To keep pace with the constant changes brought about by digital business, CFOs need to acquire new skills and knowledge. Now more than ever, digital aptitude is not only necessary to vet business cases and measure outcomes for digital projects but it’s also needed to drive a company’s long-term success.

According to a recent Gartner study,1 companies that met or exceeded expectations for returns on digital spending increased earnings before EBITDA at a rate of 2.8 percentage points faster than those whose digital investments underperformed.

Yet CFOs report feeling exposed when it comes to maintaining and growing their technology skills while also developing digital competence among their finance teams. CFOs who struggle with identifying/ cultivating skills and behaviours that they and their finance team need may create deficiencies in digital strategy and cause missed opportunities in revenue, productivity and profitable growth.

According to the 2024 Gartner Board of Directors Survey,2 which surveyed 285 non-executive board members, 56% said they expect their enterprise to accelerate investments in business initiatives in 2024-2025. Yet 67% of CFOs said their organisations’ digital initiatives underperform.

This is partly due to organisations underestimating the difficulty of change in terms of people’s behaviours, attitudes and talents needed to adopt technology fully. With this in mind, 61% of Boards of Directors surveyed plan to improve digital dexterity – which is the ambition and ability to use technology for better business outcomes – across their organisation to improve and enhance digital performance.

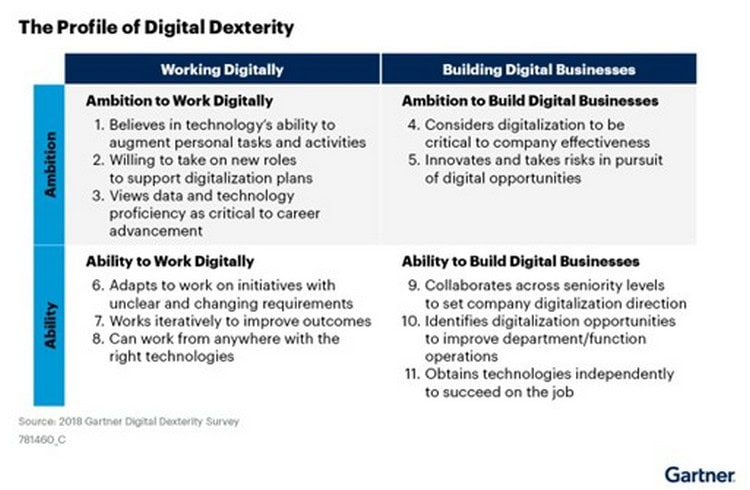

As part of its continued research on the relevance of and focus on digital dexterity, Gartner surveyed close to 3,500 corporate employees globally, representing all industries, functions and levels of seniority, to identify the beliefs, mindsets and behaviours that underpin digital dexterity. Eleven attributes were identified to create a profile of digital dexterity, which is defined as the ambition and ability to work digitally and build a digital business (see Figure 1.)

Figure 1.: The Profile of Digital Dexterity

The good news is that many behaviours that build digital dexterity are those that CFOs and finance leaders already practice or can be easily learned. Exemplifying the 11 digital dexterity attributes in Figure 1 shows the board, CEO and C-suite peers that CFOs are aligned with the overall digital ambitions of the company, while also demonstrating new capabilities.

Looking at the attributes through the lens of personal growth, they can either be fine-tuned or practised as new behaviours. Digital dexterity is both a way of thinking and a way of doing that CFOs can build by focusing on the following three actions.

Action No. 1: Challenge the mindset

A mindset is a way of thinking that shapes the way people work and lead their lives. Mindset also affects one’s relationship with success and failure. Attributes that help to challenge the CFO’s thinking are believing in technology’s ability to augment personal tasks and activities, being able to work from anywhere with the right technologies, viewing data and technology proficiency as critical to career advancement; and realising that digitalisation can be critical to a company’s effectiveness.

These attributes are within the CFO’s control: they simply involve embracing a set of beliefs about the effects and potential of technology. Those beliefs may be influenced by the culture and digital ambitions of the organisation, in which case, it’s necessary to determine whether levelling or leading the pace is best for the specific industry and culture.

Once the CFO’s mindset is aligned with the four attributes, the next step is to demonstrate and model corresponding behaviours and communications with the finance team. To better understand their technology mindset, CFOs can try asking the finance team to share insights on their favourite productivity tools during a team meeting and explore a few suggestions for personal use.

