Organisations are well on their way to maturing their approach to automation, adopting it in various areas of finance.

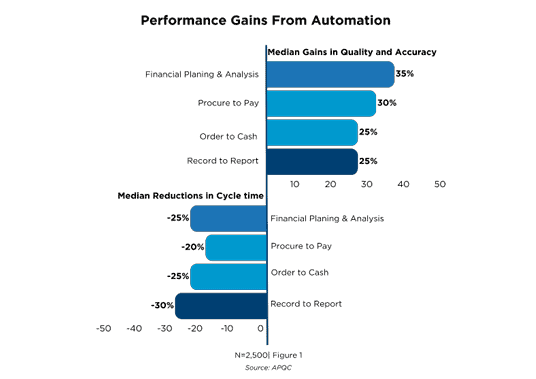

According to a research by non-profit research organisation APQC, organisations are further gearing towards automating FP&A and end-to-end processes such as order-to-cash.

The study, which polled 2,500 finance leaders found that automation can drive significant performance improvements for key finance processes, from reducing cycle times and costs to improving forecast accuracy--proving that finance process automation is no longer a 'gamble'.

According to APQC, top performers in their research see an ROI of 55% or higher from their use of finance automation.

However, finance teams are not bound to get this, along with other key benefits, overnight as many organisations will need to address longstanding challenges like data quality, skills shortages, and obsolete infrastructure on the road to automation maturity.

The research revealed that companies eye the following in their continuous journey to finance automation:

- Considering automation (the lowest level of maturity)

- Evaluating

- Piloting

- Implementing

- Operating

- Operating at scale and optimising (the highest level of maturity)

APQC says most organisations today are well beyond exploratory phases of automation like evaluating and even piloting, citing that the following areas of finance have at least implemented automation:

- Order-to-cash (O2C): 65% of respondents

- Record-to-report (R2R): 66%

- FP&A: 53%

- Procure-to-pay (P2P): 53%

Furthermore, APQC highlights that organisations that put in the hard work to grow and mature their use of automation often achieve significant benefits as a result.

Automation tools like robotic process automation (RPA) and bots can carry out work with fewer errors and a higher degree of accuracy than humans. These benefits are of critical strategic importance to FP&A, which has long struggled with challenges related to forecast accuracy.