US businesses are expected to speed up its cash accumulation in Q4, said the Association of Financial Professionals that recently released the results of its Corporate Cash Indicators, (CCI) a quarterly survey of senior corporate treasury and finance executives .

In Q3, businesses continued to accumulate cash and short-term investment holdings though at a gradual pace, according to AFP.

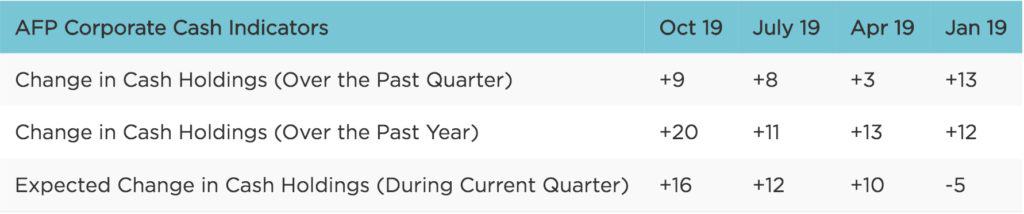

The latest CCI’s quarter-over-quarter index increased one point to +9, and the year-over-year indicator increased by nine points to +20.

These results are based on 120 responses from senior treasury and finance professionals this quarter, according to AFP. These readings suggest that treasury and finance professionals are uncertain about the economy and exhibiting caution, AFP said.

AFP predicts faster cash accumulation for Q4 as the forward-looking indicator measuring expectations for changes in cash holdings in the current quarter increased four points to +16.

“This figure is one of the highest we’ve recorded for a forward-looking indicator since it began gathering this data in January 2011," AFP pointed out.

Meanwhile, the indicator for short-term investment aggressiveness decreased significantly, moving from -3 to -10, signaling a continued conservative posture with cash and short-term investments, AFP noted.

This is the lowest this figure has been since AFP began reporting on these numbers in 2011, the organization pointed out.

Recent interest rate cuts by the Fed and the likelihood that there are more to come are prompting treasury and finance professionals to be conservative with their organizations’ short-term instruments, said Jim Kaitz, president and CEO of AFP.

“With trade tensions between the US and China continuing and fears of a potential recession, business leaders aren’t taking any chances,” said Jim Kaitz, president and CEO of AFP. “Organizations are understandably reluctant to spend any money that they don’t have to. Cash accumulation appears to be the new normal.”