Global CEO confidence returns to pre-pandemic levels, said KPMG recently when releasing results of a recent survey of more than 1,300 CEOs of the world’s largest businesses.

Survey results indicated that 60% of leaders are confident about the global economy's growth prospects over the next three years, up from 42% in the January/February survey by KPMG.

Survey highlights

- The prospect of a stronger global economy and stronger CEO confidence are leading these leaders to invest in expansion and business transformation, with 69% of respondents identifying inorganic methods such as joint ventures, M&A and strategic alliances as their organisation’s main strategy for growth.

- 87% of global leaders stated that they are looking to make acquisitions in the next three years to help grow and transform their businesses.

- 30% of CEOs plan to invest more than 10% of their revenues toward sustainability measures and programs over the next three years.

Despite the continued uncertainty around the pandemic, stronger CEO confidence has put leadership in an aggressive growth stance, KPMG said.

While inorganic growth strategies are a priority, CEOs are also looking to expand organically and continue to assess the future of work to ensure they can attract top talent, the firm added.

ESG: Reaching net zero with government support

Besides growth strategy, business leaders face growing pressure in terms of ESG issues as stakeholders are putting immense pressure on businesses to tackle climate change and leave a positive impact on society.

According to the survey, CEOs’ concern in this area are as follows:

- 27% are concerned that failing to meet climate change expectations will result in the public markets not investing in their business.

- 58% said that they face increased demands from stakeholders such as investors, regulators and customers or more reporting on ESG issues.

- 77% of global executives believe that government stimulus will be required if all businesses are to reach net zero.

- 75% of global CEOs have identified COP26 as a pivotal moment to inject urgency into the climate change agenda.

- Corporate purpose, what the company stands for and its impact on communities as well as the planet, is driving 74% of CEOs to act in addressing the needs of their stakeholders such as customers, employees, investors, and communities.

- There has also been a 10-point increase since the beginning of 2020 in the number of CEOs who say their principal objective is to embed purpose into the decisions they make to create long-term value for their stakeholders (64%).

- 86% of respondents said that their corporate purpose will shape capital allocation and inorganic growth strategies.

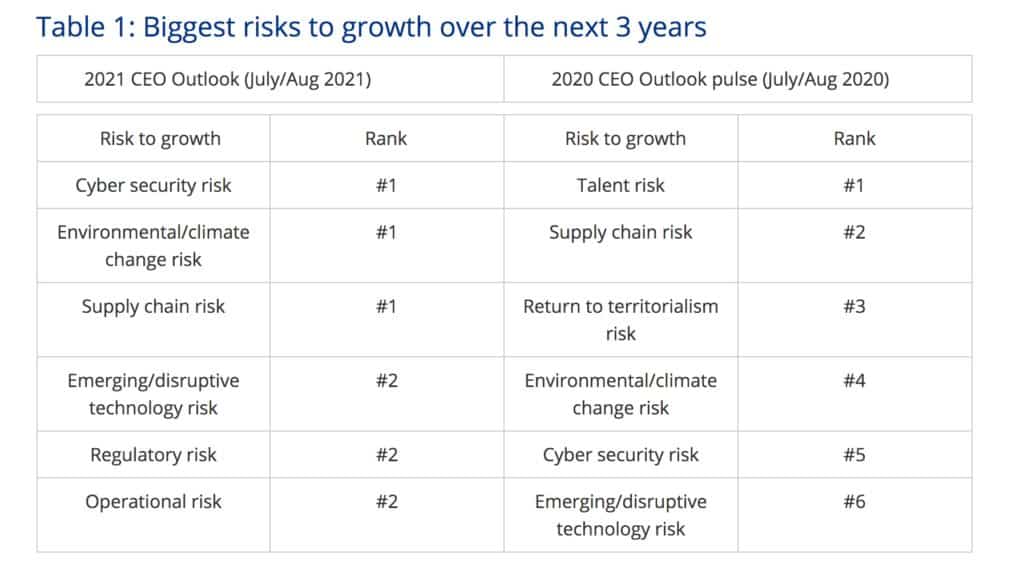

Shifting focus toward operational and environmental risks

When looking at risks for growth over three years, senior executives identified three areas they see as top risks: supply chain, cyber security and climate change, with 56% of global CEOs say that their business’ supply chain has been under increased stress during the pandemic.

Changing sentiment on the future of work

Only 21% of CEOs now say they are planning to downsize, or have already downsized, their organisation’s physical footprint—a dramatic shift from August 2020, with the first wave of the pandemic at its peak when 69% of global leaders said that they planned to downsize their space.

CEOs are focused instead on providing increased flexibility for their workforce with 51% (up from 14% in the January/February’s pulse survey) looking to invest in shared office spaces.

In addition, 37% of global executives have implemented a hybrid model of working for their staff, where most employees work remotely 2–3 days a week.

Unprecedented international tax reforms a significant focus for CEOs

While three quarters of CEOs believe that the pressure put on public finances by the pandemic response has increased the urgency for multilateral cooperation on the global tax system, 77% agree that the proposed global minimum tax regime is of “significant concern” to their organisation’s goals on growth.

Meanwhile, business leaders are more worried about regulatory and tax risks than they were prior to the pandemic.

As businesses aim to build back better, 69% of CEOs are feeling increased pressure to report their tax contributions publicly as part of their broader ESG commitments.