Natalie Runyon, director of ESG content and advisory services at Thomson Reuters Institute, predicts that in 2024, businesses are expected to embrace ESG criteria not just for compliance or risk management, but as a chance to fundamentally transform their business models with the full understanding and acceptance of the need to account for increasingly complex external risks that may be occurring simultaneously.

Sustainability and ESG: same but different

But before diving deeper into the ESG challenges that lay ahead for businesses in Asia, FutureCFO observed the habit of interchanging ESG and sustainability in conversations.

To set the baseline straight, the Corporate Governance Institute (CGI) defines sustainability as a holistic approach that considers the interplay between the three dimensions of environmental, social, and economic impacts. David W Duffy, CEO of the CGI says at the core of sustainability is the long-term viability of a company’s operations taking into account its environmental, social, and economic impacts.

“On the other hand, ESG is a set of specific criteria used to evaluate a company’s performance and behaviour in three key areas: environmental, social, and governance,” he continued.

“Sustainability and ESG are closely related concepts. However, being a global organisation, the terms can be used differently or interchangeably. Some would say, sustainability takes a broader view of resilience while ESG is more about structure, data, disclosure, performance,” commented Mandi McReynolds, vice president of global environment, social and governance at Workiva.

She pointed to the UN Global Compact CFO Coalition for the SDGs as one of the best resources for CFOs and sustainability leaders. The group doesn't focus on "terms" they focus on sustainable finance results.

Results for the business and results for the global impact of the UN Sustainable Development Goals and how these two can align. CFO and Chief Sustainability Officers can access micro-sector-specific tools as well as guidebooks.

“I think we will start to see as regulation forms around the globe a movement towards sustainable finance, sustainable accounting, responsible finance being a core focus for businesses vs. separate siloed terms,” she opined.

Asked what members of the C-suite and Board get wrong when it comes to ESG and sustainability, McReynolds explains that in ESG/Sustainability you can be asked for many various data points and disclosure.

“C-Suites and Boards must be very clear on what is most material to their business. Doing a well-developed materiality assessment and stakeholder engagement first can help everyone align to what they are going to focus on as a priority versus chasing every request for data and information.”

