Jenji’s 2021 Asia-Pacific (APAC) Expense Management Practices Survey reveals that despite increased rhetoric about the importance of digital finance, the adoption level of digitalisation and automation in expense management among companies across APAC remains low.

"We have seen almost a decade's worth of digital transformation and adoption by businesses squeezed into less than two years because of the pandemic," said Lee Chee Leong, Head of APAC, Jenji.

He cautioned that APAC continues to be slow in adopting digital processes. The result is that it compromises the speed and accuracy of expense reporting and management.

Persistent use of manual processes

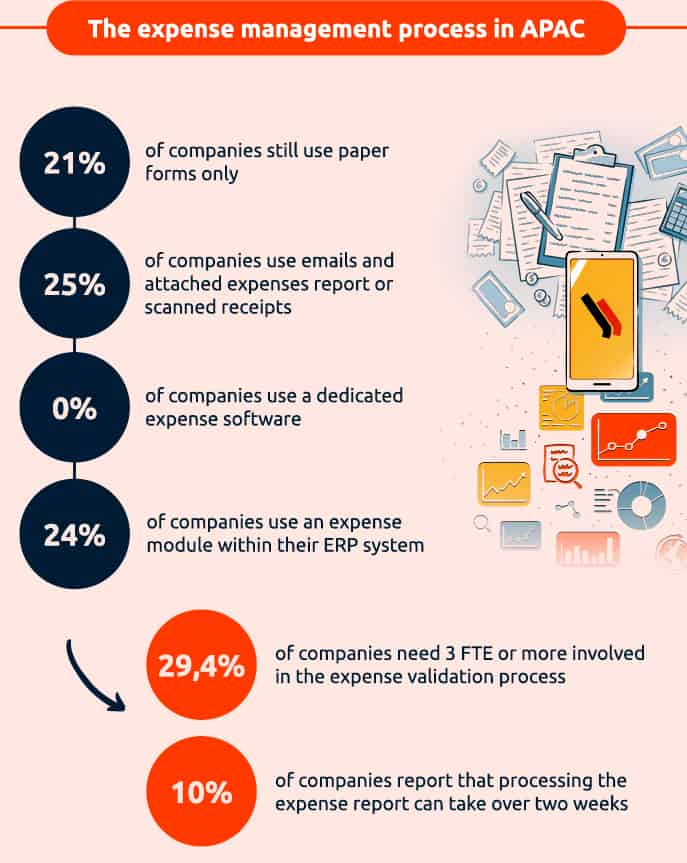

More than 21% of companies surveyed shared that they continue to use paper documents and cumbersome manual processes to record corporate expenses. The survey also found that only 25% are partially digital, using attached expense reports and scanned receipts.

This reduces paper use in the company but does not improve the speed or accuracy of expense management. More than 10% of respondents added that processing one expense report could take over two weeks.

Challenges ahead

A key challenge faced by companies surveyed is the time it takes to reconcile, review, and approve reports. Employees losing receipts or submitting reports without receipts was another common concern. Nearly 20% of respondents shared that an inability to check for fraud and duplicate receipts easily is also a problem.

"Expense fraud costs in Singapore are approximately 3.45 times more than the lost transaction value, and the loss of revenue from fraud amounts to about 1.57% of total company revenue," said Lee.

He added that most of these problems can be easily addressed by the adoption of fully digital and automated expense management statements that removes human error and speeds up the process of expense management and provide accurate reports.