FutureCFO Conferences across the key markets of Indonesia, Malaysia, Singapore, the Philippines, and Thailand, reveal that the finance function is evolving from one that focuses purely on crunching numbers and reporting how well (or not) the company is performing, but to the point where finance leaders are expected to be advisors – providing guidance on where the business is strong, weak and potentially where the opportunities lie for the industry.

Tools to aid the finance function have also evolved from simple pencil-and-paper accounting to today, when finance can call on data analytics, automation, and even artificial intelligence, alongside the old but much-used (and abused) spreadsheets.

But while traditional automation and GenAI are making inroads in 2025, Southeast Asian CFOs face persistent efficiency challenges demanding more sophisticated solutions. Despite years of digital transformation, Southeast Asian finance teams remain trapped in manual, error-prone workflows.

Persistent efficiency gap

"They haven't changed much, to be honest, compared to previous years as well," says Nikhil Parambath, regional vice president for Asia at BlackLine. "We still see a lot of bottlenecks on the month-end close process… especially when it comes to intercompany reconciliations."

Add to that the region's "sheer complexity of dealing with multiple currencies, different regulatory frameworks, and different ERP systems," and you have what Parambath calls "the perfect recipe" for inefficiency.

While robotic process automation (RPA) and generative AI have delivered incremental improvements in 2025, they have yet to solve systemic challenges. Many finance leaders report that automation has yet to meaningfully shift their teams from transactional work to strategic insight—a gap that agentic AI now promises to close.

Beyond automation: the rise of autonomous finance agents

Unlike RPA, which "struggles with complex intercompany eliminations that require interpretation of various transaction types," agentic AI can reason, plan, and act across multi-step workflows. As Parambath explains: "RPA is very effective in automating rule-based, repetitive tasks… but taking that across a process becomes a bit of a challenge, especially in a very disparate, siloed environment."

Agentic AI changes the game. "Think about an AI that will automate the entire reconciliation process—from matching underlying transactions across multiple systems to identifying and resolving discrepancies," Parambath says.

It can even "detect anomalies and take corrective action… with literally zero human intervention." In Southeast Asia's fragmented invoice-to-cash landscape—where "every customer has a different format"—this autonomy is transformative.

The three pillars of readiness

Yet success isn't guaranteed. "AI functions on only one thing: data," Parambath stresses. "For it to function very well, it needs good quality data."

In a region rife with data silos and legacy ERPs, foundational readiness is non-negotiable. CFOs must first establish "a unified data governance framework… which helps eliminate these data silos and defines ownership."

Equally critical is rethinking controls. As agentic AI assumes end-to-end process ownership, "controls will shift from being manual to algorithmic," Parambath notes.

Finance leaders must now audit not just outcomes, but reasoning: "Why did AI take this particular decision? How did AI come up with this particular outcome?" Robust, explainable audit trails are essential to satisfy regulators, auditors, and internal stakeholders.

And while AI executes, humans remain accountable. "There has to be what we call a human in the loop for exceptions," Parambath insists. "To date, we haven't got a regulatory framework where AI can be held accountable. It is still us as human beings that will be held accountable."

Strategic reorientation, not just speed

The ultimate promise of agentic AI lies in elevating finance's strategic role. "Every single technology… was one step towards [making finance] a strategic business partner," says Parambath. "Agentic AI might actually be the single biggest change that we've seen to make this a reality."

With transactional work automated, finance professionals can focus on data-driven insights, scenario planning, and cross-functional collaboration. "Finance is in the best position… to provide very strategic decision-making inputs," Parambath observes. But this shift demands new skills.

"The single biggest thing… is that everybody needs to have a fundamental understanding of data analytics. That has to be the underpinning criterion for future literacy. Do I understand the basic concepts of data analytics? That's one." Nikhil Parambath

The road ahead: Balance, not hype

Adoption remains cautious. While interest in agentic AI is growing among Southeast Asian CFOs, most are still in exploratory or pilot phases. Parambath urges pragmatism: "We've got to balance… aggressive AI adoption and governance."

Integration need not mean rip-and-replace; solutions like BlackLine, he notes, offer "seamless integration through APIs" or data lakes that "leave legacy systems untouched."

His final advice to CFOs heading into 2026? "Balance strategic imperatives with foundational readiness… figure out where you automate versus where you augment… and invest in people." Because, as he puts it, "It's not easy for someone who's keying in transactions to become a business partner suddenly. But we need to start upskilling our people—because it's not optional anymore."

