Trade in Asia Pacific could increase by US$90 billion annually due to reduced export costs brought by the Regional Comprehensive Economic partnership (RCEP) signed by 15 countries on Sunday, said Euler Hermes recently.

Encompassing the ten ASEAN countries, Australia, China, Japan, New Zealand and South Korea, the RCEP will cover around 30% of world GDP and population, making it the largest trade deal by these measures.

It’s the first multilateral free trade agreement to include China, illustrating the ‘international circulation’ component of the country’s dual circulation strategy, Euler Hermes pointed out.

This will see China increasing its influence in the Asia-Pacific region, while the U.S. has been exhibiting a more protectionist trade policy in the past few years, the firm added.

From an economic perspective, the overall impact of RCEP could be moderate and spread over time, said the trade credit insurer.

While China, Japan and South Korea could benefit more than other signatories — as the RCEP now covers the China-Japan and Japan-South Korea bilateral relationships previously not subject to free-trade agreements, the RCEP mainly consolidates and updates existing free trade agreements between the ASEAN and its partners, the company noted in a statement.

In fact, the average tariff of ASEAN countries on imports from RCEP partners had already dropped from 4.9% in 2005 (10.3% non-weighted by ASEAN countries’ import shares) to 1.8% (3.2% non-weighted) currently, according to Euler Hermes.

More importantly, the RCEP reduces non-tariff barriers by creating a common Rule of Origin (RoO) that harmonises the information requirements and local content standards for businesses to be eligible to the preferential terms of the agreement, the firm noted.

As of now, each regional free trade agreement has its own RoO; the RCEP will therefore facilitate supply-chain management by requiring a unique certificate of origin to ship the same products between members, the firm added.

This would reduce transaction costs for trading with multiple countries in the wider region, and create a more stable environment for trade, said Euler Hermes.

In the literature, the cost of rules of origin ranges between 1.4% and 5.9% of the export transaction amounts, the company pointed out.

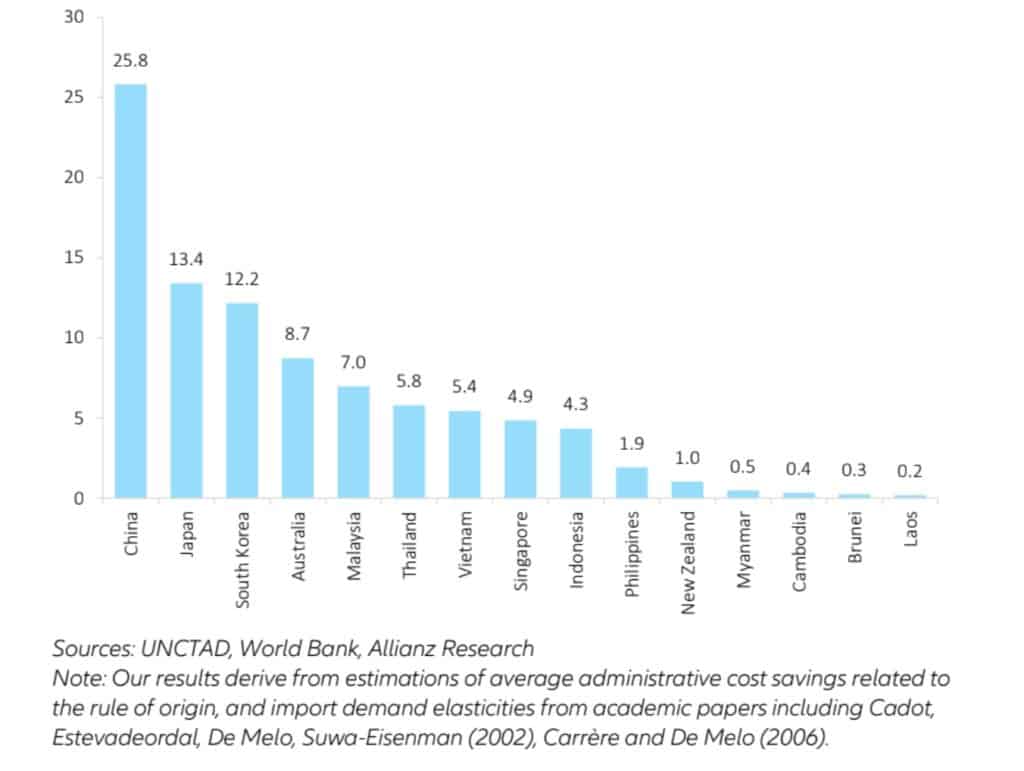

As a result, the firm estimates that the common rule of origin could reduce export costs, thereby boosting merchandise exports among signatories by around US$90 billion on average annually.

This agreement not only fosters stronger regional trade integration, but it could also make the region more attractive to further diversification of supply chains for multinational companies or multi-shoring, Euler Hermes said.

However, the agreement leaves out “sensitive” sectors, especially agriculture, and progress is only partial on services trade liberalisation, the trade credit insurer added.

Euler Hermes: Average potential gains in annual intra-zone merchandise trade (USD bn)