Rishi Mehra, financial controller Asia-Pacific at AON, observed that the amount of data organisations have created is huge. “We are applying artificial intelligence, machine learning, big data, to mine the data and make commercial use of it.”

The finance function of the digital economy is more than just a number cruncher. There is increased recognition that given the right set of tools and armed with real-time data, finance has the capability to initiate and lead transformative change to the whole organisation.

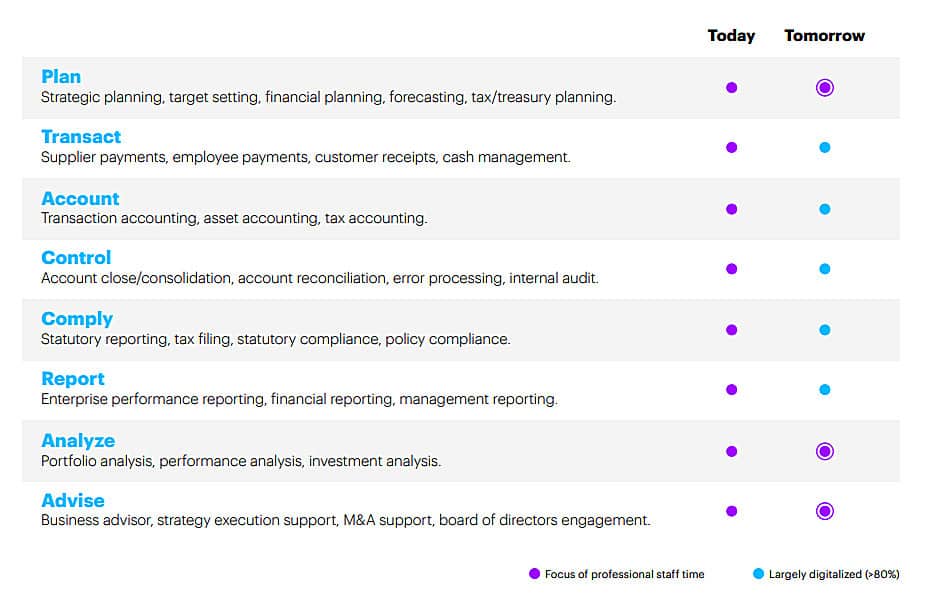

Figure 1: The changing role of the CFO and Finance

Source: The CFO Reimagined, Accenture 2019

At the helm of this change is the chief finance officer. Calling CFOs as digital guardians who can use data to drive value, improve efficiency and enable strategy, Accenture says the CFO can serve as both innovator and disruptor in their business.

This data empowerment has multiple implications for the CFO, finance and the business.

On the one hand, the automation of finance turns the function into a value creator with the capability to shape strategy.

“The data capabilities CFOs develop can help them make decisions about investing in digital and technology across the enterprise, which in turn empowers them to generate and combine even more useful data,” said Accenture.

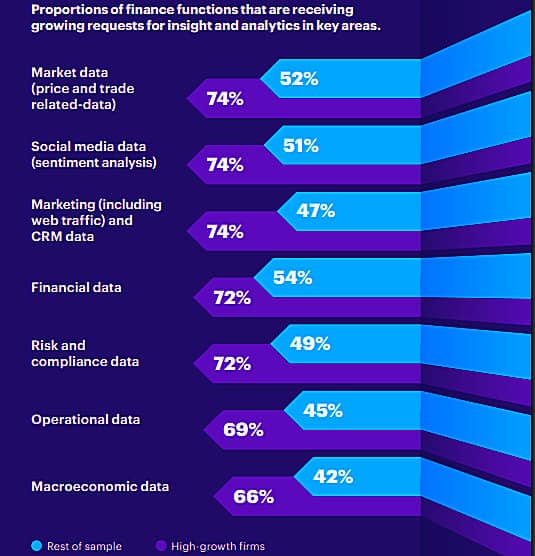

Figure 2: Comparison of data requests directed at Finance/CFO

Source: The CFO Reimagined, Accenture 2019

The consultant says the CFO’s role is evolving in part because of the data-volume explosion, requiring both focus and new capabilities.

To address this data-volume explosion, FutureCFO spoke to Mark Micallef, Cloudera vice president for Asia-Pacific and Japan, on what the industry has termed big data and how it is impacting the finance function as well as the CFO.

Describe the growth of Big Data in Asia.

Mark Micallef: There is indeed a strong appetite for big data growth in Asia. More and more enterprises are using data and analytics to fuel innovation or in fact, to accelerate innovation. There was a recent study done by IDC in fact that estimated the market size for this area will grow to about US$27 billion by 2022.

Also, Gartner had released a survey recently, talking to enterprise customers, which also is fuelling some of this growth around just the adoption of hybrid cloud and customers moving to hybrid architecture over time.

How should a CFO query or respond to a proposal to do big data?

Mark Micallef: There are two fundamental areas where a CFO would be interested in investing in our platform or technology of this nature.

One is around growing revenues, growing the top line and that's at the heart of every CFO, in terms of how to grow the business. Whether you live across FSI, telco, manufacturing, they use technology to understand customers more intimately - understand their buying behaviour, in the event to be able to cross-sell and upsell new products and services.

Another simple example could be in a large telco who is looking at customer retention or looking at customer lifetime value, looking at ways to reduce churn and a 1% variance – churn could mean tens of millions of dollars to a CFO in a telco.

The other big areas around risk, to be more specific – many of our customers are using this technology for financial crime to prevent money laundering, for example.

And two very good examples of that would be UOB. UOB is a customer of ours who uses our technology to prevent money laundering. And in that case, it's like finding the needle in the haystack. And so, their outcome from investing in this technology was that they went from three months down to three weeks in finding these anomalies. That's a real business impact. That's an impact of the CFO and all stakeholders in terms of executives because you're reducing risk protecting customers, of course, which is very important to them.

The other one would be Bank Rakyat Indonesia. They are storing five years of historical data on our platform, and they use these five years of historical data to cross-sell and upsell new products and services.