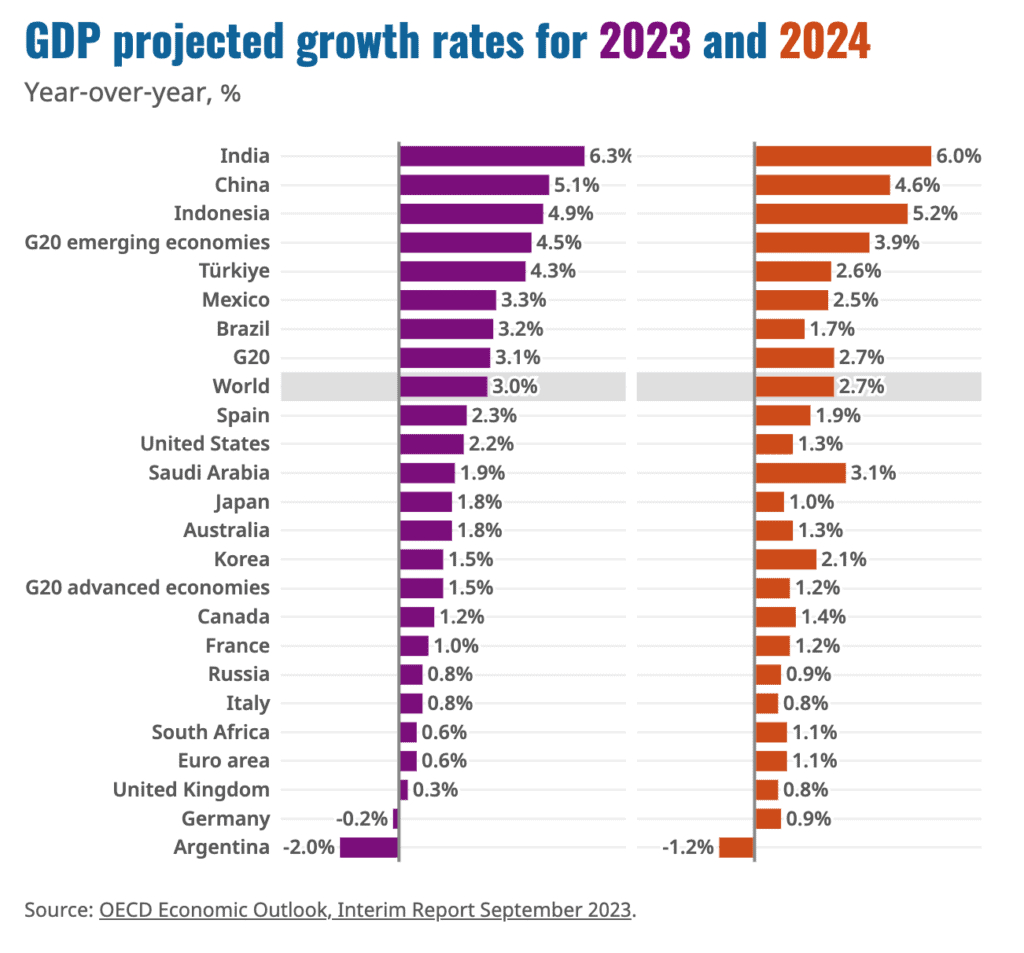

The global economic growth is estimated to reach 3% in 2023 and 2.7% in 2024, said OECD recently.

A disproportionate share of global economic growth in 2023-24 is expected to continue to come from Asia, despite the weaker-than-expected recovery in China, OECD noted.

Growth was comparatively robust in the US and Japan, but weak in most of Europe, particularly Germany, the organisation pointed out.

Among the G20 emerging-market economies, growth surprises have mostly been positive so far this year, especially in Brazil, India and South Africa, the organisation added.

Structural policy efforts need to be reinvigorated to strengthen growth prospects, OECD advised.

Reducing barriers in labour and product markets and enhancing skills development would help to boost investment, productivity and labour force participation, and make growth more inclusive, OECD added.

Highlights of OECD’s global economic growth forecast

- Headline inflation has continued to come down in many countries, driven by the decline of food and energy prices in the first half of 2023.

- However, core inflation – inflation excluding the most volatile components, energy and food – hasn’t significantly slowed. It remains well above central banks’ targets.

- A key risk is that inflation could continue to prove more persistent than expected, which would mean interest rates need to tighten further or remain higher for longer.

- The tightening of monetary policy is working its way through economies.

- Alongside the rapid increase of policy rates, interest rates for new corporate loans and new mortgage loans have increased.

- While the rising borrowing costs are painful for households and firms, dampening households’ and firms’ demand through higher borrowing costs is a standard channel through which monetary policy normally takes effect.