The modern CFOs bear the traditional and constant struggle to ensure that the company has sufficient working capital to keep the business going, while being fully compliant with all statutory and regulatory requirements relating to finance matters. Beyond that, CFOs are expected to optimise every investment dollar for maximum returns on investments and be involved in all discussions and matters that have a financial impact on the company.

The priorities of the CFO are evolving as companies seek the right balance between reducing costs for high volume tasks that can be automated while increasing the accuracy and efficiency of higher value activities. This balancing act is made more difficult when CFOs deal with multiple jurisdictions across different time zones, cultures and languages, and locally unique way of doing things.

How the tax and finance function is evolving

According to a recent EY study, How a reimagined tax and finance function can improve your bottom line, which covered the perspectives of 1,013 senior executives from large organizations globally, it was evident that the tax and finance functions are facing relentless changes in the landscape amid an ever-increasing compliance burden and fast changes in data and technology.

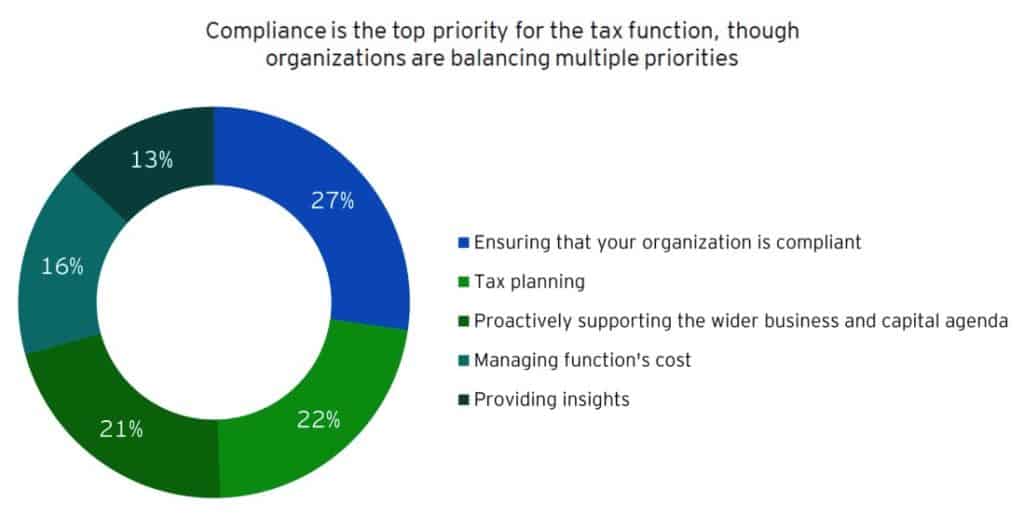

According to the survey, businesses are seeking a model that balances different priorities that transcend routine compliance tasks. Particularly, compliance (27%) is the top priority for the tax function, even as they are balancing multiple priorities like tax planning (22%), proactively supporting the wider business and capital agenda (21%), managing the tax function’s cost (16%) and positioning the tax function to provide insights (13%).

At the same time, 83% of respondents said their tax and finance personnel will shift from focusing on technical skills to data, process and technology skills over the next three years, as 84% anticipate an increase in workload from complying with digital tax filing requirements. Yet 79% of respondents plan to reduce the cost of their tax and finance function over the next two years.

Clearly, tax and finance functions are facing multiple pressure points and to deliver value in an era of cost reduction, they have to reimagine how they operate.

Best-in-class versus best-in-cost

The best-in-class versus best-in-cost dichotomy is a struggle that many companies face. In the finance function, CFOs seek “best-in-cost” solutions for their lower-value activities where speed and accuracy give them a competitive advantage; yet many also desire to be the “best-in-class” in their management of risks and compliance matters, quality and growth enablement.

Hence, companies and CFOs need to decide whether they want to own the full scale of the tasks by keeping the finance function entirely inhouse or outsource it to an external service provider. Often, the sensible approach adopted is a hybrid or co-sourced one.

For instance, there is merit in CFOs relooking at how they can manage their tax and finance operations (TFO) locally and across multiple locations.

The TFO team typically consist of dedicated accounting and tax professionals working in tandem to support the CFOs holistically. On one hand, there are centralised teams to offer “best-in-cost” transactional support and are armed with leading technologies and operational platforms to turn financial data into key insights to help CFOs make better informed decisions. On the other hand, there are local TFO teams that interact and work closely with the CFOs to develop strategies and plans, while keeping in mind compliance needs in mind.

Together, the centralised and local TFO teams deliver comprehensive service and solutions to CFOs: from handling and processing invoices; updating and maintaining the accounts; managing cash; assisting with direct and indirect tax compliance to the eventual preparation and filing of the financial statements and tax returns; as well as providing reporting dashboards and analytics.

What a strong business partner can offer

To achieve an effective hybrid operating model, CFOs need a strong TFO business partner with robust global infrastructure as well as local specialist teams to support operations in any locations around the world.

The benefits include achieving cost reduction in the long term; greater control and risk mitigation; scalability and increased efficiency; and reduced concerns over staff turnover, continuity and retraining. At the same time, the company will have access to leading technology offered by the business partner, with up-to-date dashboards and alerts and accurate and timely data, which allows for more informed and quicker decision-making.

CFOs that are looking to streamline and redesign their tax and finance functions can consider working with a TFO business partner to achieve a higher level of agility and responsiveness. As well, engaging a TFO business partner is well-suited for companies that have gone through restructuring resulting in carve-outs and spin-offs, as well as family offices and groups with many special purpose subsidiaries.

The perennial challenge for CFOs will be: how do you do more with less in a rapidly changing world of risk and regulation? To answer this, it is opportune for CFOs to review the optimal operating model for their tax and finance function today to drive one that is fit for the future.