In 1994, British management consultant and sustainability guru, John Elkington coined the phrase "triple bottom line" to measure performance in corporate America, working on the premise that a company can be profitable and also socially and environmentally responsible.

According to Investopedia in the triple bottom line (TBL) there are three bottom lines,– profit, people and the planet, instead of one bottom line – profit. “A TBL seeks to gauge a corporation's level of commitment to corporate social responsibility and its impact on the environment over time.”

Today, 22 April 2020, FutureCFO follows up with Lee Thong Tan, CFO practice lead, Asia at Workday to take his view of TBL and how it is evolving in Asia-Pacific. The discussion follows a report published by Workday on the adoption of TBL practices in Singapore.

Lee Thong Tan, CFO practice lead, Asia, Workday

In a nutshell, can you describe the state of TBL in Asia-Pacific? What’s working and not working?

Lee Thong Tan: Broadly speaking, the uptake of TBL reporting has seen strong growth in Asia-Pacific over the past decade, a region which has traditionally lagged the rest of the world. This is encouraging as more Asia-Pacific companies are supportive of a transition towards an accounting framework that doesn’t just focus on profitability but also considers a company’s impact on its wider stakeholders.

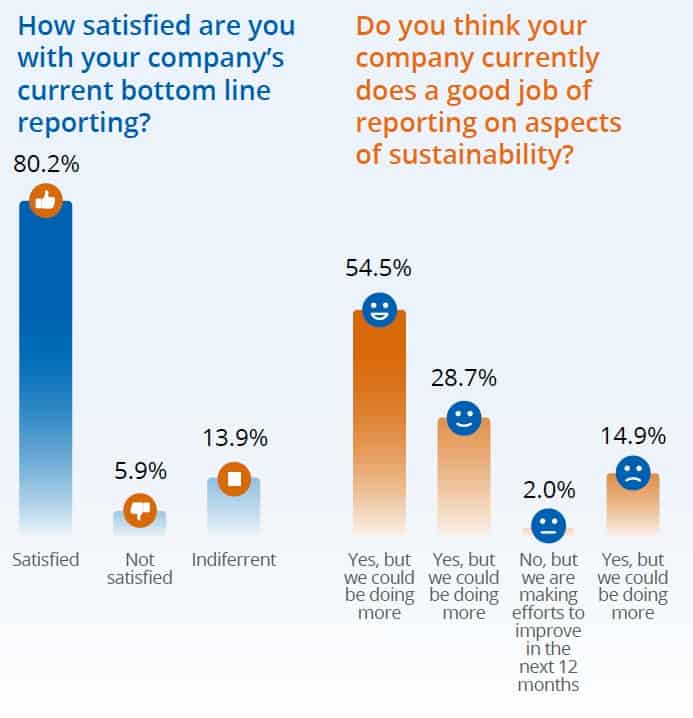

While adoption is high, satisfaction on the current approach is mixed and the lack of a unifying regulatory framework or more stringent regulation is also hampering results.

Referring to the Workday ESG report, how is Singapore performing when it comes to ESG reporting?

Lee Thong Tan: Singapore is performing well with over four-in-five companies (83.2%) producing a form of integrated bottom-line, TBL report. This is in part thanks to the efforts of many institutions, such as the Singapore Exchange (SGX), which have really brought the ESG conversation to the forefront.

Which industries have adopted TBL and why?

Lee Thong Tan: Most industries have adopted some degree of TBL reporting already but for some, it is more important for them to implement TBL reporting effectively and urgently. In the Workday survey Singaporean senior finance professionals in the manufacturing (52.5%), finance (38.7%) and transport and logistics (34.7%) topped other markets when it came to TBL reporting.

TBL is important, because it doesn’t focus on any one stakeholder group specifically but rather, presents a holistic view on the impact of a company’s activities.

To be effective who, within an enterprise, should comprise the team championing TBL efforts?

