The CFO role in the Asia-Pacific region is evolving at an unprecedented speed, shaped by digitalisation, new business models, and rising expectations for strategic leadership.

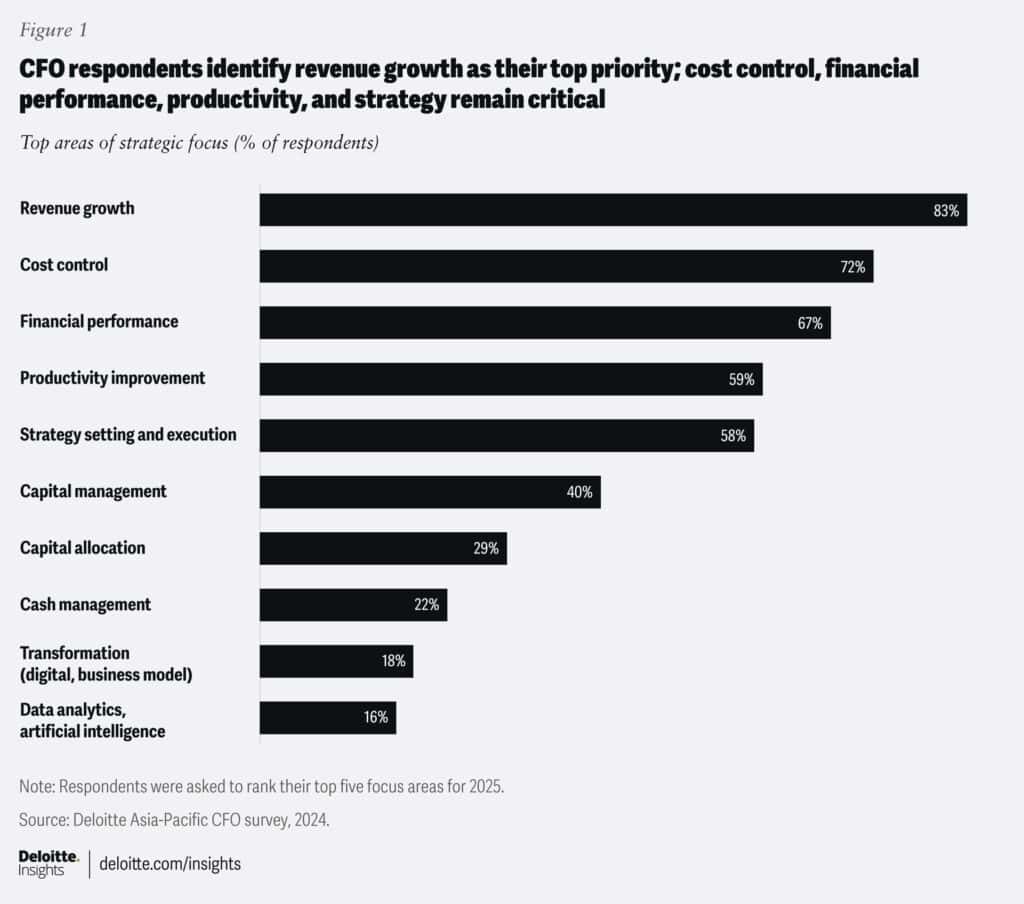

According to Deloitte’s Asia-Pacific CFO 2025 survey, revenue growth, operational optimisation, and resilience top the agenda for finance leaders, with 83% prioritising growth and nearly half planning increased M&A activity to drive transformation. Technology, particularly AI, is now at the centre of this evolution (see figure below).

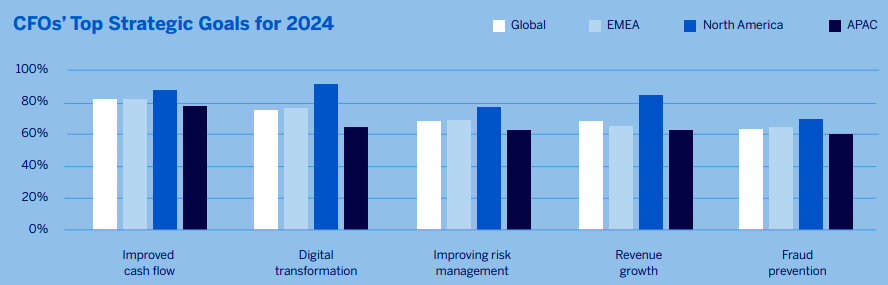

The American Express 2024 CFO Survey found that 75% of global finance leaders view digital transformation as essential—not just for efficiency but also for seizing new market opportunities and managing risk in a volatile environment (see figure below).

For CFOs in Asia, AI is a strategic enabler of Corporate Performance Management (CPM), not just a tool for automation. Working capital efficiency and talent retention remains critical, with 82% of APAC CFOs focusing on real-time cash flow visibility and 71% citing workforce capability as a transformation barrier. Intelligent, autonomous systems, such as agentic AI, are increasingly vital, enabling finance teams to automate routine tasks, gain continuous insights, and transition from reactive to proactive leadership.

In the following we examine how AI—particularly agentic AI—is transforming CPM, driving rapid adoption in the APAC region, and shaping the next generation of high-performing CFOs.

Why AI matters

AI is revolutionising CPM by fundamentally changing how organisations plan, monitor, and optimise their financial and operational performance.

