Business Intelligence is at the crossroads of business and tech and it connects so many different aspects of running the business. It’s a very important, yet often misunderstood and underutilized, part of your organisation.

When the data BI brings in is used in a smart and strategic way, it can produce incredible advantages. However, this department needs to be connected to an executive level manager who can manage and promote this data in an effective and convincing way.

Regardless of the product or services offered, every business produces data—an invaluable asset that allows a business to better understand itself and make informed decisions. The terms Business Analytics and Business Intelligence (BI) are often incorrectly conflated. Business Analytics is, in fact, a subset of BI, which encompasses much more.

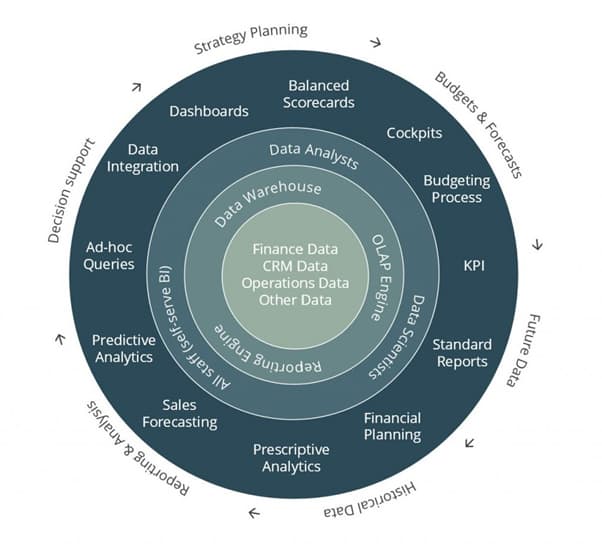

BI emerged in the 1960s as a channel of sharing information across an organisation. However, the advent of computer technology has caused significant shifts to this role. Due to transformations in entire industries caused by the Big Data Revolution, present-day BI covers a wider range of functions, including data mining, reporting, querying, data preparation and statistical analysis.

Where Does Business Intelligence Fit into Your Organisation?

BI brings in large amounts of data from multiple sources and structures such that it can be used in practical ways. It allows organisations to gain a comprehensive view of the data within their organisation and subsequently utilise the data to drive change, adapt to the market, eliminate inefficiencies and much more.

For Business Intelligence to be able to realise its full potential, it needs to be connected to an executive-level manager who can manage and promote this data effectively. Most large companies would have the resources and organisational capacity to hire a Chief Information Officer (CIO) who could shoulder the responsibilities of leading a BI department.

On the other hand, smaller or medium sized companies may not. For these companies, both the Chief Financial Officer (CFO) and Chief Technology Officer (CTO) would be fit to assume the leading role.

As BI is at the crossroads of business and technology, the Chief Financial Officer is arguably the better choice between the two. CFOs are likely to be in closer proximity to the business and more involved in big-picture strategising than CTOs.

CFOs can leverage the power of a BI department to apply valuable, data-based insight and cultivate a data-driven culture. Let’s examine more about the changing role of the Chief Financial Officer in modern times.

In addition, CFOs process, analyse and apply a lot of data, most of which is financial. Their expertise lends itself directly to the role of leading BI in an organisation.

How Does BI Enhance the Role of the CFO?

The relationship between BI and CFOs is highly symbiotic; they nourish and enhance each other’s functions and impact. The skill set and experiences of a CFO make them an ideal fit for leading BI in a company, while BI enables CFOs to offer much more to the company than plain old accounting.

Below are some of the ways that BI can enhance the value offered by CFOs to their companies.

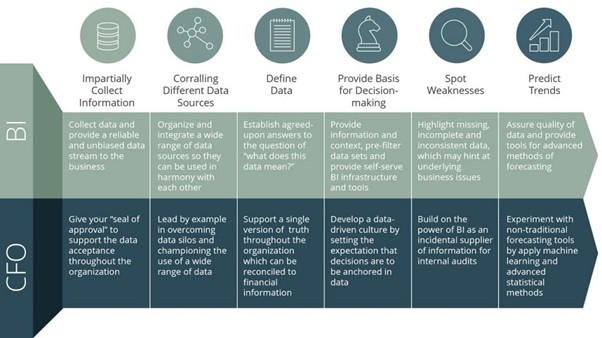

1. Collecting information impartially

The role of the BI department is to collect as much data as possible in a completely impartial manner without any bias or agenda.

Being responsible for BI will push the CFO to ensure that every piece of information is impartial and fact based. This will benefit the wider financial conditions and dealings of the company.

2. Corralling a wide range of data

Having a more robust set of data is extremely important when it comes to making business decisions as this allows the company to overcome data silos.

Working with BI will enact a mindset shift in the CFO regarding how data should be used in the finance department. They will see the value in combining all types of data – from financial to non-financial.

3. Defining data clearly

In BI, all findings are quantified and described clearly, allowing them to be used effectively and accurately across different departments. In the same vein, the CFO has to support a single version of truth throughout the entire organisation and ensure that it can be reconciled to financial information. This allows for effective inter-departmental decision making.

4. Allowing for informed decisions

Engaging in BI encourages CFOs to develop a data driven culture, as it helps them set the expectation that all decisions are to be anchored in data.

BI provides CFOs with the information and context with which they can make smart and informed decisions. Strategies that are created without context or a comprehensive understanding of key statistics are mere stabs in the dark, which could lead to devastating consequences for the business.

5. Spotting weaknesses

Stepping back and approaching a problem from a different angle can often lead to better insight and fresh ideas. By analysing data from a bird’s eye view, the BI department is more likely to spot well-concealed issues, as well as incomplete and inconsistent data within the company.

This could even lead to the implementation of cost-cutting measures. In sum, it can act as a CFO’s informal internal audit department.

6. Predicting trends

The BI department allows the CFO to gauge and follow developments in the industry, monitor changes in the market and anticipate customer needs.

Rather than applying traditional approaches to forecasting, the complex data collected through BI allows CFOs to use advanced methodologies to identify trends and market conditions, make projections for the future of the company and develop corresponding strategies.

Armed with this information, decision makers can act swiftly and take a chance on potentially profitable opportunities.

Changing Role of the CFO: Summary

The positive impacts of BI can be found in virtually every corner of a business. From supply chain optimisation and employee satisfaction to financial reporting, BI allows for better analysis and planning.

Because of its alignment with the principles and functions of BI, the position of the CFO is more exciting than ever today. Through shifts in mindset and fine tuning of their processes, CFOs can leverage the power of a BI department to apply valuable, data-based insight and cultivate a data-driven culture. The result? Consistent and continual growth for the Company.

This article also appeared in Singapore’s Association of Small & Medium Enterprises (ASME) Entrepreneur’s Digest print edition 94 and has been edited for clarity, brevity and for relevance of this website.