Only 30% of CFO-CIO relationships are characterised by strong collegiality and business centricity, said Gartner recently when releasing results of a survey of 183 executives including both CFOs and CIOs.

A strong CFO-CIO partnership that lead to the best digital investment outcomes was defined as being business centric, as opposed to function centric, and collegial, as opposed to adversarial, according to the advisory firm.

Inflationary headwinds are raising the stakes for CFOs to ensure that digital investments deliver productivity improvements and business outcomes that can offset margin erosion, said Randeep Rathindran, vice president, research in the Gartner Finance Practice.

Having the right kind of relationship with the CIO is a critical part of delivering that value, he added.

Strong CFO-CIO relationships are 51% more likely to easily find funding for digital initiatives, 39% more likely to keep digital spending in line with the budget plan and 18% more likely to achieve the intended business outcomes, Gartner pointed out.

“CFOs should be thinking of their CIO as a business strategist, rather than just a budget owner,” said Rathindran. “Better partnership here will help to ensure that executive leadership is aligned on the role of discretionary technology spend across the enterprise and what it can deliver.”

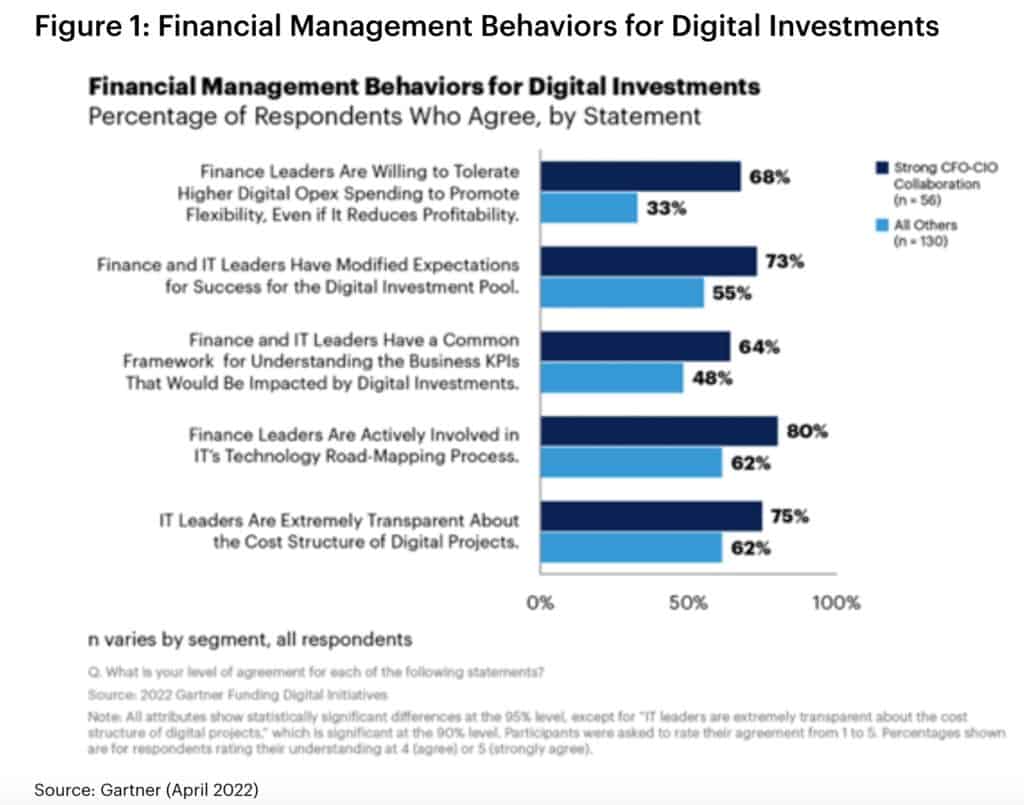

Organisations with strong CFO-CIO partnership outperform their peers in several financial management practices that are unique to digital and are enabled by collegial and business-centric relationships between finance and IT, he noted.

Five key CFO-CIO actions that enable digital success

According to Gartner, it has identified five CFO-CIO actions that enable digital success.

The following five actions are unique to digital and enabled by collegial and business-centric relationships between finance and IT, the firm said.

Adopt product-line-funding models to increase comfort with digital opex spending

Progressive CFOs shift the “digital capex versus opex” discussion from short-term profitability to long-term value creation, collaborating with their CIOs to highlight the operational and strategic benefits of digital investments funded from opex.

For instance, instead of focusing on EBITDA alone, they track how digital investments impact metrics related to workforce productivity, operational margins and revenue-generating activists, etc.

Use an expanded set of metrics to reframe expectations for digital investment success

CFOs should expand how they measure digital success to include the technology and operational metrics that CIOs emphasise.

Metrics such as those related to user engagement and participation — such as the number of users or percentage of interactions that are digital — are often a better fit for digital investments than traditional financial metrics.

Use a common performance management framework to understand how digital investments impact business KPIs

CFOs should lead their teams to work with IT to build an updated metrics cascade that includes more appropriate, granular KPIs as a shared framework for evaluating digital investment performance.

Finance and IT can use this framework to better understand how digital initiatives impact key KPIs by linking technology KPIs (for instance, user engagement), intermediate outcomes (for instance, higher sales volume) and financial outcomes (for instance, increased revenue).

Prioritise involvement in IT’s technology-roadmapping process

CFOs should use early roadmapping discussions with IT as an opportunity to share expectations for how technology should be used to advance the enterprise’s big-picture strategy, and how digital investments impact corporate financials.

Finance can do this by conducting financial analysis and providing early input on the financial feasibility of technology plans.

Equip IT with tools that promote digital-cost-structure transparency

Finance should collaborate with IT to communicate the value of digital costs in the context of measuring performance improvement in, and IT’s contribution to, the business objective of maximizing organizational value.

For this reason, service-based costing models that are less detailed but emphasise the “output” created by a cost are most likely to create the kind of transparency CFOs need.