In 2025, Gartner says chief financial officers (CFOs) are expected to continue to lead transformation to improve the finance function, driving enterprise profitably into an AI-enabled future.

However, in the road to success, CFOs are faced with mounting risks stemming from AI, global conflicts, climate change, cyberthreats, elections and new regulatory pressures which add complexity to planning and uncertainty to decisions.

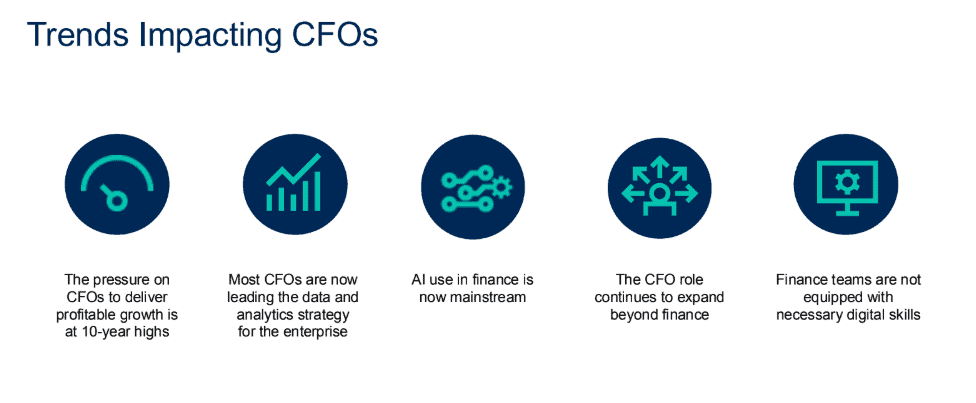

Add on to these are other trends that impact CFOs and their decision-making process: the pressure to deliver profitable growth, data and analytics strategies, AI use, expansions beyond finance, and the need for finance teams to be equipped with necessary digital skills.

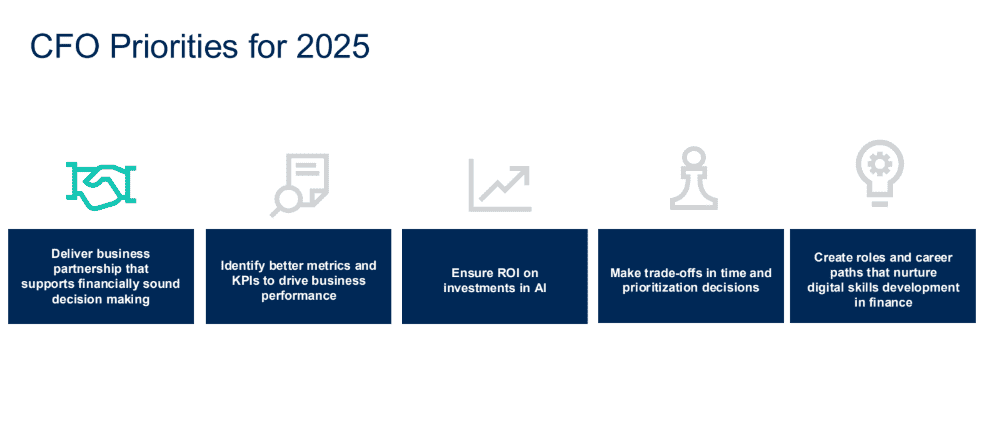

In this context, Gartner says the top CFO focus areas for 2025 revolve around delivering profitable, efficient growth through finance business partnership; driving a better enterprise data and analytics strategy; ensuring ROI with the use of AI in finance; managing the continued expansion of the CFO role; and accelerating the finance team’s digital skills

According to Gartner's 2024 CEO and Business Executive Survey, 69% of CFOs say it will be difficult or extremely difficult to reduce costs without negatively impacting performance, as CFOs must meet CEO expectations for top-line growth while also creating capacity to fund new investments in technology and the workforce.

Gartner says one of the biggest threats to delivering profitable growth are the suboptimal operating and management decisions that are made day to day without a dedicated finance business partner to “be at the table” to support them.

These unsound decisions erode, on average, about 3% of EBITDA and can undercut an otherwise profitable growth trajectory if finance cannot provide better support.

To work on delivering business partnership that supports financially sound decision-making, Gartner recommends that CFOs scale up partnerships to support efficient growth.