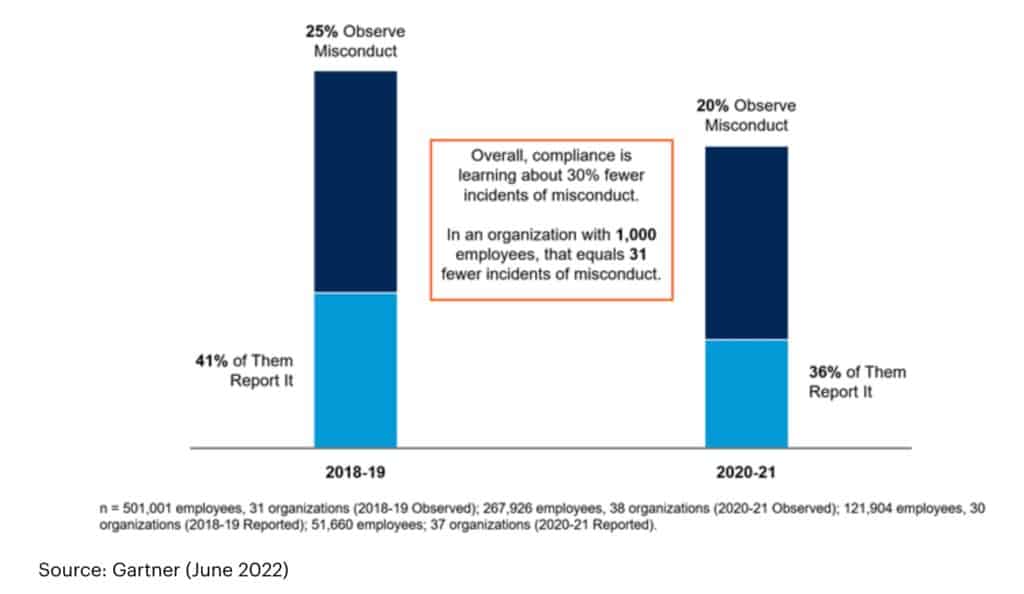

The rate of compliance reporting has dropped by 30% from before the pandemic, said Gartner recently.

According to a survey by Gartner, employees are both less likely to observe misconduct and less likely to report it when observed.

The increase in remote and hybrid working practices has reduced the amount of misconduct and the potential to observe it, said Chris Audet, senior director, research in the Gartner Legal, Risk & Compliance practice.

“However, what we see in the data is more complex: misconduct such as gifts and entertainment, and travel abuse is falling, but things such as intimidation and unwanted behavior are on the rise,” he noted.

Misconduct is certainly still occurring since the pandemic, albeit in changing ways, but compliance is hearing about it 30% less frequently than before, Gartner pointed out.

Since the pandemic, employees are a lot less likely to speak up if they sense something is wrong, whether or not the frequency of misconduct is higher or lower, said Audet.

A culture where employees don’t think others are reporting misconduct has negative implications for the business, he added.

Employees are less likely to see their company as ethical, less likely to think the company cares about them, and less likely to be engaged in their jobs, he said.

Changing landscape for misconduct

Overall, remote employees observe 11% less misconduct than their in-office peers, Gartner noted.

This is partly driven by a large fall in observed misconduct around travel, gifts and entertainment as opportunities for misconduct in these areas are significantly lower, the firm added.

However, types of misconduct that compliance typically have a very low tolerance for are holding steady or on the rise, Gartner observed.

“Bullying, intimidation and unwanted behaviour are up 7% for remote workers; misuse of time and company assets is up 3%,” said Audet. “Sexual harassment is relatively steady at just 1% lower for remote employees since the pandemic.”

In addition, new forms of misconduct are quickly emerging in a virtual environment, such as inappropriate video backgrounds or online behaviour, Gartner said.

Compliance leaders will need to start thinking differently to reverse the trend, the firm advised.

“Compliance is generally great at putting measures in place that drive compliance reporting in an office setting,” said Audet. “For example, nearly all compliance leaders have created multiple reporting channels to boost ease of reporting, and four-fifths have standalone anti-bullying or anti-retaliation policies.”

What some compliance leaders are missing, according to Audet, is that remote workers have a fundamentally different relationship with their employers in which it’s much easier for apathy to creep in because for many people the business is at arm’s length.

“For remote workers, when they close their laptop they aren’t at work anymore: office life isn’t really part of their daily social equation, they aren’t as embedded in the compliance culture” Audet observed.

In many situations remote employees are going to tell themselves reporting isn’t the right thing to do purely in terms of self-interest, he pointed out.

They are making a cost-benefit calculation and can envisage speaking up working out badly for them, he added.