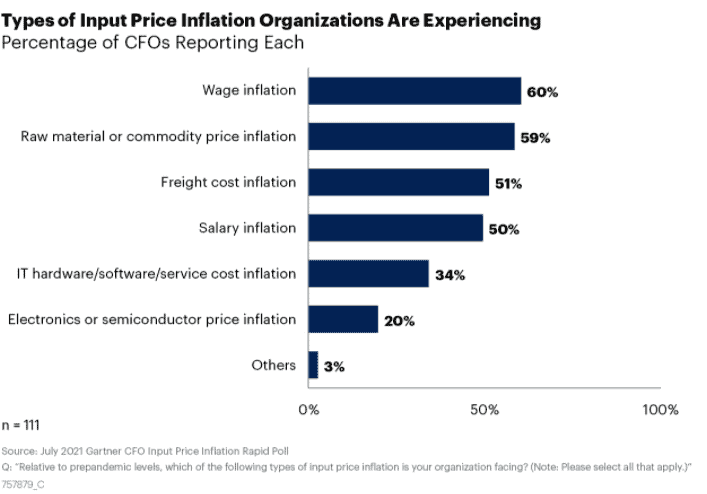

A global survey of 111 CFOs from different industries in July revealed that 60% of organisations experienced wage inflation in 2Q21, nearly double the amount compared to the previous quarter, said Gartner recently.

Nearly three in four CFOs polled cited the risk of lower profitability as their top concern as organisations face broad-based input price inflation increases, ranging from salaries and wages to higher costs for commodities and freight shipping, the advisory firm noted.

“Most CFOs today have not experienced this level of sustained and broad-based input price inflation,” said Randeep Rathindran, vice president, research, in the Gartner Finance practice. “The risks are doing too little and taking a hit to profitability, or if inflation turns out to be transitory, overcorrecting by excessively raising prices or wages.”

While wages ranked at the top of input price inflation, raw materials and commodities (59%), freight costs (51%) and salaries (50%) rounded out the top four types of input price inflation organisations are facing.

Pandemic cost strategies impact margins

Some of the actions executive leaders took during the early days of the pandemic have contributed to supply and service challenges that their organisations now face as demand recovers, Gartner pointed out.

Many organisations shortened their planning time horizons and carried the idea of just-in-time manufacturing too far to preserve cash flow, the firm added.

Survey data shows that 74% of CFOs are now concerned with the prospect of lower profitability because of margin pressures.

“The short-term cost cutting moves made by CFOs have created long-term challenges of their own,” said Rathindran. “Many CFOs are responding to early input price inflation by passing on costs to customers and failed to make long-term structural changes, such as investing in suppliers to increase capacity and improve costs. The result is they are now faced with eroding margins as they pay higher prices for materials and services as demand has surged.”

In addition, 61% of CFOs have responded to higher prices by passing costs on to customers, Gartner observed.

Less than a quarter of CFOs have pointed to innovation in their product lines to mitigate rising costs, while just 8% said they had made long-term capital investments in suppliers to improve capacity, the firm added.

How to manage margin pressure

Gartner recommends the following three key areas for CFOs to focus their efforts as they face margin pressures from a variety of sources.

Make more principled price-setting decisions. CFOs should avoid reflexively passing on costs to customers without first assessing whether input price inflation is transitory and if their competitors are rising prices.

CFOs need a clear understanding of their customer bases’ price sensitivity and profitability to avoid making a misstep in raising customer prices that could further erode margin profitability.

Recalibrate talent recruitment and retention. Organisations can reduce the impact of salary inflation for critical skills by tapping the “total skills market” and looking beyond traditional talent pools to include freelancers, part-time and contingent talent, including those who are self-taught and career restarters who had previously been out of the labor market.

CFOs can also approach recalibrating salaries for remote and hybrid workers who choose to relocate to a lower cost of living area.

Improve insight into supply chain dynamics. Progressive CFOs go beyond simply diversifying supply chain partners and deepen their visibility through the supply chain to better identify and alleviate bottlenecks.

In some cases, forming strategic partnerships to secure supply and making capital investments in suppliers could significantly decrease margin pressures over the longer term.