Asia Pacific sovereigns are seeing diverging reserve dynamics, said Fitch Ratings recently.

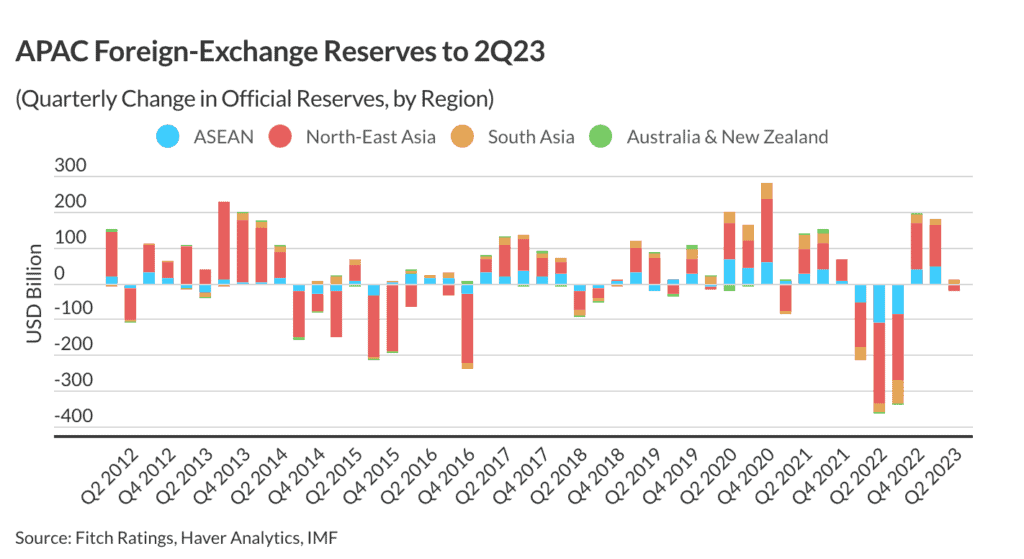

Some central banks have been able to accumulate reserves on current account improvements or investment inflows, while others still see their currencies under pressure from US Fed tightening prospects, the credit rating agency noted.

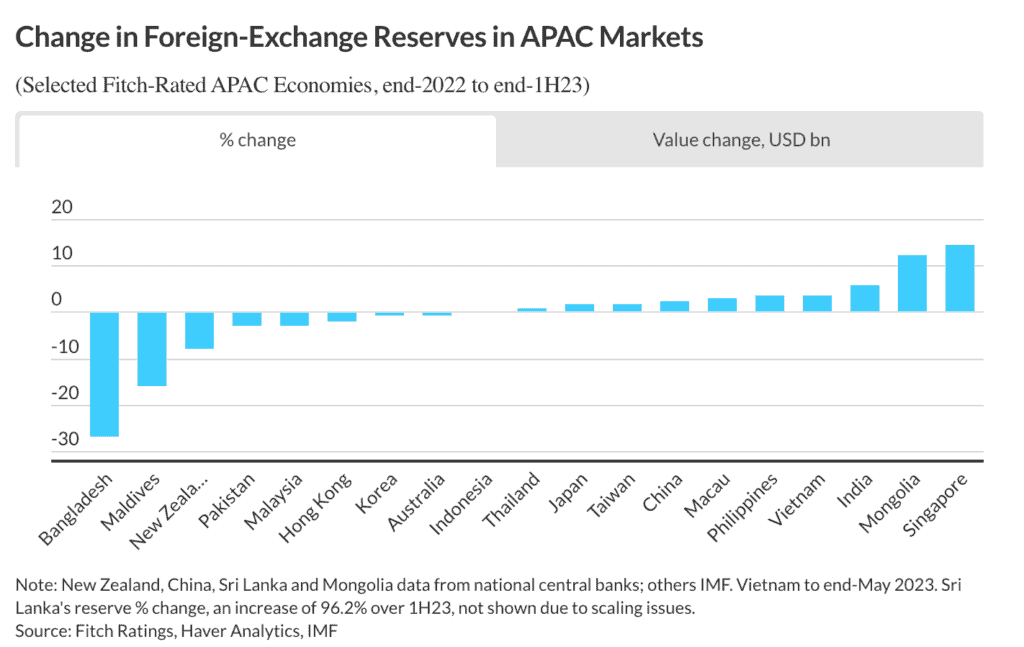

Reserves among Asia Pacific sovereigns rated by Fitch increased by almost US$170 billion in 1H23, mostly driven by growth among those with already large reserve buffers, including China (A+/Stable), Singapore (AAA/Stable), India (BBB-/Stable), Japan (A/Stable) and Taiwan (AA/Stable), Fitch pointed out.

Strong external liquidity positions support the credit profiles of these Asia Pacific sovereigns, but further reserve increases are unlikely to have much near-term influence on ratings, the firm added.

Several sovereigns in ASEAN, including Indonesia (BBB/Stable), Malaysia (BBB+/Stable), the Philippines (BBB/Stable) and Thailand (BBB+/Stable), saw reserves decline over 2Q23, which may in some cases reflect intervention to support currencies, according to Fitch.

The changes have been marginal so far, not influencing credit profiles significantly, but currency pressure may continue until the Fed finishes raising rates, Fitch observed.

Reserve dynamics may have a greater impact for frontier market sovereigns, especially where reserve coverage ratios are low and external liquidity positions fragile.

“In our most recent rating assessments, we stated that external finance factors, potentially including marked or sustained declines in foreign-exchange reserves, could be a driver of negative rating action in sovereigns such as Bangladesh (BB-/Stable), the Maldives (B-/Negative), Mongolia (B/Stable) and Vietnam (BB/Positive),” said Fitch.

Official reserves fell by around 29% in the Maldives over January-July 2023, reversing the improvement in reserves in late 2022 following the conclusion of a US$200 million bilateral currency swap with India, the firm noted.

Bangladesh improved reserve transparency with the adoption of IMF definitions in June. IMF data show its reserves declined 31% over January-July, but Fitch estimated that the decline could be around 16% if the new definitions applied throughout the period.

By contrast, reserves in Mongolia and Vietnam climbed over 1H23. Official reserves rose by 3% in Vietnam over January-May 2023 (most recent available data), after falling 21% in 2022, the firm added.

The modest increase partly reflects a widening of the goods trade surplus in 1H23, as weaker domestic demand has curbed imports, offsetting the effects of a continued contraction in exports, Fitch said.