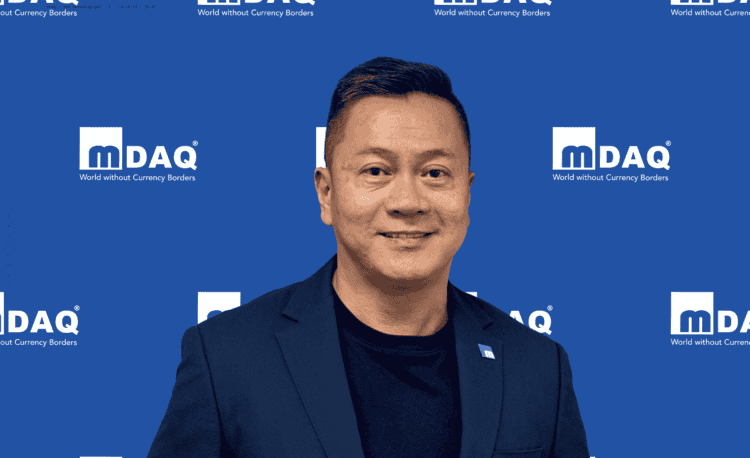

Editor’s note: In today’s A Day in the Life, Tan Choon Seng (pictured), Group CEO at M-DAQ Global, shares with FutureCFO audiences how a CEO can support their finance leader in the latter's evolving role and how dragon boating has been a major inspiration in his professional life.

FutureCFO: What does a typical day look like for you?

Tan Choon Seng (TCS): My typical day starts with a workout at the gym. This gets me refreshed and energised for the day’s events and activities.

On a busy day, my calendar can be packed with 10-12 meetings. I enjoy this pace, as I find it important to engage with my team, whether on an individual or group setting. To ensure I have time for critical tasks, I block off my calendar to address major and urgent issues that require my attention.

Every day moves quickly as my team and I work to develop innovative solutions and solve complex problems for our clients in the world of FX and cross-border payments.

FutureCFO: The role of a finance leader is evolving from a transactional one to a strategic one. What are the most effective ways a CEO can support their finance leader in this transition?

TCS: Having spent more than two decades in the banking industry, including a five-year stint as Regional CFO for Asia, I’ve seen firsthand how a modern CFO's role has evolved.

It’s no longer just about the numbers; it's about being a strategic partner and co-pilot to the CEO in charting the growth of the company.

Tan Choon Seng, Group CEO, M-DAQ Global

This firsthand experience with the daily challenges that CFOs and their finance teams face is what drives my vision for M-DAQ. We want to be a trusted partner for them, providing solutions that free them from their daily operational burdens and give them the time and tools to focus on what truly matters: driving business growth and mitigating risk.

In the world of global payments, the constant uncertainty around currency fluctuations, compliance checks, and operational failures can be a significant source of stress. The manual, day-to-day work of navigating these challenges consumes a huge amount of a finance leader's time, leaving little room for strategic thinking.

This is where I see the biggest opportunity, and where I see M-DAQ's solutions coming into play. We provide the right technology to automate these complex financial processes, especially in a dynamic and fragmented region like ASEAN, where a company might be dealing with multiple currencies, varying local regulations, and complex cross-border transfers.

By implementing solutions that simplify the management of multiple FX rates and compliance checks, we empower CFOs to shift their focus away from operational work and toward what truly matters.

It's not just about making things faster; it's about freeing up their time to focus on forecasting, mitigating risk, and shaping growth strategy.

FutureCFO: Can you share an experience which was key to your professional growth?

TCS: A pivotal moment in my professional growth came early in my career as Regional CFO for Asia at a major international bank.

When I first took the role, I asked the Regional CEO about his KPIs for me. He simply said, "Provide accurate and timely reporting of the monthly financial figures, and support business leaders in understanding their financial performance."

I remember thinking to myself then: “That’s not too hard."

Six months later, a new Regional CEO was appointed. I asked him if I could join the bi-weekly business heads' meeting to gain a deeper insight into the business.

He responded, "Of course! Why do you even need to ask?" He then clarified his expectations of me as CFO: He needed me to be his co-pilot and to act as the "bad cop", challenging business heads on their financial performance and strategy, especially when they fell short of targets. In the meantime, he played the "good cop" by supporting business growth.

I embraced this role and I like to think I was a nice and friendly bad cop, as I worked with each business head to provide financial insight, fostering collaboration while pushing for results.

This was a valuable experience for me and solidified my belief that the person makes the job, not the other way around.

FutureCFO: Is there anything outside work—such as a travel experience, a book, participation in a sport event or any volunteering experience—that serves as an important inspiration to your work or life?

TCS: Picking up dragon boating nine years ago has been a major inspiration in my professional life, shaping my views on teamwork and perseverance.

The sport is a powerful lesson in synchronised effort. With 20 paddlers moving as one to propel the boat, I learned that a team's collective success is far greater than any individual's strength.

I apply this directly to my work by promoting a "One Company" culture, where we leverage our individual strengths to achieve shared goals and move the entire organization forward. Just like in the boat, it takes the collective effort of each and every paddler to move as one to win the race.

Beyond the physical discipline, the camaraderie within the dragon boating community is incredibly inspiring. We celebrate each other's victories and support one another through losses.

This experience has reinforced the value of creating a positive and encouraging environment. I strive to bring that same spirit of empathy and support to the workplace, because I believe a cohesive and motivated team is the winning team.