Cash flow management has emerged as a top financial risk that poses the greatest threat to organisational growth, according to a report by insurance company Chubb.

In the Chubb Risk Decisions 360°: Emerging Risks that Can Impede Sustainable Company Growth report, which polled senior risk management or insurance purchaser decision-makers, to seek clarity on the emerging risks that can impede sustainable company growth, it was revealed that there is a huge concern among executives involving cash flow management.

This was followed by inflation and/or interest rate risk, credit risk, and liquidity risk, among others.

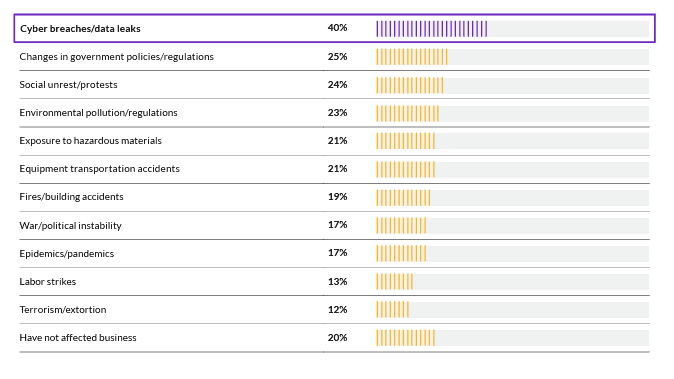

Cyber breaches and data leaks was also found to have become the leading man-made disruptions that resulted in the most unexpected and significant financial burdens for the respondents' businesses in recent years, followed by changes in government policies and regulations, social unrest and protests, and environmental pollutions and regulations.

Chubb says just over half of the respondents have business interruption coverage in place for events like cyber attacks, natural disasters or supply chain disruptions, and another one-third plan to add it in the next 12 months.

Further, majority of organisations now view cyber attacks as a top threat, with 56% of respondents stating that data breaches and malware have become their greatest concerns.

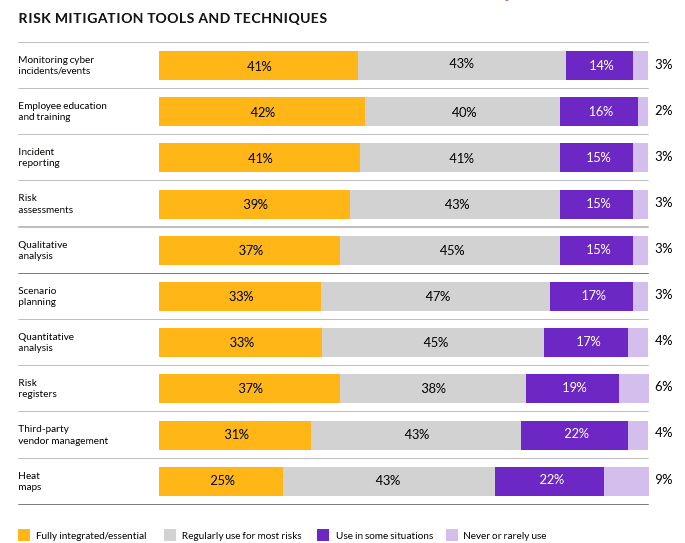

To mitigate risks, Chubb says companies now use nearly dozen tools and techniques, including monitoring of cyber incidences, providing employee education, and engaging in scenario planning.

Given this, it can be concluded that the evolving risk landscape shows that cyber security has made its way to stand out as a dominant concern for CFOs, hence it must be treated not just as an IT issue but rather as a fundamental financial risk.