A look back at 2023 and it becomes clear that persistent challenges were the norm for much of the year – be it in the form of social, geopolitical or economic.

Among such challenges in the market include insolvencies, denoting the state of financial distress wherein a business is unable to pay its debts. Insolvency pertains to a point when liabilities are greater than the value of the organisation, exceeding the value of the company’s assets, and when a debtor cannot pay the debt it owes.

This can be particularly tricky in the eye of financial leaders as this can dictate where the organisation goes. When facing insolvency challenges, it should be noted that there is a risk that a company will be unable to meet its payment obligations in a defined period, thereby insinuating bankruptcy risks.

Insolvency in business can stem from different factors, including bad cash flow management, excessive expenditures, and failure of clients.

Edmond Lee, CEO of Hong Kong, Taiwan, and South Korea for credit insurance company Allianz Trade, delves deep into the insolvency challenges and climate being dealt with in Asian markets.

Insolvency in Asia

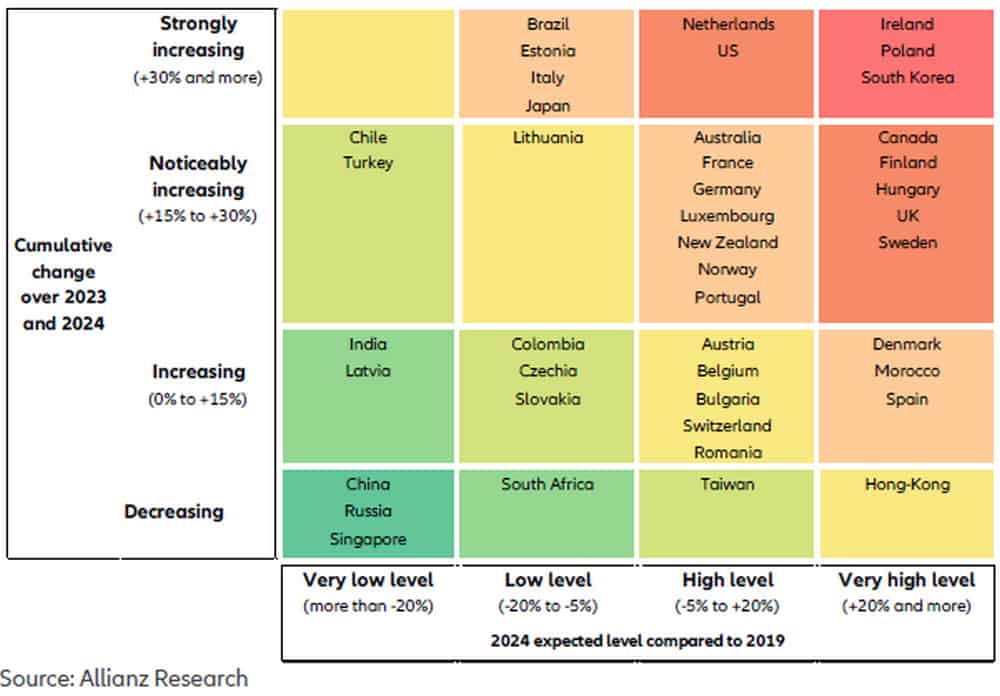

The Allianz Research paper, Global Economic Outlook 2023-25, notes that businesses face declining demand and higher costs while pricing power is fading. The Allianz Trade Global Insolvency Index forecasts insolvencies to increase by +6% in 2023 and at least +10% in 2024. Interestingly, the outlook for Asia, except for South Korea, is more positive (see Figure 1).

Figure 1: Business insolvencies - Forecasts

In terms of insolvency issues, Lee says it is a bit different in Asia compared to the other areas in the world such as the US and Europe, although insolvency rates in Japan and South Korea have gone up quite noticeably in 2023, with a 35% increase for the former and 41% in the latter.

“I think the insolvency rates, generally speaking, for Asia is still quite benign,” Lee notes.