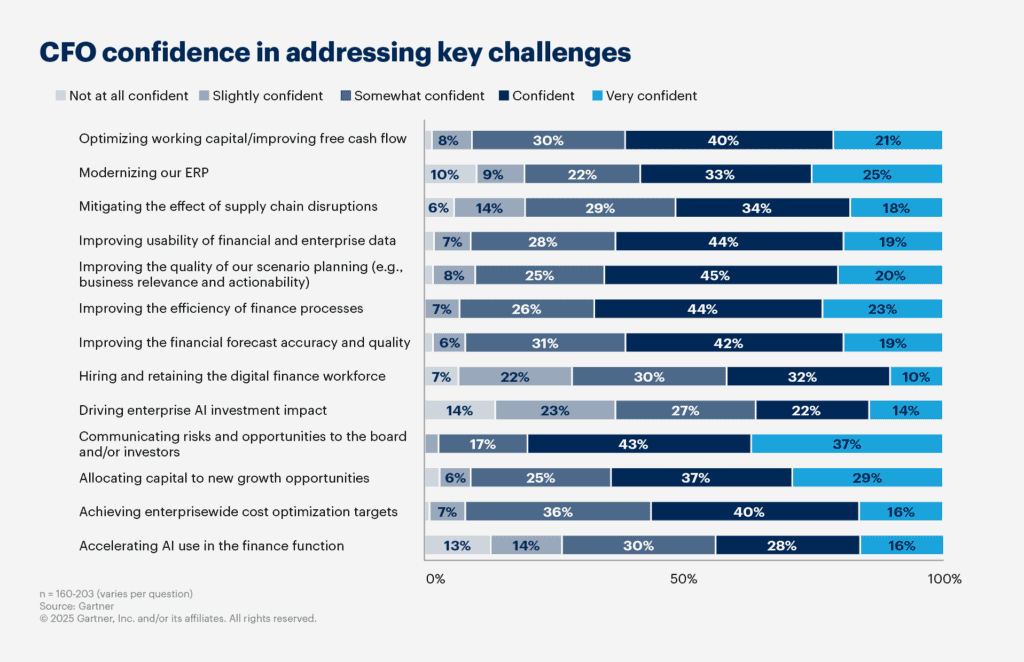

Gartner opines that despite increased investment in AI and digital transformation, CFOs lack confidence in these initiatives' ability to deliver real enterprise impact. Only 36% feel assured they can achieve meaningful AI outcomes, and just 44% believe they can accelerate AI adoption across the finance function. Plus, only 42% express confidence in hiring and retaining digital finance talent. This uncertainty threatens future financial performance.

Gartner recommends a dual-path strategy: CFOs should leverage embedded AI within vendor software for immediate gains, while building the culture, governance, skills and data capabilities required for sustained value.

Finance transformation must align with digital talent strategies, supported by clear targets and agile management.

Click on the PodChats player to hear Parambath's perspective on "Finance Efficiency: Is Agentic AI the Answer"

- Which specific finance processes (e.g., closing, reconciliation, reporting, compliance) still represent the most significant bottlenecks to efficiency and strategic agility within the finance function in Asia in 2025?

- Where have traditional automation tools (like RPA) fallen short in delivering the transformative efficiency gains finance needs, particularly in our complex, diverse SEA operating environments?

- From your observation, how would you assess finance leaders in Southeast Asia in terms of their understanding of AI, Generative AI and Agentic AI (framed in the context of 2025)?

- For SEA finance leaders prioritising efficiency in 2026, what are the 1-2 most compelling, near-term practical applications of Agentic AI within core finance operations (e.g., dynamic forecasting, intelligent reconciliation, autonomous fraud detection)?

- What foundational data governance and integration challenges must SEA finance functions urgently address now to be ready to leverage this technology effectively in 2026?

- As AI agents potentially execute multi-step processes autonomously, how should finance leaders rethink internal controls, audit trails, and human oversight mechanisms to ensure accuracy, compliance, and ethical operation?

- How can Agentic AI agents be practically integrated with existing ERP systems, legacy platforms, and other best-of-breed finance applications commonly used across SEA businesses without creating untenable complexity or risk?

- If Agentic AI takes over complex operational execution, how must the skillset and role of the finance professional evolve in 2026? What does "strategic business partnering" look like in this context, and how do we upskill our SEA teams?

- Traditional cost savings aside, what new metrics should CFOs use to evaluate the actual efficiency and strategic value delivered by Agentic AI implementations within the finance function in 2026 (e.g., speed to insight, reduction in manual intervention points, improved forecast accuracy)?

- Finally, any recommendations on how SEA finance leaders should strike the optimal balance for 2026 and beyond?