Without a doubt, artificial intelligence (AI) is now a topic of interest among CFOs. How to properly channel this interest into the finance function remains to be seen.

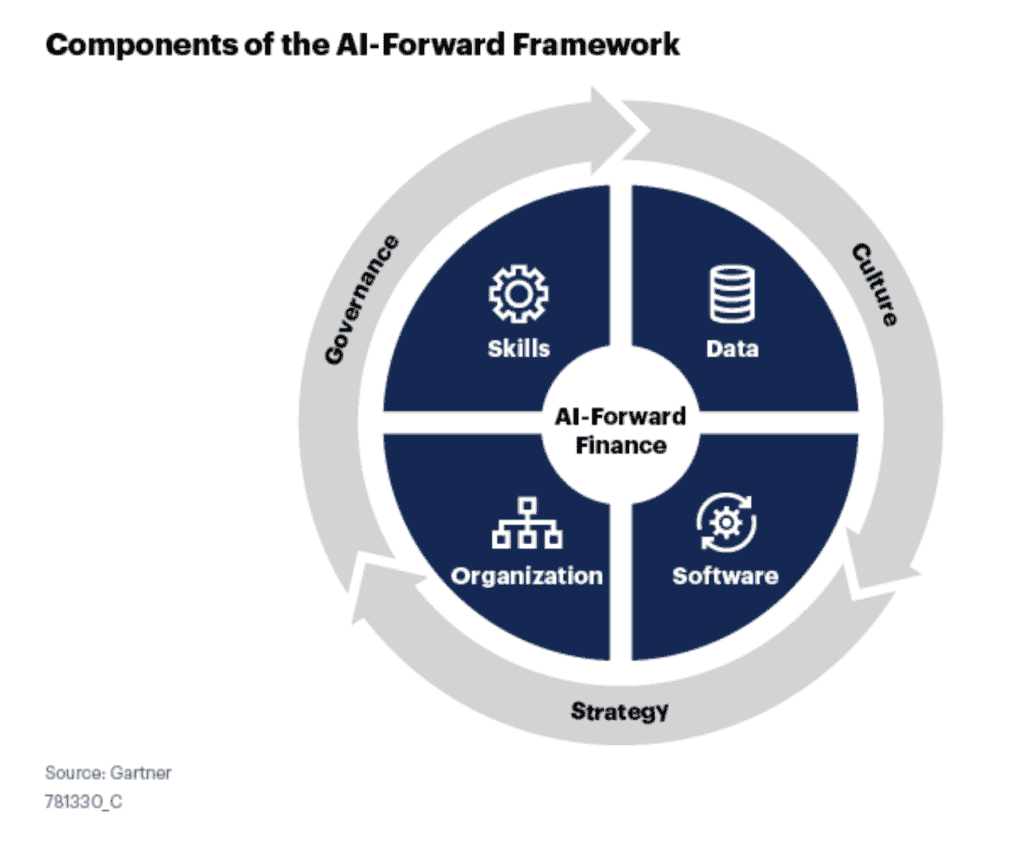

Gartner says to build an AI-driven finance organisation for the future will require a combination of technical and business skills that many finance teams do not have today.

Mark D McDonald, a senior director analyst in the Gartner Finance practice, observes that there remains scepticism over AI's impact on the finance function in general, particularly on the CFO.

"CFOs think AI is overpromised. There is this interest to see the technology when it has matured," he started out. He concedes that "there are others who are excited over the technology and are willing to invest with the expectation of seeing some outcome in the next few months."

Both extremes, according to McDonald are realistic. The one certainty is that AI can be applied to areas where automation is possible.

"AI and machine learning can emulate certain tasks that we thought only people can do. We've got machines that now can start making decisions. They can start looking at things and using data, they can emulate the human decision-making process," he added.

Pointing out that these machines are (software) algorithms, he believes these can handle many of the complexities that humans have been struggling with in finance. That said, he is adamant that these machines will not completely replace humans in the finance teams.

Embrace AI today – proceed with realistic expectations

Acknowledging that the technology is relatively young, he nonetheless believes that finance professionals should not have to wait for the technology to mature. "We can spend the next 10 years working on bringing this into our function before we catch up to the technology," he opined.

While McDonald agreed to proceed with caution in the adoption journey, it is suggested that time be spent "to think about how we're doing this for absolute certain," he started. More than caution, he suggested proceeding with a realistic expectation reminding us that finance is a little different from other functions in the enterprise. "We (finance) have the unique responsibility in our business to validate the integrity," he added.

Using financial statements as an example, he posited that: "We can't build an algorithmic-driven process that does this for us. This is our task to do. We have to build these algorithms in such a way that they help us to do that task," he continued.

He believed that leading finance teams will learn to position AI-driven tools and solutions as co-workers that help them do their jobs better. "Using AI as a co-worker instead of a replacement also ensures that finance leaders avoid delegating responsibility to machines that should be owned by a person,” he added.

He cautioned that finance needs to make sure that the financial responsibilities are not passed over to algorithms.

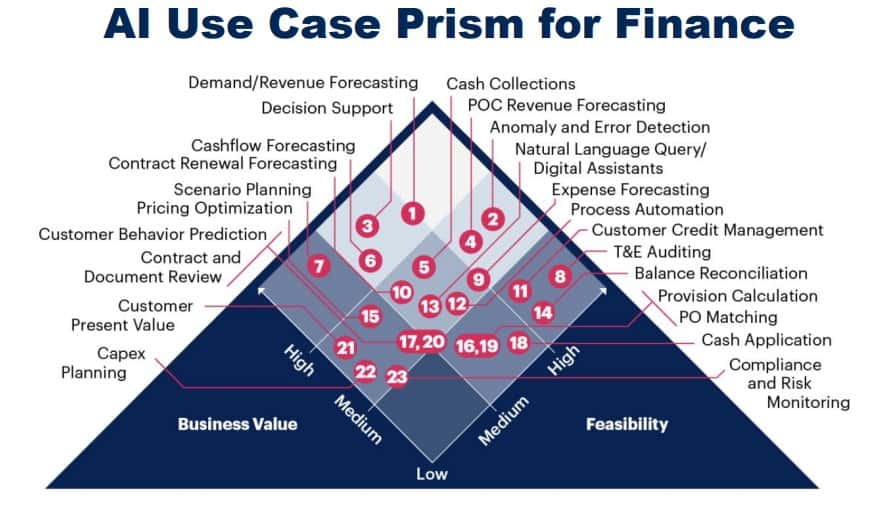

How to leverage AI today

“Just like any disruptive technology throughout history, AI will inevitably displace and replace some roles and skills, but new roles, skills, and opportunities will also emerge," said McDonald.

He advocates leveraging AI to take advantage of what it does best – automating manual tasks. At the same time, he suggests being cautious about allowing machines to take action based on their advice.

"By leveraging the strengths of both people and their new machine counterparts, organisations can reach new levels of productivity and value without big risks," he added.

Click on the PodChat player and listen to McDonald share his perspective on AI as used in the finance function.

- What do finance professionals think AI can do for them?

- Should they embrace AI with caution?

- What are the long-term implications of AI for the finance function?

- Gartner expects future finance teams to look more like software development organisations. Why is that?

- [AI-generation workforce]

- How should the CIO and traditional development respond to this?

- What is Gartner's recommendation regarding how the CFO and finance team approach the adoption of AI into the function? Where do they start?

- Will AI-driven finance lead to an autonomous finance function?

- For finance teams that have adopted RPA, what knowledge/understanding should they carry forward when leveraging AI?

- What is your advice for CFOs to best leverage AI for the finance team?