Atradius forecasts a jump in insolvencies across Asia in 2020, with Hong Kong expected to be one of the most affected markets across the globe.

The increases are primarily driven by the impact the pandemic is having on global economies, the trade credit insurer noted.

Every major economy, except for China, is expected to enter recession this year, the depth and length of which will be determined by the ability of economies to manage health regulations and either exit lockdowns or thrive in social distancing, Atradius predicted.

“Government measures have reduced the anticipated increase in bankruptcy filings in a range of ways,” said Atradius Chief Economist John Lorié. “They have either shifted the threshold for filing, reduced debtor’s ability to force bankruptcy, or provided sufficient financial support to delay filings. However, as the support programs begin to expire, the number of filings should climb rapidly.”

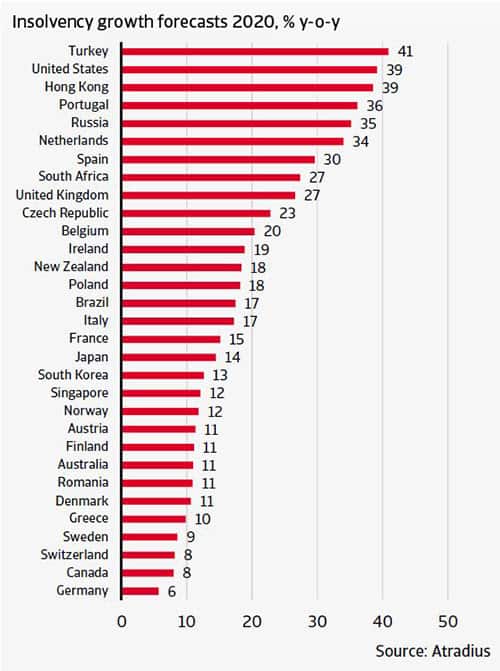

Among Asian economies, Atradius forecasts insolvencies to rise 39% in Hong Kong, behind just Turkey and the United States in the global ranking.

Hong Kong’s government’s implementation of a sizable fiscal stimulus programme has helped to dampen the number of insolvencies, said Atradius.

Elsewhere in the region, Japan, Singapore and South Korea will experience a considerable growth in insolvencies during 2020 but see a significant decrease in 2021, the firm added.

“The pandemic has put downward pressure on Asia’s export-driven economies as global supply chains come under pressure and demand wanes,” said Bart Poublon, Head of Risk for Atradius APAC. “But as one of the first regions to reopen, Asia is well-positioned to benefit from the rebound in economic activity, which will lead to falling rates of insolvency in 2021.