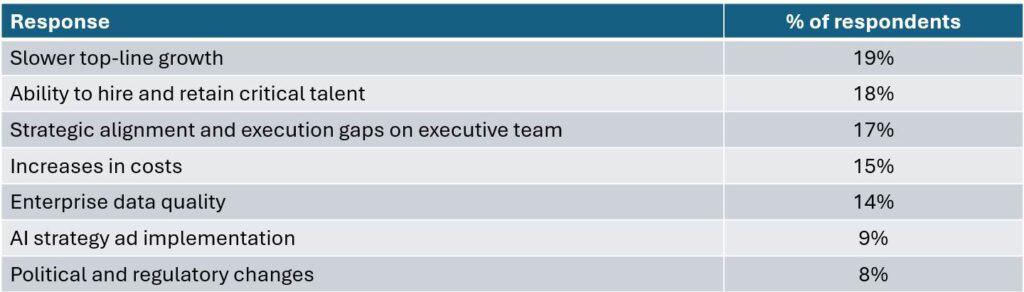

Chief financial officers are seeing slower top line growth and talent issues as the biggest challenges in 2025, according to a recent survey by Gartner.

The study, which polled 250 CFOs and finance leaders, also reveals a range of other concerns including the strategic alignment of executive teams, increases in costs and enterprise data quality.

CFOs’ Biggest 2025 Challenges Relating to Enterprise Performance

Source: Gartner

"Most CFOs think underlying market growth in their industries will be similar when comparing 2024 and 2025," says Alexander Bant, chief of research in the Gartner Finance practice. "However, three quarters of finance respondents said they are more focused on downside risk and cost containment in their scenario planning for 2025 budgets."

To protect top line growth, Gartner identified five practices that set apart a top 5% of companies that have delivered efficient growth relative to their industry peers through several economic cycles:

Cycle Discipline

Efficient growth leaders plan around all four phases of the business cycle: stable growth, peak, recession and trough. They practice cycle discipline by reducing operating costs incrementally when economic growth is strong and funding bold investment opportunities when economic activity hits a trough, and competitors struggle to match their spending.

Remove Growth Anchors

"Consistently funding and helping bigger, riskier growth investments succeed is one of the hallmarks of efficient growth leaders," Bant says.

"However, CFOs often overlook an important piece of the puzzle: growth ‘anchors’ or finance processes, internal politics, prior precedence, and outdated policies that inadvertently result in business leaders directing resources and attention away from bigger, riskier growth investments." Alexander Bant

There are four common growth anchors in times of economic volatility:

- Bureaucracy: Tighter controls and additional approval requirements hinder approval and funding for high-risk growth investments.

- Dangerous-to-Fail: Career and financial risks deter project sponsors from proposing high risk initiatives.

- Short-Termism: A focus on short-term performance issues limits attention to long-term growth.

- Capacity: Overstretched teams struggle to plan and execute transformative projects.

Cultivate overperformance

"While focusing on minimising investment misses may seem prudent for CFOs, it often leads to underperformance in growth investment portfolios because it tends to also filter out the highest potential, transformative initiatives too," said" says Bant. "Instead, CFOs should aim to cultivate overperformance where investments exceed initial expectations. This is especially critical during economic uncertainty."

CFOs should remove barriers to overperformance such as bureaucracy, fear of failure, and short-term thinking, while ensuring sufficient funding by reallocating capital from low-value to high-potential investments.

Avoid starving growth investments during cost-cutting

"CFOs often resort to cost-cutting to protect profitability during economic headwinds, but this can inadvertently jeopardise critical growth investments," says Bant. "To avoid this, CFOs should play the role of ‘internal activist investor’ to relocate cost rapidly and find creative funding techniques to ensure growth investments continue to receive necessary resources."

For example, the ability to reallocate capital from low-performing to high-potential investments is a hallmark of efficient growth leaders. To achieve this outcome, CFOs need to choose the right investments to cut funding from and assign funding to. This means tracking a small number of additional metrics to evaluate performance of in-progress investments and realign resources accordingly.

Another tactic seen in efficient growth leaders is cost saving winbacks – a mechanism allowing business units to regain a portion of their cost savings to fund growth projects. Alternatively, use any unallocated funds set aside during the annual budgeting process to support growth investments as needed.

Address offering complexity

While funding new products and services is essential for growth, unchecked proliferation can drive costs and complexity. Looking at a company’s offerings through a return on invested capital (ROIC) lens can optimise capital-efficient growth.

"Companies with fewer, strategically targeted product lines outperform peers in profitability and shareholder returns," says Bant. "Traditional portfolio management often prioritises revenue and margin metrics over ROIC drivers like fixed assets and working capital, which is insufficient in a capital-constrained environment."

Gartner experts recommend that finance teams identify and insulate products that are crucial to long-term growth and then use an ROIC scorecard to assess product lines based on revenue, costs, working capital, and fixed assets.