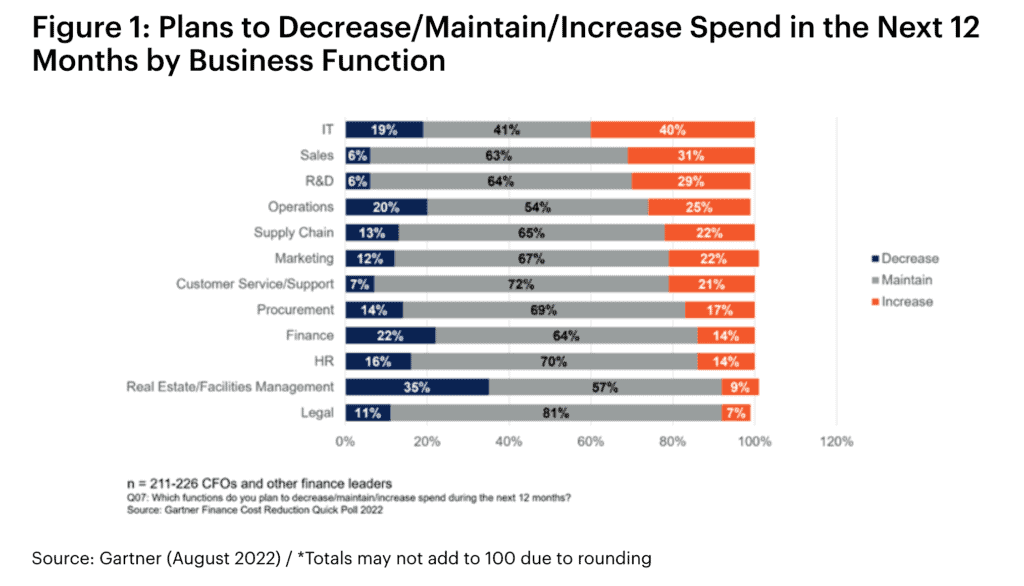

Budget cuts for real estate/facilities management and finance functions are the most likely in the next 12 months, said Gartner when releasing results of a July 2022 survey of more than 200 CFOs and finance leaders.

IT and sales, on the contrary, are the most likely to get budget increases, the advisory firm noted.

“Given that 72% of CFOs want to trim their organisation’s real estate footprint by the end of 2022, it’s to be expected that facilities management is looking at budget cuts,” said Marko Horvat, vice president, research in the Gartner Finance practice.

This makes sense for many organisations where a large share of employees is working from home at least part of the time, he noted.

However, it’s also interesting to note the 9% of companies that are differentiating by increasing their real estate spending in the next 12 months, he added.

Tech as a smart long-term bet

IT is the most popular function for increasing spending with 40% planning increases in the next 12 months, according to Gartner.

“This sentiment is holding steady from a similar survey in May 2022 when 46% of CFO respondents said they planned to scale up enterprise digital initiatives in the next two years,” Horvat said.

CFOs see digital technology as a smart long-term bet, but it’s also a critical part of their plan to tackle the effects of rising inflation on corporate margins, said Horvat.

“Nearly a quarter of CFOs think greater automation will help to combat inflation, and this aligns with CEOs who are even more bullish on tech with 85% planning to increase spend over last year,” he pointed out.

Sales and R&D are the second and third most likely functions to see increases in the next year with 31% and 29% of respondents planning increases, according to the research firm.

“The investment in sales and R&D shows that companies are not abandoning their growth bets at the current time, and they are turning to two functions to drive growth in difficult conditions,” said Horvat.

This is broadly consistent with our surveys through May and June where CFOs and CEOs selected these areas as being the most likely to protect from cuts, he added.

Gartner experts noted that “efficient growth” companies — those which used spending to differentiate themselves from competitors during times of economic difficulty, rather than relying on cuts — tended to achieve better sustained growth and margin improvements in the long term.