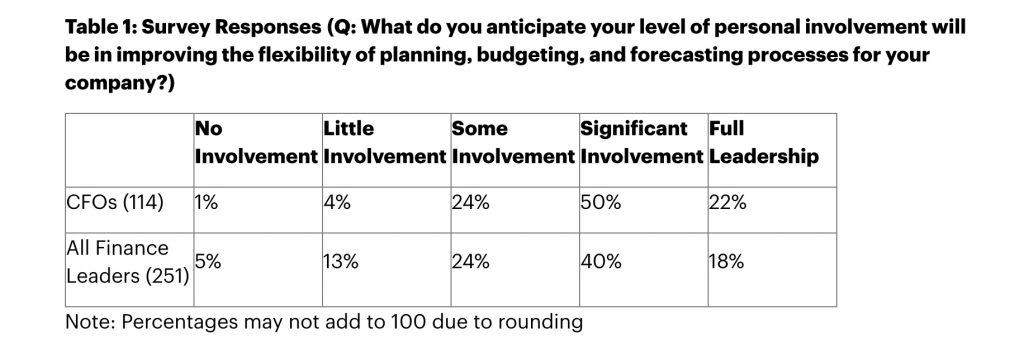

The top CFO focus for 2022 is improving the flexibility of budgeting and forecasting, according to a September 2021 survey of 251 CFOs and other finance leaders by Gartner.

While 72% of respondents indicated that as the top CFO focus, the next most common CFO focus areas next year will be initiatives to reallocate capital based on changing demands (60%) and redefine the employee value proposition in a hybrid environment (58%).

The pandemic exposed budgeting and forecasting processes that were not able to handle rapid and unpredictable changes in operating conditions, said Faith Vakil, director, research in the Gartner Finance practice.

Furthermore, it showed that there can be opportunity in disruption and the benefits of flexibility in how an organisation uses money throughout a year, she added.

“The annual budget plan is a convenient starting point but the way an organisation uses money throughout the year is far from static,” Vakil pointed out.

Disruption inevitably forces deviation from the plan, and finance leaders typically look for quick wins: cutting selling, general and administrative expenses (SG&A), and/or moving resources around within a business unit to avoid more difficult trade-offs between business units, she said.

“The problem with this approach is that the quick wins dry up sooner or later. This forces finance leaders to make the more difficult trade-offs anyway, often at the most challenging moments for a business,” she noted.

Instead, it’s better to embed flexibility into budgeting and forecasting in a more sustainable way that encourages a total company mindset and can foster innovation and alignment to changing priorities, Gartner said.

“The key change in mindset that finance leaders must adopt is to make tradeoffs between business units early and often rather than trying to stick to an annual plan until the last minute,” Vakil advised.

“This approach encourages collaboration between business units, it embraces innovation as necessary and normal, and improves funding alignment to changing priorities,” she added.

Late tradeoffs are harmful tradeoffs

The long-term consequence of ad hoc tradeoff decisions is to normalise crisis mode and short-termism, said Vakil.

This lengthens the time for companies to recover from a shock and reduces the chances of taking advantage of potential investment opportunities arising from disruption, she added

“For example, finance leaders may try to freeze T&E budgets, and cut marketing spend to avoid having to shift budget between business units. Then when it becomes clear that these changes won’t be sufficient, with no other quick win options in sight, finance will turn to resource tradeoffs between business units,” Vakil noted. “Because this is happening as a last resort there is rarely the benefit of time for the affected business units to provide input.”

To capture the potential value of disruption, finance leaders need to establish processes to know why, and where their budget plan went wrong and then correct it while there is still time within the fiscal year to course correct and reap the benefits of reallocations, Gartner said.

A cadenced approach to tradeoffs recommended

Gartner recommends a cadenced approach to tradeoffs that embeds the idea of resource flexibility throughout a year rather than it being a last resort measure.

This means cross-functional and business unit resource allocation reviews throughout the year as part of the in-year business review cycles, and for total company performance to be weighted more heavily than individual business unit performance, Gartner said.

It also means setting these expectations with functional and business leaders upfront, to begin to breakdown internal cultural barriers associated with budget “ownership.”

“This is not the end of budgeting as we know it. Finance will still prepare their annual budget and targets,” said Vakil. “It is simply a shift from using resource tradeoffs as an emergency response tactic to using them as an ongoing tool for budgeting and resource flexibility.”