India should cut public debt instead of boosting the economy with fiscal stimulus, said IMF recently.

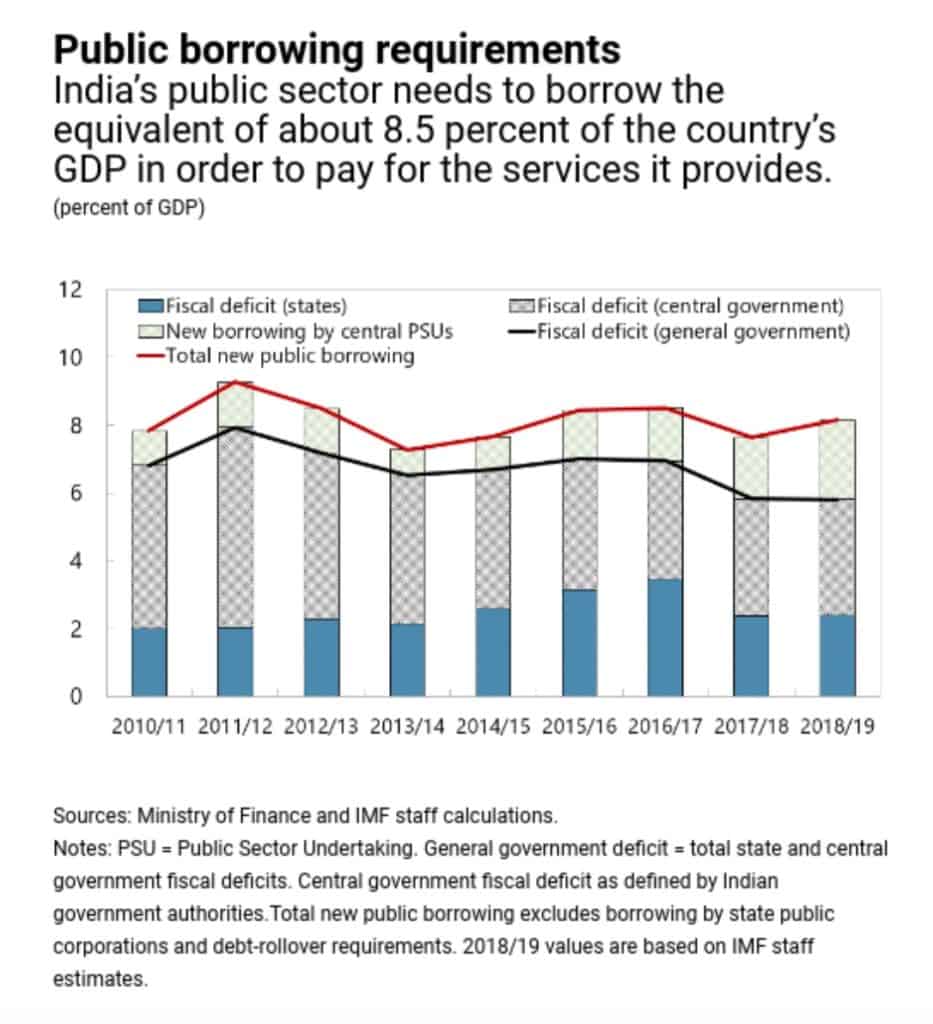

The IMF estimated that India’s public sector borrowing requirement has increased to around 8.5% of its GDP. The country has a budget deficit target of 3.3% of GDP in the year through March.

The Indian government needs a credible consolidation path to rein in debt, including reducing subsidies and boosting the tax base, while additional monetary policy easing may be warranted to support the economy in its downturn, The lender said in a recent statement.

IMF Chief Economist Gita Gopinath said earlier this month that the organisation will likely cut India’s growth forecast of 6.1% for the fiscal year through March.

The country’s central bank has an estimated growth of 5% in the period while Moody's expects GDP growth to slow to 6.6% in 2020.

Moody’s said that India has limited prospects for government stimulus measures to improve credit conditions in the near term. .

According to the credit rating agency, credit conditions will weaken for most Indian non-financial companies in 2020, driven by sluggish economic growth and slowing earnings, but that infrastructure issuers' credit quality will remain stable.

"Rated companies' credit profiles are unlikely to improve significantly over 2020-2021, due to elevated debt levels, weakening profitability and the continued economic slowdown, which is pressuring both investment and consumption," said Kaustubh Chaubal, a Moody's VP and senior credit officer.

The IMF estimates that general government debt hit a three-year high of 68.1% of GDP in fiscal 2019, recommending that India adopts measures to reduce this to the officially adopted target of 60% of GDP.

In addition, IMF advised India to maintain an easing bias in terms of monetary policy. The country’s central bank cut its benchmark rate five times this year.