“AI empowers companies to gain deeper insights into financial and operational data, enabling faster and more accurate decision-making,” explains Mark Velthuis, APAC General Manager - CCH Tagetik at Wolters Kluwer. He adds that AI automates routine tasks such as forecasting, budgeting, and variance analysis, freeing up time for strategic thinking.

“Moreover, AI enhances agility by identifying trends and anomalies in real-time, allowing businesses to respond proactively to market changes and internal inefficiencies,” he continues.

This shift is more than incremental automation; agentic AI, a new generation of AI, can autonomously take actions and make decisions with minimal human intervention. Unlike traditional AI, which primarily analyses data and provides recommendations, agentic AI acts as a digital finance analyst or assistant, proactively managing cash flow optimisation, risk mitigation, and scenario planning.

Velthuis says that for CFOs, this changes the dynamic from simply using AI as a tool to collaborating with it as a strategic partner. “It raises the bar for trust, requiring transparency, explainability, and robust governance to ensure AI-driven actions align with business objectives and compliance standards,” he elaborates further.

Survey & APAC trends

Wolters Kluwer’s survey reveals a projected increase of over 600% in agentic AI adoption among finance leaders globally over the next 12 months. The growing demand for speed, precision, and strategic agility in complex business environments drives this surge.

“Finance teams are under pressure to do more with less—delivering real-time insights, managing risks, and driving value creation. Agentic AI offers a solution by automating decision-making and operational tasks, enabling finance leaders to shift from reactive to proactive strategies.” Mark Velthuis

In the Asia-Pacific (APAC) region, the adoption of agentic AI is accelerating rapidly. Approximately 70% of organisations in APAC expect agentic AI to disrupt their business models within the next 18 months, according to IDC. While APAC CFOs initially lagged behind global peers in AI adoption, the region is now catching up swiftly, particularly in digitally mature markets such as Singapore, Australia, and South Korea.

This trend aligns with broader industry data. Gartner’s 2024 survey found that 58% of finance functions worldwide are using AI, a 21 percentage point increase from the previous year, with many finance leaders optimistic about AI’s impact. The narrowing gap between finance and other administrative functions in AI adoption underscores the growing recognition of AI’s strategic value in finance.

AI use cases

Agentic AI’s most impactful use cases in CPM centre on the autonomous management of complex financial workflows. It continuously monitors key performance indicators (KPIs), simulates scenarios, adjusts forecasts, reallocates budgets, and identifies risks in real-time without human prompting.

“Agentic AI is enabling finance systems to not only analyse data but also take the initiative—adjusting forecasts, reallocating budgets, and identifying risks in real-time without human prompting,” explains Velthuis.

This autonomous capability frees CFOs from operational firefighting, allowing them to focus on strategic decision-making. Gartner highlights this shift as part of a broader move toward AI-augmented work, where intelligent agents collaborate with humans to drive outcomes.

Specific benefits include:

- Improved forecasting and scenario modelling: AI enables continuous, dynamic forecasting that adapts to changing market conditions, providing CFOs with more accurate and timely insights.

- Enhanced resource allocation: AI identifies inefficiencies and reallocates resources dynamically to maximise cost savings and operational efficiency.

- Risk management: Agentic AI proactively assesses financial risks, detects anomalies, and autonomously adjusts mitigation strategies to minimise losses and ensure compliance.

These capabilities are already delivering measurable efficiency gains. For example, CFOs who leverage agentic AI report a doubling of operational efficiency by automating financial processes and improving decision-making accuracy.

The road ahead

Looking ahead, AI will evolve from a support tool into a strategic co-pilot for finance leaders. Platforms like Wolters Kluwer’s CCH Tagetik Intelligent Platform are embedding agentic AI capabilities directly into financial processes, enabling autonomous forecasting, continuous scenario modelling, and real-time performance optimisation.

Velthuis recalls: “A standout example is AskAI, which leverages natural language processing and intelligent analytics to allow finance teams to query complex data sets conversationally and receive instant, actionable insights.”

Gartner predicts that AI-augmented work and autonomous systems will become central to enterprise strategy, with CFOs relying increasingly on intelligent platforms not just for efficiency but for proactive decision-making, risk mitigation, and strategic agility.

To lead effectively in this AI-enabled future, CFOs will need new skill sets beyond traditional finance expertise. These include:

Data literacy and AI fluency: Understanding AI capabilities, limitations, and governance to collaborate effectively with intelligent systems.

Strategic agility: Leveraging AI insights to drive rapid, informed decision-making in volatile markets.

Ethical and Transparent AI Governance: Ensuring AI use aligns with regulatory standards and ethical considerations.

Change management and talent development: Leading teams through digital transformation and fostering a culture of continuous learning.

What it means now

For CFOs and finance leaders in Asia, the imperative to adopt AI-powered finance is clear. The rapid acceleration of agentic AI adoption, supported by robust platforms like CCH Tagetik, is reshaping CPM into a proactive, insight-driven function.

By embracing AI as a strategic partner, CFOs can enhance forecasting accuracy, optimise resources, mitigate risks, and ultimately drive greater business value.

The future of finance leadership in Asia will be defined by the ability to harness AI’s full potential, striking a balance between technological innovation and governance, as well as human insight.

As Velthuis notes, this transformation is not just about technology but about redefining the role of finance in an increasingly complex and dynamic business landscape.