Export opportunities

As for the export opportunities in Hong Kong and China, Lee believes it will still be based on the traditional markets, saying nothing will change much.

Electronic vehicles are expected to be a big thing in the Chinese exporting scene, with transactions with India, Europe, and America tipped to grow a little bit.

Meanwhile, Lee does not expect the retail and electronics sector to play a huge role in terms of export opportunities in 2024.

The Allianz Trade executive says they see a lot of larger corporations in China set up selling offices in Hong Kong, making use of the favourable business environment.

“A lot of Chinese exporters are setting up subsidiaries in Hong Kong,” Lee says, noting that these selling arms in Hong Kong could take up 10% to 20% of the exporters’ sales, generally speaking.

Additionally, Lee highlights that they see a lot of potential for credit insurance because the sales booked in Hong Kong are all exports.

As for what attracts Chinese corporations to set up subsidiaries and arms in Hong Kong as opposed to other countries such as Singapore, Lee believes it’s because Hong Kong is a part of China.

He notes that the move will not cross borders, thereby making it easier for the Chinese companies to decide, considering the familiarity in cultures.

Standing out among trade credit insurers

For Lee, trade credit insurers have similar products on offer, but the underlying service provided differs.

“What differentiates one trade credit insurer from another is quite a few things,” Lee notes, highlighting the importance of understanding credit appetite and the consistency in the service being provided.

“Any policyholder doesn’t want their credit insurer to be all over the place when it comes to writing limits,” Lee said, explaining that this can affect the buyer-seller relationship altogether.

Lee also believes that pricing is very important as it has to be very competitive considering the market situation at present.

He concedes that most of their bread-and-butter business is in electronics, that’s why companies must keep up with the big-volume, small-margin requirement in the sector.

Lee also adds that being fair and sustainable is very important among trade credit insurers, saying customers should be treated as partners.

“We need to work with them and understand them, listen to them, what their needs and pain points are,“ Lee says.

In terms of turnaround service, it is a highly competitive space among trade credit insurers as nowadays transactions are done through computers and decisions are expected to be made in a matter of hours.

Forecasts for 2024 and 2025

“Generally speaking, we don’t see 2024 as a good year,” Lee says, noting that they expect insolvency trends for the year to go up.

Globally, Allianz Trade is looking at an around 10% increase in 2024, which will be concentrated in the US and European markets, driven mainly by the global economy, what with the expected mild recession in Europe and the continuing Russia-Ukraine war, as well as the coming elections in the US.

Although these factors aren’t considered as drastic, according to Lee, economic rebound is expected to become slower.

On the other hand, insolvency rates are forecast to go back down in 2025 to a single digit, according to Lee.

Trade risk management advice

For Lee, repayment risk is the number one trading risk that chief financial officers, as well as other financial leaders, will face in 2024, noting how buyers will be paying companies back.

“On the open account trade, what’s happening right now is that I think there’s a major shift for the past 20 years,” Lee says, “the gradual shift in open accounts is much riskier from the perspective of the supplier.”

In addition, Lee believes that the fluctuation of product prices also poses another risk for financial leaders, saying this has a very disruptive effect when one is trading as this can affect the whole financial planning process of the organisation.

“We see this a lot going on nowadays in the field of major component commodities,” Lee points out.

One-stop credit insurance service

Given all the uncertainties ahead that can impact how businesses, especially exporters, operate in Asia, Lee advises CFOs to get a one-stop credit insurance service provider to manage risks.

For him, this means that the service provider can give support on credit insurance policy suitable for domestic sales and export businesses.

He adds that companies need an organisation that can provide a worldwide database with local expertise to help clients filter high-quality customers and develop new markets, which will allow firms to have access to funding and better financial terms.

Lee says these are all needed by corporations, on top of international debt collection service, regardless of if they are big or small enterprises, to begin working with a credit insurance partner.