Digital transformation has elevated the role of the finance function from financial steward to enabled. The extended COVID-19 pandemic has upped the ante in the race to finance agility.

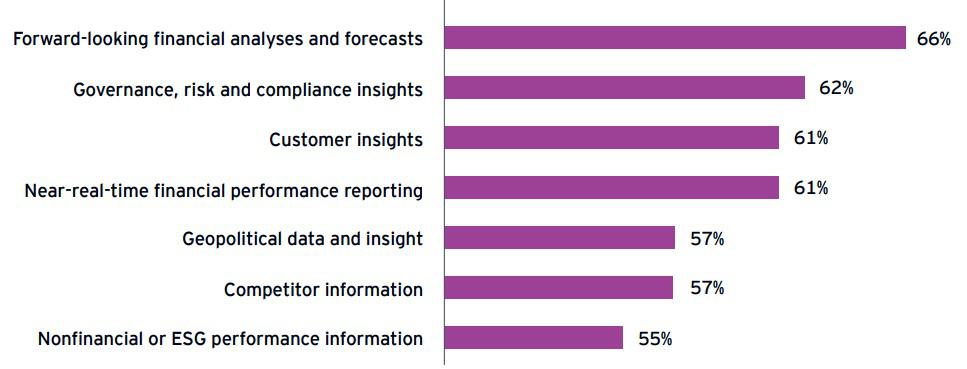

An EY study reveals that up to 70% of financial controllers and CFOs in Singapore found an increase in demand for financial analysis and forecasts as stakeholders are increasingly interested in including non-financial data for corporate reporting.

Source: Financial Accounting Advisory Services (FAAS) | 7th Global Corporate Reporting Survey | February 2021, EY

With the World Bank stating that the world is edging toward a global recession in 2023 and the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) reporting that Singapore’s core inflation is nearing a 14-year high, businesses will need to brace themselves for a new reality.

A Gartner survey of 400 finance executives found that self-service data and analytics are drivers of employee productivity. At least one in four respondents also saw it as being a driver of increased organisational speed and agility.

Philip Madgwick, senior director with Alteryx Asia, acknowledges that data is the lifeblood of any digital transformation. He cites an Alteryx-commissioned IDC survey which revealed that more than 94% of Asia Pacific leaders agree that data analytics is important for organisations to stay competitive.

He believes that as organisations look to adopt a data-driven culture, people empowerment and making data analytics accessible to everyone within the organisation will be critical. He sees the trend of putting data in the hands of different business domain experts, as opposed to just one or two IT personnel.

“Data analytics is really one of the best tools to identify and analyse complex issues and develop solutions and track an organisation’s performance. Turning to technology to extract valuable insights that may exist within domain expertise and sharing that wider across the organisation will really help organisations to thrive in the economy today,” he concluded.

Becoming data-driven challenges

But the road to data-driven, even for a team that deals with data every day, is not easy. Madgwick says there is a lack of easy-to-use tools and a shortage of data-literate and data-confident talents.

“These don't need to be highly skilled or specialised data scientists. There’s also some failure around cultivating the right data culture. Driving the change requires very strong leadership at the top,” he added.

A McKinsey report revealed that CFOs have really declared a desire to spend more time on digital initiatives, but fell short on the execution, showing why it's really imperative for the Office of Finance to embrace a data culture.

“As the Office of Finance, you have a unique insight into how businesses operate and, and how they conduct themselves to really be the linchpin and really help drive the organisation to become more data literate,” said Madgwick.

Partner with the business

Andy Burrows, CEO and founder of Supercharged Finance, writes that the CFO role has become more about strategic partnering with the CEO and the Board, to maximise the performance of the business. He concludes that the CFO is now generally held responsible for business performance, and not just getting the accounts right.

Madgwick agrees and adds that the CFO role is evolving beyond operating as a financial steward to drive the catalyst for strategic digital change.

Businesses are really seeking ways to harness data to leverage their data. They have access to data that can be a gamechanger for their operation.

“The Office of Finance can lead the business in setting financial goals but also to look at more critical business decisions and forecasting some of their financial planning activities, by leveraging predictive analytics,” he opined.

Best practices

Some argue that for a company to achieve true business transformation, the finance function must lead the effort by being one of the first areas to modernise.

Deloitte says finance is in the unique position to become the orchestrator of enterprise data, and in the process, become the strategic partner of the business.

But to do this, finance must upskill itself and narrow the analytics gap to keep pace with the evolving business landscape.

The World Economic Forum estimates that 50% of all employees will require reskilling by 2025. Data and analytics, and AI are the kinds of skills amongst the top 10 required to accelerate their digital transformations.

Madgwick observed a large uptick in government grants to promote some of the adoptions of AI and data analytics to really help strengthen the ecosystem and the workforce in Singapore.

“By democratising data and analytics, we can really help to enable automation across the Office of Finance. It is crucial to do that in a learner-centric approach so that users have the confidence to make use of any tool or platform, irrespective of their business acumen or the technical skill sets.”

Philip Madgwick

“Finance teams are rich with data and it's important to give them a no code/low code analytics automation tool that enables them to conduct the analysis to inform the C suite. We want to look at how we can better automate some of those time-consuming and repeatable processes done on multiple excel spreadsheets to help free up their time to focus on other activities,” he continued.

What lies ahead in 2023

Marko Horvat, vice president of research in the Gartner Finance practice, says the top three challenges reflect CFOs’ struggles to manage against a backdrop of persistent inflation and unusually high macroeconomic uncertainty.

“CFOs need to identify the few critical areas where investments should be accelerated, such as human capital and digital investments while optimising costs against a backdrop of stubbornly high inflation; this is no easy task.”

Marko Horvat

Madgwick believes that 2023 will be interesting in part due to the huge number of inefficiencies that can be tackled early on. The finance department is so rich with data that it’s imperative to get started on that journey early.

“You don't need to have the exact sort of outcome in mind from day one, just a clear direction of where you want to be by the end of 2023. Businesses can start with smaller steps, identify the users across your organisation, who may embrace and have a little bit more time to get stuck into new technologies to help them on their journey.

“Ultimately, it’s about taking that first step and embracing that journey to reap the benefits that will come with it. More importantly, identify the ROI that can be driven with these new technologies. Organisations should look at data analytics, not just across finance, but across any organisation to really embrace digital and technologies which may exist,” concluded Madgwick.

Click on the PodChat player and hear Madgwick’s perspective on how Asia’s finance leaders can use data analytics to be strategic enablers of digital transformation to drive business outcomes amid continuing uncertainties.

- How does fostering a data-driven culture empower the finance team to deliver insights-driven decision-making in an agile and scalable manner, and drive business outcomes?

- Can you describe the challenges and pitfalls impeding the Office of Finance in its data-driven journey?

- How can enterprises better equip CFOs and their finance teams to step up as strategic business partners and navigate the upheavals in the economic market?

- Can you share three best practices to help guide finance teams as they undertake finance modernisation?

- Given all the emerging technologies that continue to evolve, what is your prediction and guidance for finance in 2023?