023.

Lito Villanueva, chief innovation and inclusion officer at Rizal Commercial Banking Corporation (RCBC), said this roadmap, and the fact that its goal is set to be achieved this year, serves as a plus point for everybody in the industry, highlighting how the digitisation of payments reshaped the landscape of the sector overall.

He points out that digital payments have long since been steady in growth, observing that when one gets into it, one can no longer go back to the traditional manual ways of transactions. Villanueva attributed this to the convenience, transparency, and security of the process.

Austria, on the other hand, highlighted that the Philippine central bank, during the pandemic, was able to license around six digital lenders including UnionBank.

Influential factors

As for the influential factors affecting the payments landscape, Villanueva said their engagements as universal commercial banks with different players impacted the sector overall. “It’s really more about having to collaborate, having to have a synergy,” he said.

He also touched on the credit market of the Philippines, noting that it is an interesting one since there is still a great number of Filipinos who have no access to it despite the legislation and regulations. “At the end of the day, the whole idea is how we can cover as many Filipinos in providing them access to credit.”

Meanwhile, Yeo thinks diversity, cross-border, and security play roles in the sector as new payments emerge, including different models of BNPL (merchant-led, acquirer-led). ASEAN initiatives to link domestic real-time payment schemes across the region affected the payments landscape as well and people are allowed now to use their banking and wallet apps in any other ASEAN country.

Technology’s role

Admittedly, the advent of new technology, particularly generative artificial intelligence and OpenAI, has been spread out not only in the banking sector but across all industries. Villanueva said they have seen how banks are now leveraging on advancement, highlighting that RCBC is set to be an AI-led digital banking player in the Philippines aimed at catering to the needs of their consumers.

Meanwhile, Austria believes that part of its role in the banking sector is to “evangelise” consumers regarding digital literacy, highlighting the need to educate consumers and merchants on the benefits of shifting to digital payments. Along with this is learning how to tread on the path of building trust among the stakeholders.

“The common question that comes to mind for the regular consumers: ‘How secure is my money or my funds inside this app?’”

According to Austria, Consumers must be aware that banks spend a significant amount on the security of the said apps and the integrity of these systems.

The UnionBank finance leader also believes in the importance of the usability of the payment platforms and applications, saying it should be determined how useful the advancements are in consumers’ day-to-day lives. “Payment platforms should be able to make the lives easier for the consumers,” he pointed out.

Moreover, merchants also play a role in the adoption of digital platforms as relevant segments such as the public transport system should be able to adapt to the digital economy.

Challenges and opportunities

Villanueva believes the rise of digital currencies, cashless payments, operation resilience, sophisticated customer journeys, and compliance pose greater challenges for the Philippine banking system in the coming years, emphasising the weight of dealing with the country’s road to a cash-lite society.

On the other hand, Austria sees these challenges as underlying opportunities.

Among these opportunities, for Austria, is borderless payments, explaining that connecting domestic payment schemes to their respective international counterparts creates new revenue streams for them and a stronger value proposition for the consumer.

Open finance also poses new opportunities for the sector, said Austria, highlighting that this promotes consent-driven data and collaboration between entities. “For UnionBnk, we see this more as an opportunity because it drives innovation.” Consumers also benefit from this as they can select a wide range of financial products and services.

Customer experience and online onboarding

Austria believes the key is to focus on the customers, admitting that it is a challenge to understand them. “As financial institutions, we must understand their need and be able to use the right tools and channels to deliver seamless customer experience.”

He said they work closely with their data team to analyse consumer sentiment and make use of the information to further improve their services and products.

Meanwhile, onboarding is viewed as a challenge, especially with a limited network where merchants or consumers can’t interact with an actual representative of the bank. “This is where digital onboarding plays a vital role,” Austria said.

UnionBank has introduced digital account opening, expanding its reach to people as they no longer need to go to physical branches to open an account. The lender also has a deposit check feature on its online banking platform, where customers can simply take a picture of the check to have it deposited into their accounts.

Banks and fintechs as partners

Villanueva believes lenders and fintechs have evolved into partners in the industry, saying this makes the value of the proposition much clearer and of greater quality as the parties become part of the collective engagement with customers.

This view is shared by Austria, saying technology vendors are seen as partners instead of competitors or even threats. “What we learned in the digital transformation is that collaboration is one of the keys to success in innovation,” he said.