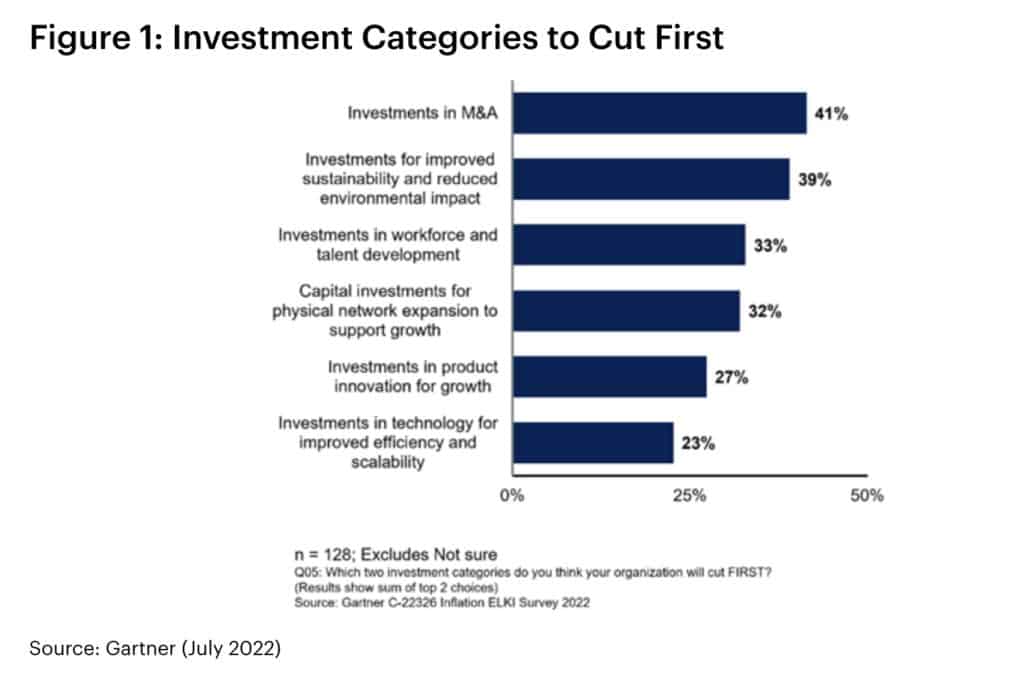

When it comes to corporate investment, M&A and sustainability will be the first areas to face cuts in organisations feeling their margins triple squeezed by rising inflation, talent shortages and supply constraints, said Gartner recently when releasing results of a survey.

The survey was done in June 2022 and collected responses from 128 CFOs and CEOs, according to the advisory firm.

Talent, tech: the least likely to face cuts

In addition, survey results also indicate that 46% of CEOs and CFOs said spending on workforce and talent development would be the last area to cut in terms of corporate investment, and 45% of respondents said they would cut digital investments last.

Technology investments are also the least likely first cut, with just 23% of respondents placing it in their top two.

Cuts to M&A are an obvious choice after record activity in 2021 and with rising interest rates significantly increasing the cost of financing such deals, said Randeep Rathindran, vice president, research in the Gartner Finance practice.

“It’s more surprising to see sustainability so close to the chopping block because CEOs rated it as a top strategic priority for the first time in 2022, and ESG disclosures are increasingly becoming enshrined in legislation,” he noted.

Despite the cost, companies are turning to digital investments to improve efficiency and protect margins, said Rathindran.

According to Gartner’s 2022 FinTech Bullseye Report, companies that implement blockchain, IoT, and digital twin technologies see improvements in reporting ability, performance optimisation, and workforce efficiency, he added.

Implementing digital in a way that boosts the productivity of workers, assets, and working capital will be a necessity going forward, he advised.

Industry differences

Although talent and workforce development was the top pick to protect from corporate investment cuts, a third of respondents also rated it as one of first areas to cut, according to the survey.

This is likely due to differences by industry, because companies in service-based industries are most likely to reduce their investments due to the high proportion of labor costs, said Rathindran.

“Meanwhile, product-based industries protect these investments as a source of advantage, helping them to maximize human capital,” he pointed out.