Editor’s note: In today’s A Day in the Life, Jason Rankin (pictured), Group CFO & GM ASEAN at CPM Group, shares with FutureCFO audiences how the shift toward a more forward-looking, data-driven, technology-enabled finance function excites him and how travelling through communities in Africa, Middle East and Asia influences the way he leads.

FutureCFO: What does a typical day look like for you?

Jason Rankin (JR): A typical day for me starts early, being in Singapore, (and) Australia being two hours ahead, and often before the Asia region is fully awake.

I like having that quiet window to get those steps in for the day, ensure my biological solar panel gets the rays it needs, and then onto reviewing regional developments, and look at the performance of our cash positions and liquidity buffers.

Ensuring that our finance systems are optimising cash and generating the right returns is a daily focus, and it helps me begin the day with clarity on where value is being created and where adjustments may be needed.

Well, I stand all day... and only sit at client site when required.

Once meetings begin, my day becomes a blend of strategic dialogue and team engagement. Because I work across multiple Asian markets, mornings often include coaching sessions with finance leads or conversations around digital transformation initiatives within our largest practice, FP&A.

I spend a lot of time thinking about how we can modernise the way finance operates—whether through process redesign, upgraded systems, or data-driven insights. But just as important, is ensuring the team feels empowered to shape that future and make decisions.

Jason Rankin, Group CFO and GM ASEAN, CPM Group

I prioritise creating a culture where people feel safe to challenge, experiment, and bring forward new ideas—I want to be the sounding-board they utilise, but ensure they benefit from the confidence generated from sound commercial decisions.

Midday usually means crossfunctional collaboration—operations, functional practices, risk, or IT—because transformation does not happen in a silo. My role there is often as a connector, helping teams align on the end goal and translating finance priorities into language that supports the broader business narrative.

I end most days by checking in on progress, not just on metrics but on people: Are our teams equipped and do they understand the value-chain we offer clients? Are we living the culture we want, which starts with me and our executive leadership team? Are we building solutions that drive client ROI?

That blend of transformation, people development, and financial stewardship is what keeps my role meaningful.

FutureCFO: What excites you the most when you work with the Finance Function?

JR: What excites me most about working with CFOs, finance and cross-functional teams is the shift toward a more forward-looking, data-driven, technolog-yenabled finance function.

Digital transformation has changed the expectations of the CFO’s office, and I enjoy helping leaders and teams navigate that evolution. It is no longer just about controlling spend, closing books on time, or ensuring governance and compliance; it is about building systems and processes that unlock speed, insight, and value.

For me, enabling finance teams to adopt tools that maximise cash visibility, streamline forecasting, or optimise revenue via front-end teams’ collaboration is incredibly motivating because these improvements have a real, measurable impact on business resilience.

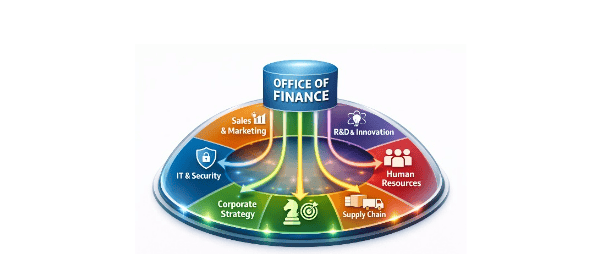

It is imperative to every Board of Directors, that the Office of Finance is at the centre of the organisation, elevated, to ensure it is mandated to deliver value in the decision-chain, rather than depressed below other functions, absorbing downstream issues or in permanent fire-fighting mode.

I also enjoy partnering with CFOs who recognise that technology is only one part of transformation.

The cultural shift—encouraging curiosity, fostering collaboration, developing talent—is equally important. Some of my most fulfilling experiences come from watching team members grow in confidence, expand their technical skills, step into more strategic roles and become the best versions of themselves.

When finance professionals feel empowered and equipped, they become true partners to the business—more than just a job or pay- check mentality. And yes, it is still possible in this new-gen day-and-age.

Working across Asia-Pacific brings cultural diversity and additional energy to my role. Every market is at a different stage and awareness in its transformation journey, and each presents unique opportunities to learn, adapt and influence. That diversity—of people, challenges, and perspectives—keeps me engaged and continuously learning.

FutureCFO: Can you share an experience which was key to your professional growth?

JR: A defining moment in my professional growth came when I was asked to lead a transformation initiative in Asia Pacific (from Toyko to Dubai) where performance was under pressure, the finance function needed a reset, and a CoE for Analytics was non-existent.

Initially, I focused heavily on technical solutions—process improvements, system upgrades, and reestablishing financial discipline.

But it became clear that the real challenge wasn’t the numbers; it was the culture. The team needed direction, confidence, and a sense of shared purpose.

This experience taught me that sustainable transformation is always a people journey first, regardless of how powerful AI becomes.

When I shifted from diagnosing issues to empowering the team—giving them space to contribute, building trust, and reinforcing small wins—the momentum changed. We implemented new digital tools, harmonised finance platforms (after making deals with regional CFOs), and strengthened controls, but what really accelerated performance was the renewed belief within the team that they could deliver something exceptional.

That project shaped my leadership approach. It reinforced the importance of empathy, transparency, patience, especially in environments where change feels overwhelming and although (I) loathe to quote this, “the art of the deal” in negotiations with Country Managers and Country CFOs. It also strengthened my conviction that finance can drive culture just as powerfully as any other function.

Today, when I work on platform implementations or digital initiatives, I lead with the mindset that technology amplifies people—but people create the change.

FutureCFO: Is there anything outside work—such as a travel experience, a book, participation in a sport event or any volunteering experience—that serves as an important inspiration to your work or life?

JR: One of the experiences outside work that continues to influence how I lead came from travelling through communities in Africa, Middle East and Asia where life is lived at a different rhythm, with at times no financial safety net.

What stood out to me, about human-nature, was the strong sense of shared responsibility—people supported each other instinctively even though they have very little, and the absolute necessity to innovate and create, else we all fail. Even with limited resources, there was an undeniable clarity of purpose and resilience in how challenges were approached.

Throughout my family history, we have inspirational stories of entrepreneurship and a “never-say-die” attitude. I am constantly reminded of the need to be respectful, strive to achieve, humble in the light of success, and most importantly to always pay it forward. Hence, why I am always open to meet with young professionals in need of vocational guidance and be a mentor. If I’m honest, I’ve probably learnt a great deal more from them that they have from me, so thank you to you all that have taken the time to engage.

My experience has reminded me that progress is built on collaboration, not individual effort. That message resonates deeply with my philosophy on building teams and shaping corporate culture.

In finance, especially when working on digital transformation or strengthening cash management systems, it’s easy to focus on the technical solution. But real impact comes from empowering people and fostering environments where every voice matters.

This perspective continues to guide me when I lead regional teams or support corporate initiatives to strengthen culture. Whether we are redesigning a process, rolling out a new tool, or building capability in a market, I try to create space for people to grow, contribute, and take ownership.

The global travel experience (now up to 63 countries) taught me the value of patience, balance, and collective strength—qualities that I believe are essential in both life and leadership.