On any given day, capital is king.

During the financial crisis of 2009, “How does your perspective differ as a businessman versus an economist on the way any organization or firm should try to be proactive in an environment with as many uncertainties as we have today?”

During a Bloomberg-Vanity Fair panel, Legendary GE CEO, Jack Welch, was asked for his perspective on the way any organization or firm should try to be proactive in an environment with many uncertainties (this was during the financial crisis of 2009).

“We have 11 companies in our private equity company. We meet with them every 30 days. Our objectives with them and our challenge to them were three things. One, cash is king. Get every drop of cash you can get and hold onto it. That is number one,” Welch responded.

This is just as true in periods of uncertainties. The early days of the COVID-19 outbreak saw massive disruptions across many areas of industries. Very few businesses from the ravages of lockdown as supply chains halted to a grind, consumers limited their purchases to essentials, and governments closed economies in a desperate bid to stop the spread of the pandemic.

Expansion and growth strategies were quickly replaced with survival, almost guerrilla, tactics in a bid to stay afloat. CFOs and financial planning & analysis teams focused on developing multiple “what if” scenarios with a view towards recovery.

As one CFO told FutureCFO, attention is now towards developing workable recovery scenarios. But even these scenarios need to be fluid to reflect the uncertainty of the times.

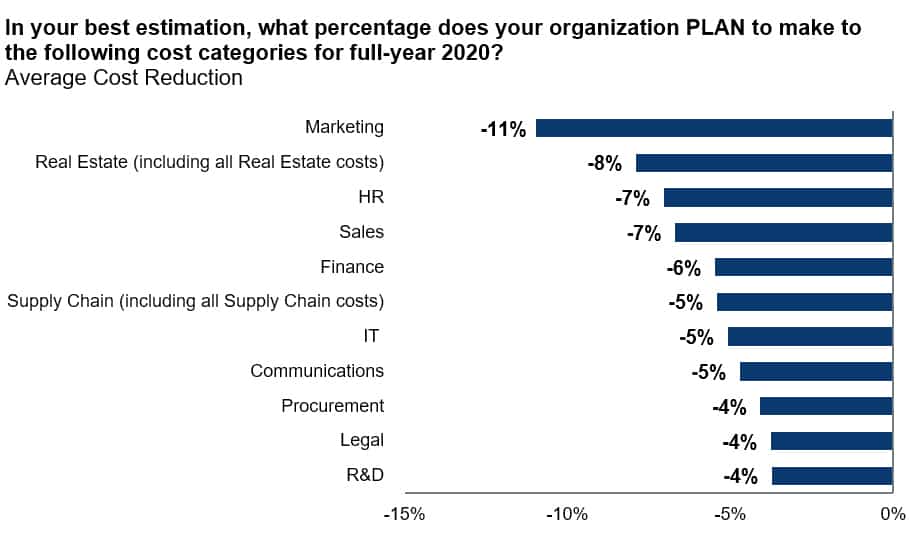

With the latest Gartner CFO surveys revealing expanded cost-cutting measures in 2020 (see Figure 1), FutureCFO spoke to Tony Lee, head of Finance Transformation, IBM Services ASEAN, to discuss arguably one of the most critically looked and discussed areas of finance – working capital and how to optimise capital during and after COVID-19.

Click on the audio stream and listen to the Lee cover the following questions:

- What is working capital optimisation?

- How has it changed as a result of COVID-19?

- What are the top 3 misconception about capital optimisation?

- Name the most common pitfall people/companies make when it comes to capital optimisation?

- What would you recommend organisations do to establish a strategic approach to capital management, to optimizing cash flows during uncertain times?

- Post COVID-19, do you expect a return to business-as-usual when it comes to capital management?

If you found the topic interesting, we invite you to submit your ideas on topics you’d like us to cover on the next episode of PodChats for FutureCFO. Please email us at editors@cxociety.com.