In leading an organisation effectively, one must have a full grasp of the way towards success, value, and innovation.

With the world and the market evolving at a rapid pace, it is no question how finance leaders grapple and juggle responsibilities in the department to keep up with the demands and the competition--most of them even now traverse unfamiliar roads and explore new opportunities that rose from challenges of the past as well as from technological advancements.

For quite some time now, finance leaders oversee even non-financial strategic matters: environmental, social, and governance (ESG), the increasing regulatory requirements, and systems and software, including artificial intelligence, as well as talent management.

Aspiring candidates for the C-suite, and even those who are already in position, must understand various pathways to deliver value to their respective organisations.

In a study by Gartner, it was found that chief financial officers are seeing slower top line growth and talent issues as the biggest challenges in 2025, spanning from their ability to hire and retain critical talent to strategic alignment and execution gaps within the executive team.

Therefore, for the year ahead, it is imperative finance leaders dive deep on both existing and arising concerns within the department, whilst aspiring heads study pathways toward career growth.

Pathways to finance leadership

Fortune Ernest Jose, chief financial officer, Enderun Colleges, believes that becoming a competent financial leader requires a blend of education, experience, and skill development.

"Having a formal education in accounting, business, and management, as well as certifications such as CPA, CFA, CMA, and the likes, would give the requisite foundation and theoretical understanding."

He adds that having actual experience allows for a better knowledge of real-world situations and practical applications.

"Finally, mentorship, networking with other finance professionals, and staying current on business developments can all help to meet the demand for ongoing learning."

Meanwhile, when asked about what pathways aspiring and current finance leaders must walk on, Hazel Nuñez, Center of Excellence Accounting and Center of Excellence Internal Control Systems lead at Fresenius Medical Care Philippines, Inc., believes in "passion, passion, and passion" that is passion for strategic impact, passion to add value, and passion for problem solving.

"As a finance leader, we may not be in the frontlines or we may not be directly connected to the customer... but we must ensure that everything we do positively impacts the company, whether with internal or external stakeholders."

For her, the finance leadership position now is a totally different role, as it is now a merged function for accounting and the internal control systems.

"I also directly work with the shared service because they are really doing the accounting tasks," Nuñez says.

She recounts that in their company, for example, which is a multinational healthcare company providing products and services for dialysis in hospitals, including inpatient and outpatient medical care, they are undergoing finance transformation where some of the tasks that they have been doing previously will be shifted to share service.

She adds that the current direction of their company is more on for efficiency and for uniform processes all throughout the group.

Moreover, Nuñez believes that without passion, one cannot help the business achieve its goals as one will only see it as a task to be accomplished.

Essential skills

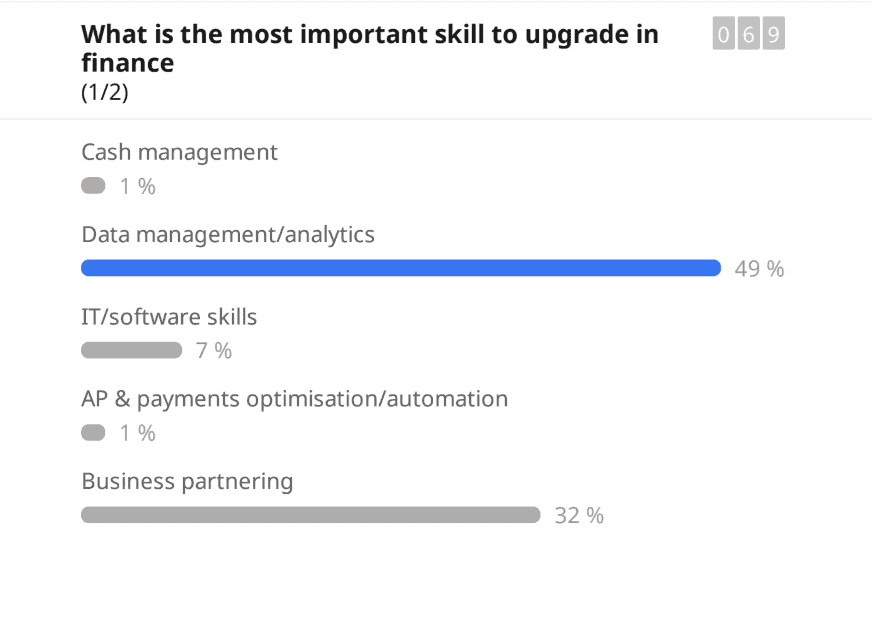

In a poll by Cxociety conducted during the fourth annual FutureCFO Conference in the Philippines, in terms of the most important skill to upgrade in finance, almost half or 49% of the respondents see data management and analytics to look into, while 32% view business partnering skills and IT and software skills as areas to improve on to deliver value to the organisation.

For Jose, considering that he views the finance leadership landscape now as rapidly evolving due to technological advancements, regulatory changes, and shifting market dynamics, there are key traits aspirants must ponder on.

"Leaders now play strategic roles, digital transformation roles and integrating ESG factors into decision-making. Collaboration across departments is essential for effective communication, while adaptability and agility are crucial in navigating the complexities of globalization and digital transformation in the finance landscape."

Jose believes that on the road to leadership in finance, one must take in mind the following:

1. Strategic Thinking: The ability to see the big picture and develop long-term strategies

2. Leadership: fostering a collaborative environment and ensuring everyone is motivated to work toward common objectives

3. Communication: Combination of presentation and story-telling skill

"For me, C-suites' formula for success should be a well-defined Vision and Mission + SMART strategic objectives + clear understanding of key enablers," Jose notes.

On the other hand, Nuñez highlights the importance of having people skills, saying there is a different approach in handling different people, especially the next generation (Gen Alpha and Gen Zs), as they have varying reactions to problems in the workplace.

"We should be sensitive to the needs of each generation," Nuñez adds.

Beyond the role

Nuñez admits that sometimes, being a finance leader means going beyond their role, as they have to ensure that the processes that they are doing are connected to the other processes.

She warns that sometimes, leaders--who may lack passion for what they do--tend to just drop the ball, saying they have done their tasks and that is it, when there can be a mistake or error, or even missing information.

A passion to add value, she stresses, is important as they do not just provide result reports for the company--they also deliver results.

"We have to help the business," Nuñez notes.

On top of these, the Fresenius Medical Care Center of Excellence Accounting and Center of Excellence Internal Control Systems lead also highlights the importance of solving problems and challenges without having to pinpoint who to blame, but rather focusing on the processes to improve.

"You have to handle them in a manner where they know that they should be accountable with what they have done, but a the same time, you provide the proper guidance if you think that that person still contribute to the company."

Nuñez says one vying for the finance leadership role needs to have a clear goal. "Having a clear goal and understanding why you are doing what you are doing... it's the 'why' of what you are doing," she explains.

Additionally, she says a well-defined and overarching goal will guide aspiring finance leaders and motivate them into their paths.