Indonesia's card payments market is expected to reach $87 billion in 2029, supported by the constant consumer shift towards electronic payments, according to analytics company GlobalData.

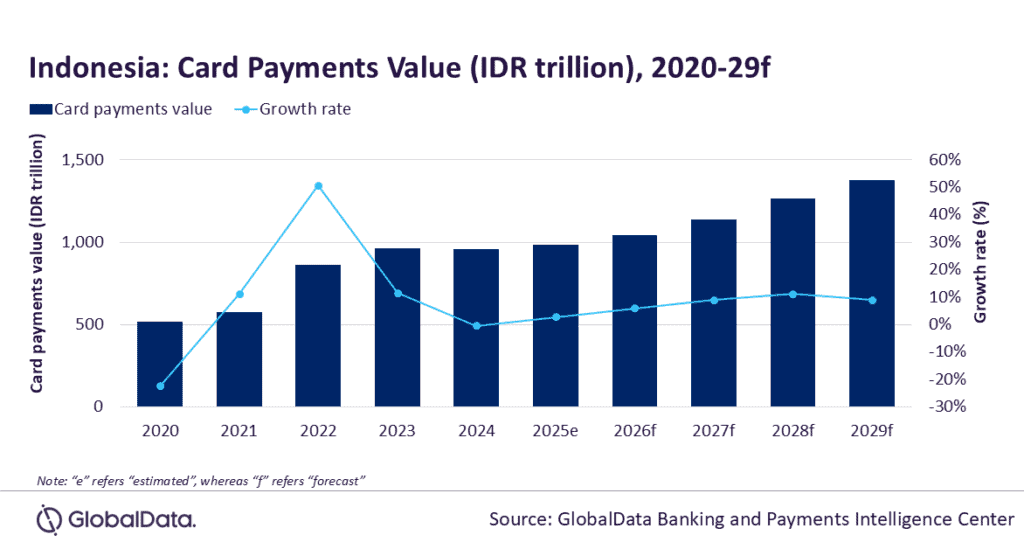

The market is forecast to register a compound annual growth rate (CAGR) of 8.8% between 2025 and 2029 to reach IDR1,379.4 trillion in 2029, as the card payment value in Indonesia is expected to register an estimated growth of 2.6% to reach IDR984.7 trillion ($62.1 billion) in 2025.

According to Ravi Sharma, lead banking and payments analyst at GlobalData, the Indonesian payment ecosystem has seen a gradual yet steady shift from cash to electronic payments over the past five years.

"In 2020, the card payment market was significantly smaller, but the introduction of various initiatives, such as the National Strategy for Financial Inclusion and the KEJAR program (One Student One Account), has catalyzed growth. The launch of domestic credit card schemes like Kartu Kredit Indonesia (KKI) and the debit card scheme, Gerbang Pembayaran Nasional (GPN) has also contributed to the rising adoption of payment cards," Sharma says.

The deployment of agent banking services has also played a significant role in expanding the banked population, as while the market size for credit cards is smaller compared to debit cards, it is experiencing notable growth.

In addition, debit cards are widely preferred which is largely attributed to the Indonesian government's financial inclusion initiatives, which have facilitated access to basic banking services. The central bank's efforts to increase financial inclusion, particularly through the KEJAR program, have also played a pivotal role in expanding the debit card user base.