The pandemic separates the readiest innovators from the rest, said BCG recently when releasing its report titled Most Innovative Companies 2021: Overcoming the Innovation Readiness Gap.

Pharma companies performed strongly this year, joining technology and software companies that have dominated the rankings in recent years, according to the report.

The survey — on which the report is based — also identified strong regional variations in the innovation readiness of companies, with China and the US in the lead, BCG pointed out.

Only about 20% of companies globally have built high-performing innovation systems that can transform ambitious aspirations into real results, survey results indicate.

In additions, some industries show big gaps in innovation readiness.

Companies that are both committed (they back priorities with investment) and ready (they have the necessary platforms and practices in place) are up to four times as likely as those that aren’t to outperform their peers in terms of revenues from new products, services, and business models, BCG noted.

17 companies enter the top 50

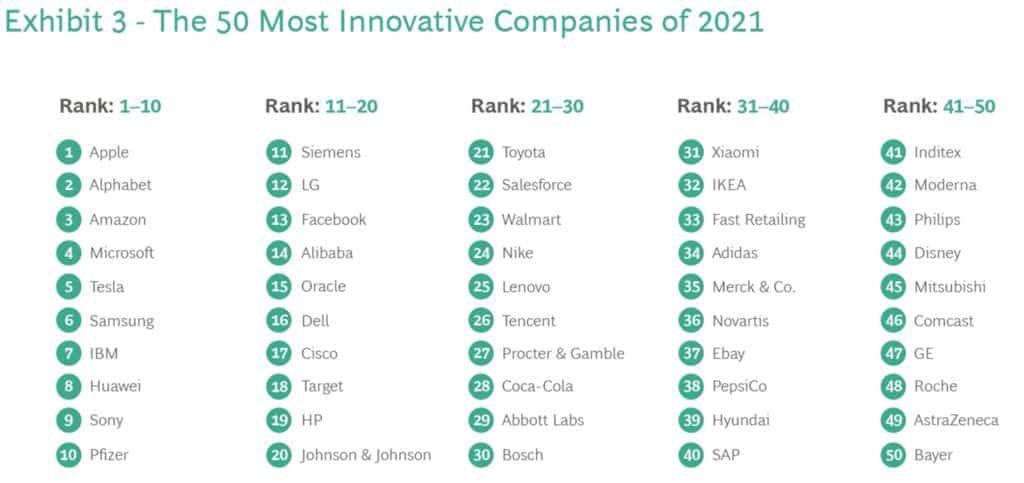

This year’s ranking of the 50 most innovative companies underscores the power of commitment and readiness, BCG said.

In addition to 33 holdovers from last year, the 2021 list includes 12 companies that have returned to the top 50 after an absence of at least one year, and five firms that are new to the list.

While technology and software companies continue to dominate, this year’s ranking saw a breakout performance by pharma, with nine companies ranked (three times the number in 2020), a third of them making their first appearance there, according to the report.

Differences in readiness also show up in performance, as demonstrated by the shareholder returns that members of BCG’s previous 50 most innovative companies rankings have generated, the firm observed.

“The pre-pandemic top 50 from 2020 have outperformed the MSCI World Index by a staggering 17 percentage points in the past year; and even if you remove the high-flying tech giants, top innovators still beat the index by 13 percentage points, demonstrating that investment in innovation delivers short-term as well as longer-term benefits, particularly in a time of crisis,” said Konstantinos Apostolatos, BCG managing director and senior partner and a coauthor of the report.

Overcoming the readiness gap is essential

This year’s research reveals a worrisome readiness gap, said BCG.

On the positive side, 75% of companies identify innovation as a top-three priority (up 10% from 2020—the largest year-over-year increase in the 15 year history of the report), and 60% plan to increase their investment in innovation, with one-third of those planning to boost spending by more than 10%, the firm noted.

But 80% of companies fall short of BCG’s innovation readiness benchmark across multiple dimensions of their innovation systems, the firm added.

BCG suggests that attention to two areas can help bridge the gap: C-suite engagement and stronger bonds between product and sales teams.

The firm said its data shows that among companies that outperform their peers on innovation outcomes (as measured by the share of sales from new products and services), close to 90% demonstrate clear C-suite-level ownership, compared with only 20% of underperformers.

Meanwhile, almost a third of companies in the 2021 survey cited less-than-optimal collaboration between their R&D and sales teams as their biggest barrier to higher innovation output, BCG noted.