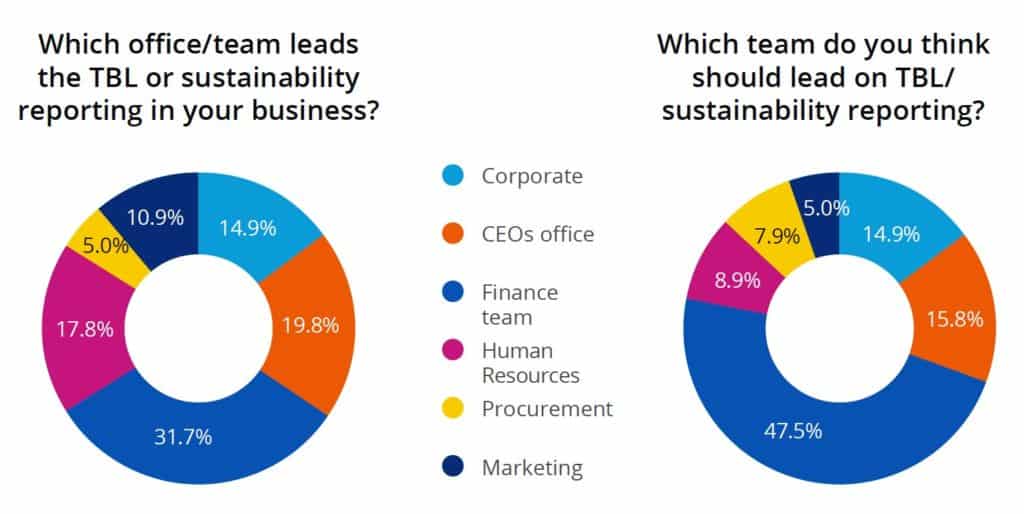

Lee Thong Tan: Many larger companies have dedicated investor relations specialists that will lead to TBL reporting efforts. This traditionally sits under the corporate or finance function of a company and they are good teams for effective TBL reporting.

Ultimately, for TBL reporting efforts to be championed effectively, what’s more, important than who should champion TBL reporting, is how TBL reporting is championed.

TBL needs to be driven from the top-down and advocated throughout an organisation. Through collaboration between different departments, consistently working towards it and a general mindset shift, TBL reporting will transform from a box-ticking exercise to an activity that delivers a meaningful representation of how a company is performing holistically and what steps it can take to improve.

Within the finance function, who should lead TBL efforts?

Lee Thong Tan: This should start from the top-down, so C-suite level (CFO, Head of Investor Relations). There should also be a collaboration between various function leaders on improving transparency and efficiency in TBL reporting.

For the finance team, what remains its biggest challenge in applying the TBL framework?

