“As the economic climate continues to improve, CFOs have the opportunity to show themselves able to support growth while managing complexity and keeping costs in check. Those who succeed in becoming architects of business value will help drive the success of their companies.” Dr. Christian Campagna, Managing Director ‑ Accenture Strategy, Finance & Enterprise Performance lead.

That was from a 2014 Accenture Strategy report, The CFO as the architect of business value. Five years on and Dr. Campagna’s prediction has proved real as forward-thinking CFOs have stepped up to into the leadership plate to become the go-to partners of CEOs in driving operational transformation and strategic execution.

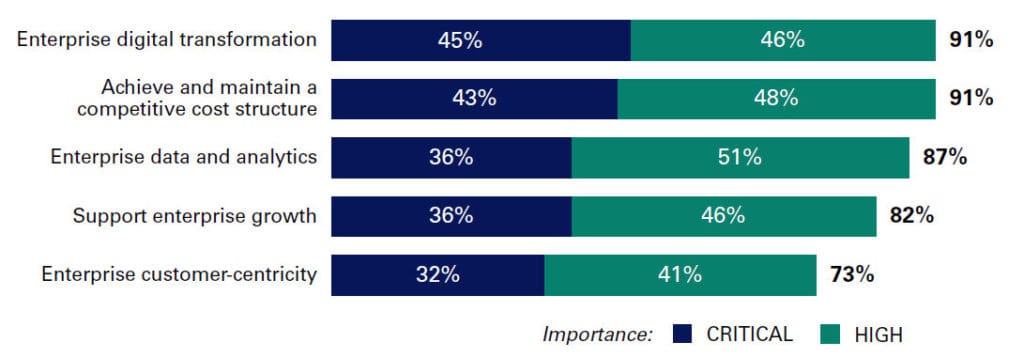

The Hackett Report, 2019 CFO Agenda: Building Next-Generation Capabilities, noted that digital transformation is expected to have a significant impact on financial performance; nearly 90% of finance respondents also rated improving enterprise data and analytics capabilities as a critical or highly important goal.

Figure 1: Finance’s top business objectives in 2019

Source: Key Issues Study, The Hackett Group 2019

The CFO of the digital economy has expanded his/her taking on an active role in driving growth, without relinquishing traditional responsibilities like cost control, cash and capital management. CFOs now advises business leaders on how to allocate scarce resources against a highly challenging backdrop.

As architects of business value, CFOs provide the means, the tools and the acumen to design for and deliver valuable business outcomes.

FutureCFO spoke to Tom Berquist, chief finance officer at TIBCO Software during a recent visit to Singapore. In the most recent 13 years, Berquist has moved around the executive suite circuit at various companies. He credits this experience to giving him a better appreciation for the challenges each role presented, and more important how his role as CFO can better support the work of the CEO.

Importance of technology

With increased dependence on technology and the data that flows through it, CFOs are expected to improve their ability to manage large data sets in order to understand the business risks and impact of new ventures for their organization, according to a CEO-CFO survey by The Hackett Group.

“Technology is extremely important. I ‘own’ a lot of the systems and part of that ‘responsibility’ is to ensure that appropriate controls are in place on the systems. By having the systems under finance control and ensuring that they have the proper security on them, you can significantly reduce risks. I think if you don't have knowledge of technology and the finance function, you're not going to be able to manage those risks,” he mused.

Expanding responsibility

Drawing from a comment by The Great Room CEO, Jaelle Ang, on the role of the CFO expanding beyond just managing the costs of running a business, Berquist commented that as CFO part of his remit is overseeing the company’s investment strategies, including product development, R&D, marketing, and the company’s renewal business.

He noted that data has become a significant challenge and opportunity for businesses. Like other companies, TIBCO has a healthy and growing ecosystem of channels partners, suppliers, and customers.

“There is a lot of data in these relationships. In order to have better control over all those master data files, they've been put under a CFO assisted by legal. This has broadened the charter because we now have to make sure that we're negotiating with each of those business functions about the data rights,” he elaborated.

Changing business models

Among the various technology-led disruptions of the last decade, cloud computing has had a significant impact on how TIBCO operations. The data is also increasingly being governed by very complex regulatory requirements.

“Cloud services are definitely shaking up the industry,” said Sid Nag, research vice president at Gartner. “At Gartner, we know of no vendor or service provider today whose business model offerings and revenue growth are not influenced by the increasing adoption of cloud-first strategies in organizations. What we see now is only the beginning, though.”

TIBCO’s Berquist admitted that as a business, TIBCO also had to deal with the recognition that much of its business will need to be delivered and supported in the cloud. As an organisation that has its roots on on-prem software, he acknowledged learning to negotiate with cloud vendors like Amazon, Microsoft and Google as it put elements of its business in the cloud.

“More and more of our business – how we manage our customer relationships, how we do our quoting, how we do our fulfilment – is being done in the cloud. The same challenges that our customers have as they take our products that used to be primarily on premise and deploy them in their clouds to solve their business problems, we're doing at TIBCO as well,” he concurred.

CFO’s view of customer experience

Asked on how TIBCO is responding to trends around customer experience, Berquist conceded that TIBCO has taken to an omni-channel strategy to cope with an expanding universe of customers and partners. TIBCO is adding digital into what previously were very analogue mechanisms for engaging customers.

“When I joined TIBCO [2015], we had kept the data separate from each acquisition, which made it very difficult to quote a customer new business if they wanted to have things that spanned multiple acquisitions. So, the first thing that we did is we created a universal customer master. Once we had done that, it became easier to add new accesses to new channels, whether it's a partner channel or an e-commerce channel. We have gotten pretty good at adding different distribution channels onto our customer depository,” he added.

Managing risks

The AON report, Managing Risk: How To Maximize Performance In Volatile Times, noted that technology companies have a higher cyber risk ranking than their peer groups. The insurer links this to large-scale breaches and various high-profile investigations into data privacy practices. Other risks for which technology companies need to keep in check include disruptive technologies and the failure to innovate [meet customer needs].

Berquist acknowledged the difficulty of eliminating all forms of risks. As CFO, the approach TIBCO has taken is to distribute the responsibility of managing risks, including engaging legal to make sure contracts include all necessary provisions.

“We have a chief security officer who handles a lot of the security for the networks, the cloud, who has access to company data. We have groups who do perimeter testing and penetration testing to try and make sure that people can't break in and steal our data. You try to take care of all of the obvious risks,” he confided.