A September 2021 survey of 251 CFOs and other finance leaders revealed that 47% intend to assess digital currencies for business in 2022, said Gartner recently.

A February poll centred on bitcoin adoption indicated that 84% of finance leaders said they would never hold bitcoin as a corporate asset and pointed to a range of risks associated with holding the currency, Gartner noted.

“Sentiment towards digital currencies appears to be improving among finance leaders,” said Alexander Bant, Chief of Research in the Gartner Finance practice. “As digital currencies mature and successful use cases materialise, finance leaders are looking at what their competitors are doing and whether it can be applied to their own organisations.”

Among CFOs, sentiment was slightly more favourable, with 50% saying they intended to assess the risks and opportunities of digital currencies for their organisations next year.

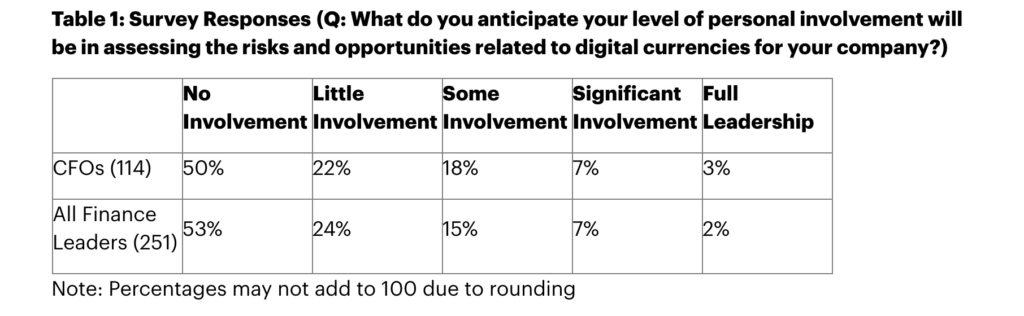

“While the actual adoption in most corporate settings may not happen right away, it’s clear that digital currencies are beginning to make finance leaders sit up and notice,” said Bant. “But interest remains tentative at this stage with around a quarter of respondents expecting their personal involvement to be quite limited and only a few percent expecting to take full leadership of digital currency initiatives.”

From the February polling data, the most noted risk was the volatility of digital currencies, and this is likely to remain a key concern as finance executives assess their merits next year, the advisory firm pointed out.

“That equation could be altered by increased CFO concerns around inflation in more traditional currencies,” said Bant. “Some digital currencies may be seen as a viable hedge in an inflationary environment, and that in turn might lead many to consider taking payment in digital form especially considering the SEC said recently it won’t ban them as China has done.”

Bant also pointed to other potential long-term future benefits such as reduced fraud risk, improved ESG accountability, real-time transparent reporting and fast more accurate audits.

Blockchain

While digital currencies and blockchain are often incorrectly conflated as the same thing, Gartner advises that blockchain may be useful for organizations even when digital currencies are not.

Blockchain is a digital ledger in which each cryptographically signed record contains a timestamp and reference links to previous transactions. The records on a blockchain ledger are irrevocable and are shared by all participants in a network.

“While adoption of digital currencies based on blockchain might not happen in the near future for many organisations, it’s perhaps easier to see how business blockchains shared between organisations can provide CFOs opportunities to lower operational costs and drive efficiencies,” said Bant.

According to Gartner, examples of areas where business blockchains could drive such improvements include:

Reduce transactional finance costs. Streamline flows of payments to and from customers and suppliers (order-to-cash and procure-to-pay).

Reduce payroll costs. Employees over time may request compensation in bitcoin. Compensation payments to employees may become more seamless.

Reduce legal costs. Smart contracts could automate payments once an obligation is fulfilled, including providing legal proof of deed or rights.

Audit supply chain. Manage complex, fragmented, distributed supply chains across organisational and geographic boundaries, especially for fraud prevention. Verify the veracity of the origin and path of product components.

Manage physical or digital Assets. Permissioning, access and identity verification related to control of physical or digital assets.

Record internal transactions. Help large complex organizations reconcile multiple databases intracompany and track cross-charges, providing a single source of truth.

Reduce audit costs. Used as an automated and standardised way of audit, which can minimise and mitigate the chances of any biases affecting the audit’s outcome.