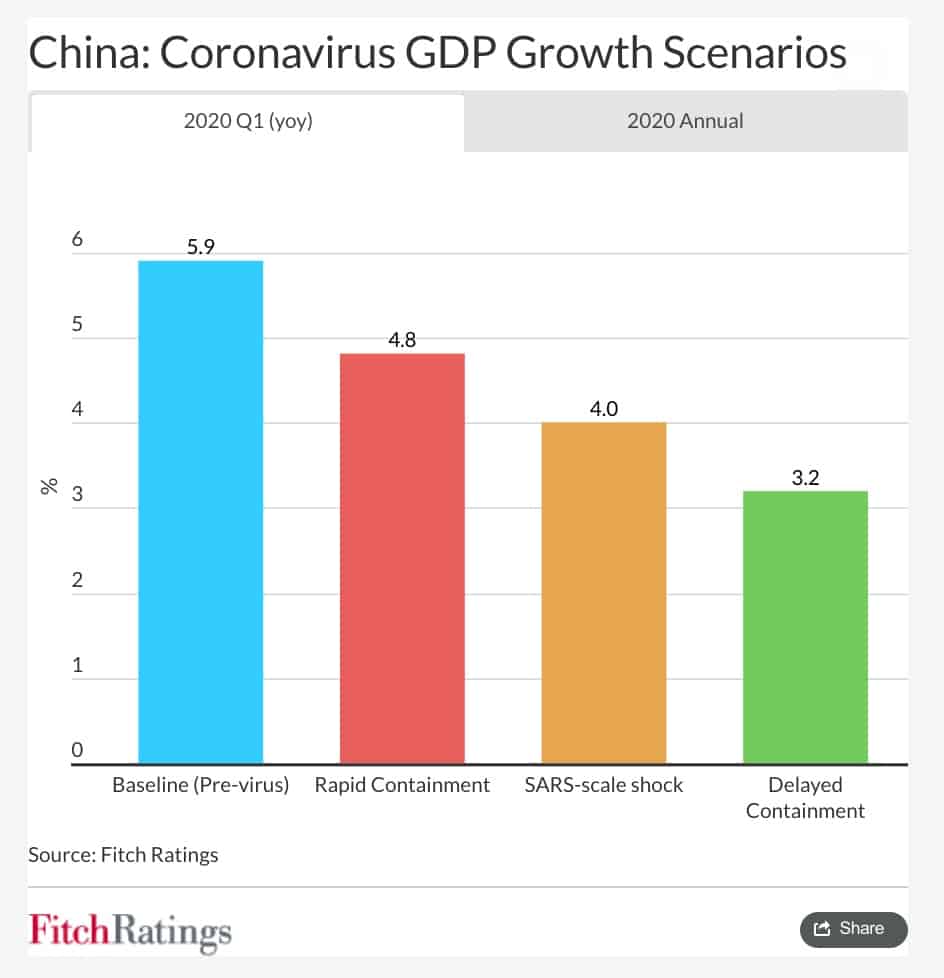

While huge uncertainties remain over the impact of the coronavirus on China's economy, Fitch Ratings has come up with two major scenarios for estimation.

According to the rating agency, only 2.2 percentage points would be knocked of the country’s growth in 2020 in a scenario where the virus peaks soon and starts to be contained around the end of February.

In this case, the impact would be the smallest, Fitch noted.

A more adverse scenario

If the epidemic is not contained until well into the second quarter, growth could fall more steeply, said the company.

GDP growth in Q1 could be closer to 3%, according to Fitch.

This more adverse scenario would, however, be likely to prompt a more assertive policy-easing response that would boost growth in the second half, cushioning the impact of the shock to annual economic growth, possibly leaving annual growth above 5%, the company estimated.

If the government were to substantially ease credit policy to support the economy, this could impede or delay its efforts to reduce risks in the financial sector, Fitch added.

“However, we believe that this would only be likely if the outbreak were to extend into Q2 2020. Fitch believes the authorities have more room to ease fiscal policy, but a substantial easing of credit policy could put downward pressure on China's sovereign rating, which we affirmed at 'A+/Stable' in December 2019,” the rating agency said in a statement.