Mandi McReynolds

Challenges around ESG reporting

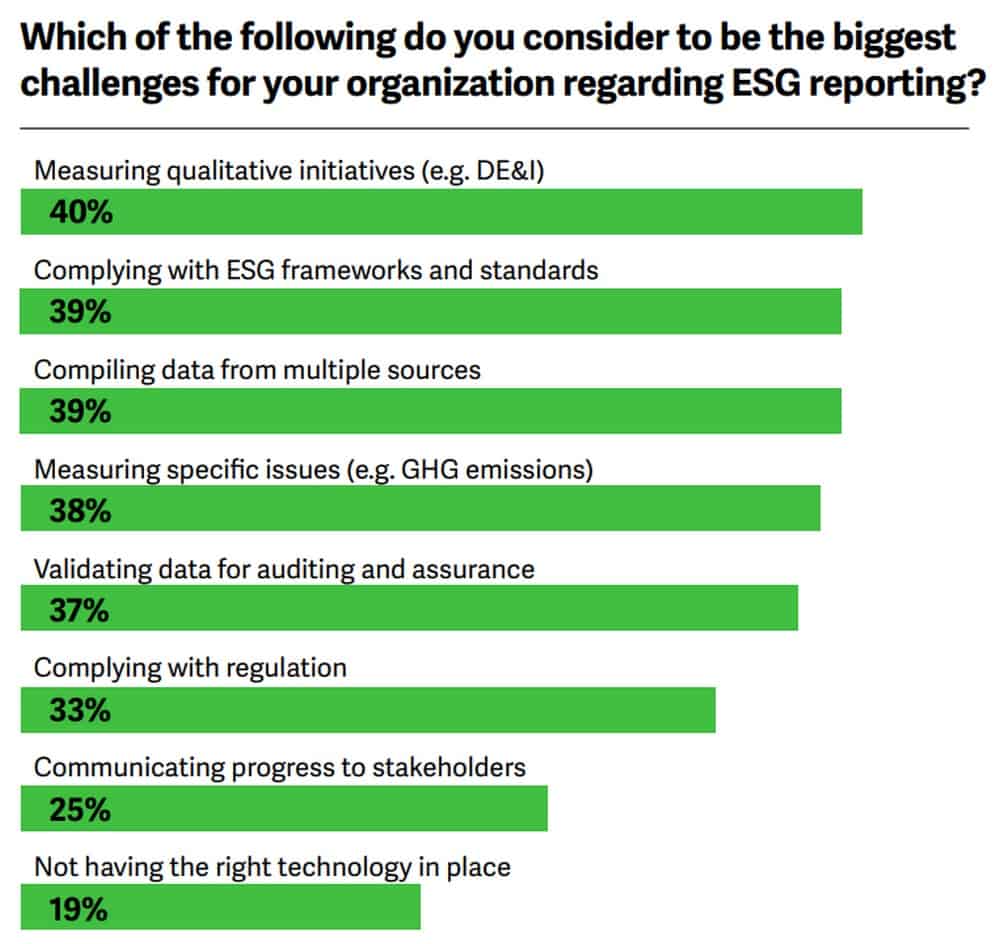

As ESG reporting becomes more commonplace – albeit not mandatory at present – ESG teams are discovering several challenges that make reporting not as easy as first thought.

The Workiva Global ESG Practitioner Survey of over 900+ ESG professionals revealed three challenges common around the world:

Businesses worldwide are grappling with ESG complexity. 74% of respondents expect to be required to comply with two or more global regulations.

There is a disconnect between executives and employees. 62% of executives strongly agree their companies apply the same diligence to ESG reporting as they do to financial reporting. Just 32% of managers say the same

Technology access is going to be key to unlocking value in ESG/Sustainability. 97% agree that access to technology and data will play an essential role in making decisions to advance ESG strategies in the future.

Best practice for ESG leaders

Just as many roads to the same destination, so too achieving ESG goals will be different for each organisation given the regulations and market conditions they operate.

McReynolds believes that financial, Risk, Legal, and ESG/Sustainability must come together often. “We have a disclosure working group that meets regularly, sometimes even weekly to support the development of our data, reporting, and disclosure management,” she revealed.

One best practice centred around aligning key talent and technology to reduce inconsistencies and errors. She cited a total economic study conducted by Forrester Consulting of five Workiva customers across industries and geographies.

The customers collectively use Workiva across different reporting and governance, risk, and compliance (GRC) functions; the results showed data integrations, automation, and other efficiencies that helped realise a 204% ROI and net present value (NPV) of US$2.9 million for organisations.

It is a strong example of teams together with the right technology to support collaboration. Yes, they will mitigate risk and they will support strong ROI in terms of efficiencies for their organisation.

CFO as the driver of ESG and sustainability

In Asia, ESG and sustainability have gained the attention of the CFO with some taking ownership of the initiative. But what about in other parts of the world? What can CFOs in Asia learn from ESG leaders in the US and Europe as regards the execution/fulfilment of ESG/sustainability commitments/ambitions?

McReynolds concedes that governance is one of the most important factors for ESG/Sustainability.

“The CFO plays a critical role in the oversight of ESG Governance to ensure from the board and throughout the company. We are aligned to strategy and accountability that will deliver on business and societal impacts."

Mandi McReynolds

Looking into its efforts, McReynolds says Workiva’s ESG strategy is anchored by a robust governance structure of internal and external stakeholders. It includes:

General oversight by and accountability to the Nomination and Governance Committee of the company’s Board of Directors (the “Board”). “Our Board committee charters include responsibilities related to ESG oversight as applicable to each of our Audit, Compensation, and Nominating and Governance committees. Detailed descriptions of the duties and responsibilities of each of our committees can be found in our most recent proxy statement,” she explained.

An ESG Task Force led by the CFO to ensure forward progress of ESG targets and committed to alignment with the United Nations SDGs and the TCFD, GRI, SASB, and CDP. “Our ESG Task Force is appointed by our President and CEO and is composed of executives responsible for the oversight of various priority ESG issues,” she added.

An external ESG Advisory Council comprises a group of experts who are knowledgeable about global ESG regulation, strategy, practices, and reporting. “Leveraging the expertise of our ESG Advisory Council helps us develop relevant products and take actions that are innovative, socially responsible and meet the demands of our stakeholders,” she added.

According to McReynolds, Workiva’s ESG strategy and targets are tied to its broader business objectives and embedded throughout business operations.

“Our four ESG Workstreams (working groups dedicated to executing on our Innovation, Environment, People, and Philanthropy targets) are staffed by subject matter experts and stakeholders throughout the company who help to drive programs and operations to achieve key results,” she concluded.