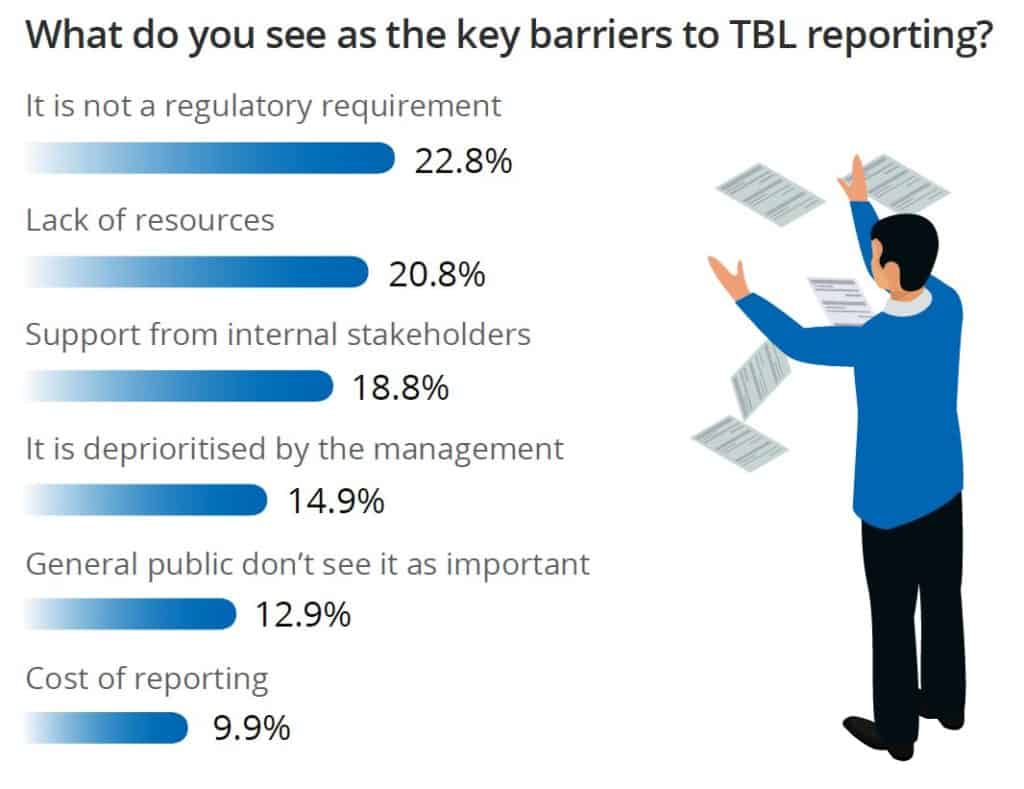

Lee Thong Tan: The standout challenge for many senior finance professionals is that TBL reporting is not a regulatory requirement (22.8%), followed by a lack of resource (20.8%) and support from internal stakeholders (18.8%).

This lack of regulation maybe because it is difficult to have a unifying framework for business across various industries and that TBL reporting itself is not currently mandatory for all companies. Over a quarter (26.7%) believe that while it is a nice-to-have, TBL reporting should not be mandatory for any company.

Respondents to the report picked on “not a regulatory requirement” as a top barrier to TBL reporting. What does this suggest the mentality that persists within the enterprise? How can finance move the needle?

Lee Thong Tan: Unfortunately, this sort of mentality needs to be changed if companies are to collectively improve in their TBL reporting. It also speaks to the lack of understanding of the importance of TBL reporting, where the conversation is still on whether we need to do it or not.

TBL reporting can impact future funding sources of banks and investors. It can also affect customers’ support and corporate reputation, ultimately impacting the revenue and profitability of a company.

As such, finance professionals certainly have a central and key role to play as the gatekeepers of the company’s bottom line, to take charge and demonstrate to the entire company that these are all correlated and should not be looked at separately.

With the COVID-19 pandemic hitting businesses hard, should they set aside TBL in favour of surviving the economic crisis?

Lee Thong Tan: It’s a difficult question because we find ourselves in unprecedented times. Many companies are taking drastic measures to survive the economic crisis.

What can be said about the pandemic is that we’re witnessing companies coming together to support the community, as well as the most vulnerable. We’ve seen major fashion brands turn their production lines towards producing essential medical supplies.

We’ve seen some technology companies offer their platform and services for free during the crisis. We’ve seen hotels requisitioned to become quarantine and care facilities in a fight against the pandemic.

It is encouraging to see this, and it highlights how at a time like this, TBL reporting is integral and it is no longer appropriate to see it as a side project that corporations do to feel good about themselves.

Earth Day is upon us. How do you relate TBL efforts with those of Earth Day, and given the prospects of a slow recovery from COVID-19, what are your suggestions for finance teams to support these efforts?

Lee Thong Tan: Earth Day is an international observance about humanity’s impact on the natural environment. TBL reporting, as a holistic approach towards a company’s impact on its wider stakeholders (which we’d like to summarise as People, Profit and Planet) will also be relevant.

This is especially true in the context of the pandemic that we’re going through at the moment, where supply chains are constantly disrupted and there is increased scrutiny on the ESG risks inherent within globalised businesses.

Finance teams will need to readjust and reevaluate their metrics for company performance in light of these disruptions, as well as the projected slow recovery. Why not take this time to focus on implementing wider TBL reporting reforms?