Investors are demonstrating stronger preferences and interest in office assets and alternatives, according to CBRE's 2025 Asia Pacific Investor Intentions Survey.

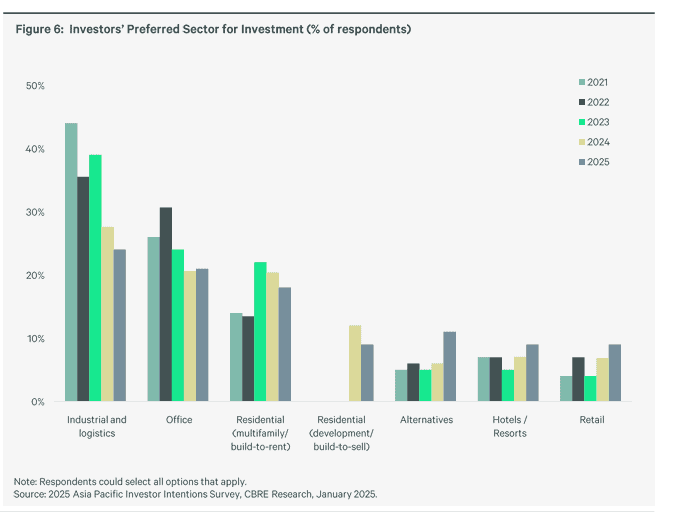

While the industrial and logistics sector still remained on top in terms of investors' preference for investment, the January 2025 research finds that interest in industrial properties declined slightly.

Preference for office assets in 2025 has picked up marginally, according to CBRE, as some of the occupier leasing activity in some CBD markets in the Asia-Pacific region stabilises and shows signs of growth.

CBRE says markets where the price gap between buyers and sellers has narrowed, such as Singapore, will be the most active ones for office investment in 2025.

Another finding from the research is how investors now seek further repricing of value-add offices and shopping malls.

Repricing expectations among investors in the region have fallen over the past two years, indicating that pricing for prime assets is declining.

According to the study, almost 50% of investors expressed their intentions to continue to seek discounts for value-add office acquisitions in the belief that further price cuts for such properties are on the horizon.

CBRE says investors expect further increases in pricing for hotel and multifamily assets over the next months, but the real estate services and investments firm anticipates this trend to emerge only in a few selected locations and among high quality assets.