Alternative payments are taking the centre stage in the Philippines for online purchases, according to data and analytics company GlobalData.

Cash remains the preferred payment method in the interim for online purchases in the country, but alternative payment solutions collectively accounted for over one-third share in the overall e-commerce payments in 2023.

According to GlobalData’s 2023 Financial Services Consumer Survey, 88.2% Filipino consumers reported having shopped online in the past six months, while only 7% stated that they never shopped online.

GlobalData’s E-Commerce Analytics reveals that an increasing number of consumers in the Philippines are opting the convenience of online shopping.

The Filipino e-commerce market grew by 27.8% in 2023 to reach PHP1.1 trillion ($20.6 billion), driven by a large young population and rising internet and smartphone penetration. The e-commerce market is expected to continue the strong momentum and is estimated to grow by 23.3% to reach PHP1.4 trillion ($25.4 billion) in 2024.

"Philippines e-commerce market is experiencing strong growth, driven by factors such as rising internet penetration, improving logistics, a rise in the number of middle-income families, and increasing confidence in online payments," says Kartik Challa, senior banking and payments analyst at GlobalData.

"With a preference for online shopping due to its ease and time-saving benefits, Filipinos are embracing digital platforms, making e-commerce an integral part of their shopping experience."

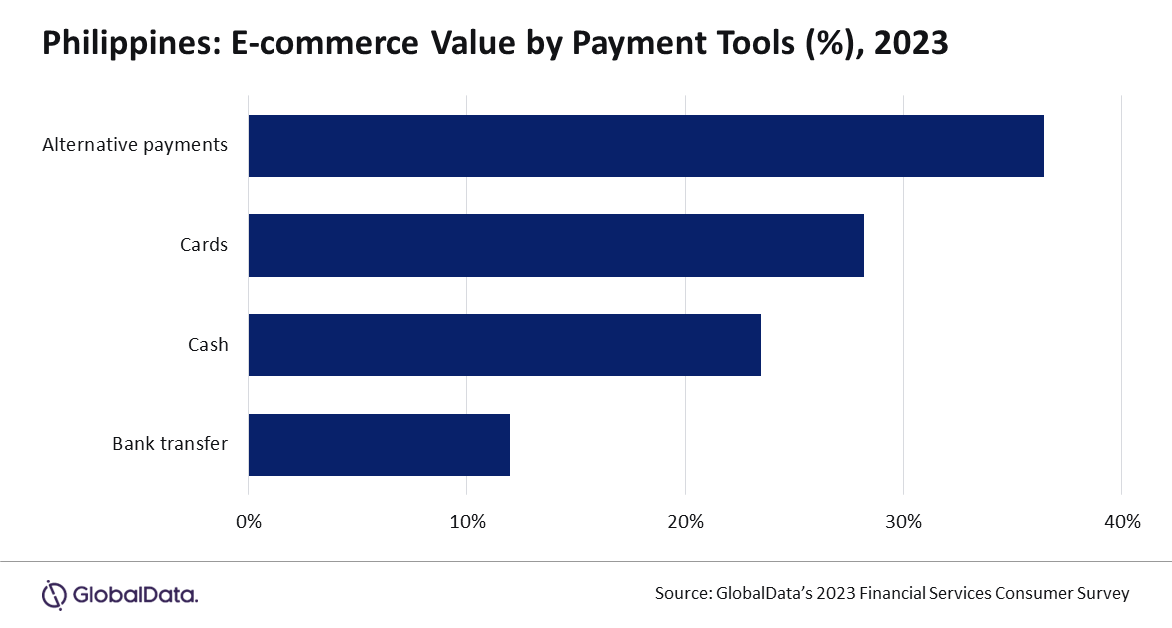

Despite the rise in electronic payments, GlobalData says over 23.5% of e-commerce purchases in the Philippines are still made in cash. This highlights the traditional preference for cash among Filipino consumers due to its high unbanked population and limited financial awareness especially among the rural population.

Apart from a strong inclination towards traditional payment methods such as cards and cash, Filipinos, particularly among Generation Z and millennials, are also enthusiastic about embracing new payment technologies.

Consequently, alternative payment solutions are increasingly used for online purchases and collectively accounted for 36.4% share with GCash, Maya, PayPal, and Dragonpay being some of the popular brands. Consumers value these alternative payment methods due to their simplicity and ease of use.

Other factors supporting the alternative payments’ growth is the emergence of new payment models such as “buy now pay later,” which allows consumers to split total purchase amount into instalments. Several players including Atome, BillEase, Akulaku, and Tendo are offering this service in the Philippines.