CFOs can also try blocking time to work remotely to allow freedom from office distractions which will advance projects that require more critical thinking and focus time.

Action No. 2: Evolve work practices

To practice digital dexterity attributes, it is crucial to manage uncertainty and change. By encouraging a mindset that reacts and adapts to unclear or changing requirements, finance leaders can consider the opportunity cost of participating in unfamiliar experiences and get more comfortable with being uncomfortable.

In a similar vein, CFOs can approach planning scenarios and other occasions where unplanned events develop in a workflow with an iterative approach, using Agile methodology and principles to address unexpected changes. This approach deems the unexpected as necessary for progress and growth, rather than problematic.

Additionally, finance leaders can take steps to move beyond monitoring and managing finance operations and seek ways to actively improve finance or business workflows. Anticipating and identifying digitalisation opportunities to improve function operations helps encourage ways to continuously improve and realise the efficiencies offered by new technology.

One way to inspire innovation in finance is to create an award program for employees to showcase these opportunities and their approach to improving efficiencies. Another way is to innovate and take risks in pursuit of digital opportunities, as this attribute creates occasions to collaborate and problem-solve with finance and other teams across the business.

Trying out new ideas through trial and proof-of-concept will not always lead to an immediate solution but will encourage innovation and comfort with pursuing digital opportunities.

Action No. 3: Embrace new experiences

Working in a way that embraces new experiences is the final key to increasing digital dexterity. Three attributes – being willing to take on new roles to support digitalisation plans, obtaining technologies independently to succeed on the job, and collaborating across seniority levels to set company digitalisation direction – help finance leaders continually grow and adjust to the demands of digital business.

The CFO typically focuses on wearing the hat of an investor during digitalisation plans. But by exploring new roles, they can pose more productive, strategic questions about digital investments, such as whether the size of an investment is appropriate for the business problem it is meant to solve, or whether the capabilities to achieve expected outcomes exist or are attainable.

As a point of entry, CFOs should approach digital efforts with a beginner’s mindset, and simply participate to gain experience in discovering the right questions about digital investments. For example, acting as a sponsor for a digital project is a way to gain better exposure and experience in addressing customer or operational issues.

While CFOs don’t need the ability to apply next-generation technology skills for data mining and training machine learning models, being educated on and aware of available technologies in finance is important for creating strategic plans. Create time to attend meetings or demonstrations where firsthand examples are showcased and explained to gain new information.

Finally, CFOs should collaborate with colleagues across different levels to set the company's digitalisation direction. For example, frontline teams, who know customers and handle details of operations, could provide rich insights.

However sharing those insights with those who can decide to allocate resources adds a further opportunity to interact across the organisation and develop a better perspective for digital needs, leading to better prioritisation of time and investments.

The path to gaining technical skills and comfort levels requires small changes in what CFOs do today but those small adjustments will make a difference tomorrow. With time and practice, the ambition and ability put into new ways of working will collectively build digital business effectiveness and the finance function’s overall success.

1 2022 Gartner Business Outcomes From Digital Spending Survey. Gartner conducted this survey to understand how to drive business outcomes from enterprise digital spending. The research was conducted online among 104 respondents across North America, Western Europe, Asia and Oceania regions. Qualifying organisations have at least $250 million for fiscal year 2022. All industry segments qualified for the survey. Further, the questionnaire required the respondents who managed specific finance and accounting responsibilities. Interviews were conducted online.

2 2024 Gartner Board of Directors Survey on Driving Business Success in an Uncertain World. This survey was conducted to understand the new approaches adopted by non-executive boards of directors (BoDs) to drive growth in a rapidly changing business environment. The survey also sought to understand the BoDs’ focus on investments in digital acceleration; sustainability; diversity, equity and inclusion. The survey was conducted online from June through August 2023 among 285 respondents from North America, Latin America, Europe and Asia/Pacific. Respondents came from organisations with $50 million or more in annual revenue in industries except governments, nonprofits, charities and nongovernmental organisations (NGOs). Respondents were required to be non-executive members of corporate boards of directors. If respondents served on multiple boards, they answered questions about the largest company, defined by its annual revenue, for which they are a board member.